Sharesight release notes - May 2020

May was another busy month for the product team as we continue to scale out our infrastructure and onboard new staff. A key highlight for the month was rolling out our new and much improved broker file importer UI to around half of our supported brokers. Work on the new importer is continuing at pace and we expect to roll it out more widely over the coming month.

Tax Reporting

- Improved income year date matching for all Australian unit trust distributions

Sharesight Usability

-

Added broker import tiles for Interactive Brokers, Selfwealth and Robinhood to better expose our support for these popular brokers

-

Added Suggested Prices, Exchange Rates, and Currency Codes into the new broker file import UI

-

Enhanced caching logic to further improve the time that it takes to generate performance reports

Broker Transaction Import

- Added support for BT Panorama

Sharesight API

- API V3 - added option to enable quantity validation when creating trades

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

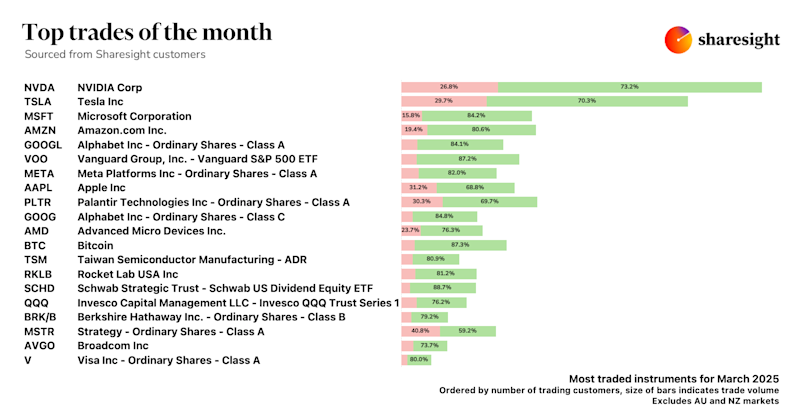

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.