Sharesight release notes - May 2019

We’ve been busy in May with some infrastructure work to improve site performance and support our ever growing user base. We’ve also been continuing to work on our Interactive Brokers Integration with a range of bug-fixes and enhancements, and anticipate a public release before then end of June.

Users who want early access to features we’re developing like our Interactive Brokers Integration, should join the Sharesight Beta Program.

Sharesight development release highlights for May:

Usability

-

Improvements to streamline the onboarding flow on both desktop and mobile for new users that haven’t added any data to a Sharesight portfolio

-

Improved placeholder text on the add holding form

-

Display localised currency icons (ie: €,¥, $) for dividend and distribution payments on the price chart of the Holdings page

Broker Import

-

Added file import support for New Zealand broker Hatch

-

Added Trade Confirmation Email support for Mint Partners and Macrovue

Supported stock exchanges

Sharesight now tracks 28 international stock exchanges and managed/mutual fund markets.

-

Added support for Shenzhen Stock Exchange (Sharesight code SHE)

-

Added support for Korea Exchange (Sharesight code KRX)

-

Added support for Taiwan Stock Exchange (Sharesight code TAI)

Sharesight API

- Add a new optional parameter include_limited to the v3 performance endpoint (beta) - This will return limited information for holdings that exceed the allowable limit based on the users subscription

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

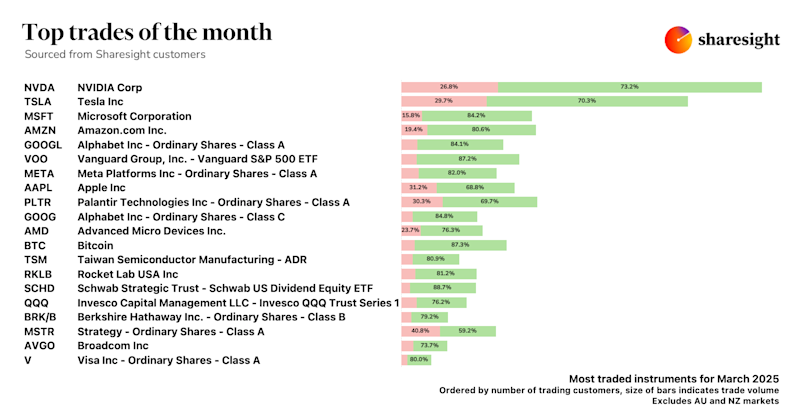

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.