Blog | Product updates

Sharesight release notes - July 2020

by Scott Ryburn, CTO, Sharesight | Aug 6th 2020

July kept the product team busy as we continue to overhaul our backend architecture for better page load performance and to support growth in signups. We also have some major new features nearing completion including support for unlisted managed funds in the UK -- stay turned for an announcement on this next month!

New Functionality / Enhancements

- Added pricing support for London Stock Exchange listings that trade off book on the AIM market

Broker Transaction Import

- Add support for Vanguard US trade confirmations

- Add support for Fidelity US trade confirmations

- All broker imports now use the new and improved bulk trade import UI

Sharesight API

- Enhance single sign-on endpoint to work with unactivated accounts

- API V3 Enhance and expand support for attachments in the API

- API V3 Add support for custom fixed interest investments

FURTHER READING

Case studies

Why Strawman’s founder uses Sharesight to track performance and tax

by Stephanie Stefanovic | Apr 2nd 2025

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Market insights

Top trades by New Zealand Sharesight users — March 2025

by Stephanie Stefanovic | Apr 1st 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

Market insights

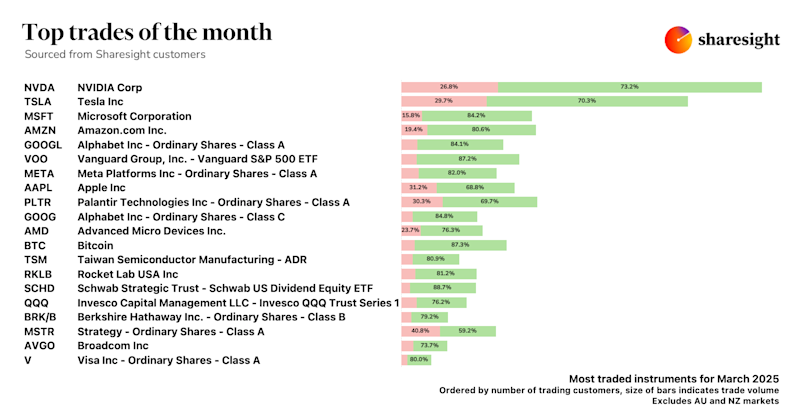

Top trades by global Sharesight users — March 2025

by Stephanie Stefanovic | Apr 1st 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.