Sharesight release notes - January 2020

The Sharesight development team took advantage of the holiday period to perform a variety of backend maintenance and housekeeping tasks, including a major database upgrade requiring a small amount of scheduled downtime (in all there were only two small windows of downtime totalling less than 15 minutes!). We also managed to ship a few enhancements here and there as detailed below.

New Functionality / Enhancements

- Increased file size upload restriction from 1 MB to 10 MB

Sharesight Usability

- Improved messaging on reports when no data available within a date range

- Revised design for signing up to Sharesight with Google account

- Update the settings tab buttons to be more consistent

Broker Transaction Import

- Migrated all broker imports to use the redesigned bulk trades import UI

Sharesight API

- Add trading cash account parameter to V2 and V3 portfolio endpoints

- Added Exchange rates endpoint to API v3 (Beta)

- Added Xero sync status to API v3 Create Trade, Update Trade, Show Trade, List Trade endpoints (Beta)

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

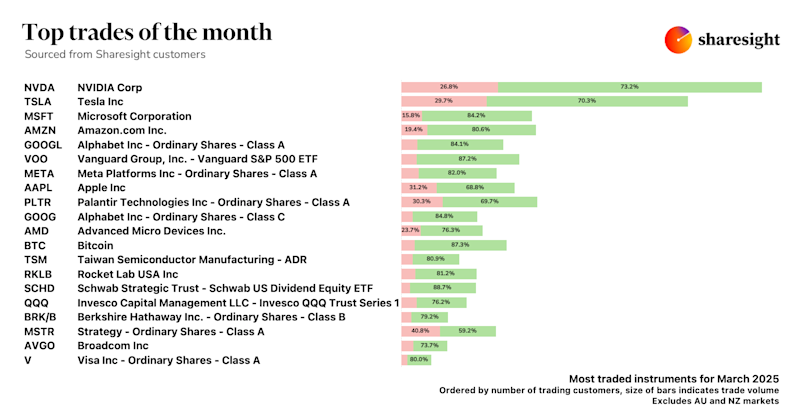

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.