Sharesight product updates – November 2024

As I indicated in last month's update, we have been working on a new reporting function which I’m pleased to announce was rolled out to all expert and business customers on our beta program. This new drawdown risk report is our first major foray into the risk space. The report allows you to see your annualised total return alongside the maximum drawdown (MDD) of each of your investments or group of investments. The report also provides a simple ratio for each investment highlighting a form of risk-adjusted return as well as featuring a powerful, interactive graph.

We chose MDD as our first risk metric as it highlights clearly the potential loss of an investment, based on what has occurred previously. It is also a difficult value to calculate in that you need the full price history of an instrument and you need to recalculate on a daily basis. Unless you have an abundance of spare time, most investors are unlikely to go to this effort. This is where Sharesight comes in.

I’m excited by the new report and what we may explore next in the risk space, depending on the feedback we receive from this first endeavour. You can find the new report under the Asset allocation section of the reports page. To join our beta program, navigate to Account > Account preferences and toggle the ‘Enable beta features’ setting. You can visit our drawdown risk report help page to find out more.

New functionality / enhancements

- Optimised our instrument search results when searching on instrument names, not just on symbols

- Added support for another 11 cryptocurrencies including FUN, GMTT, HOT, IOTX, ONE, OSMO, SLP, SXP, HEX, PLS and POLYX

- Modernised our Log in and Sign up pages

- Rolled out our new drawdown risk report to expert and business customers on our beta program.

Broker import functionality

- Added support for the seamless import of historical and future Fidelity Investments (US) trades using Snaptrade

- Added trade confirmation support for JP Morgan (US)

- New broker support for:

- Expanded support for the following brokers to include additional trade file imports;

- Avanza – Support for the inkopskurs file

- Independent Reserve – OrderStatement file

- Jarden Direct – Movements and Holdings files

- Nabtrade – OrderHistory and TradingHoldings files.

FURTHER READING

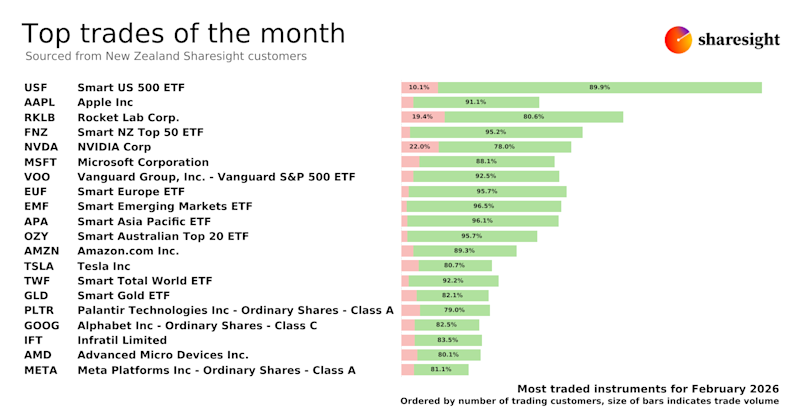

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

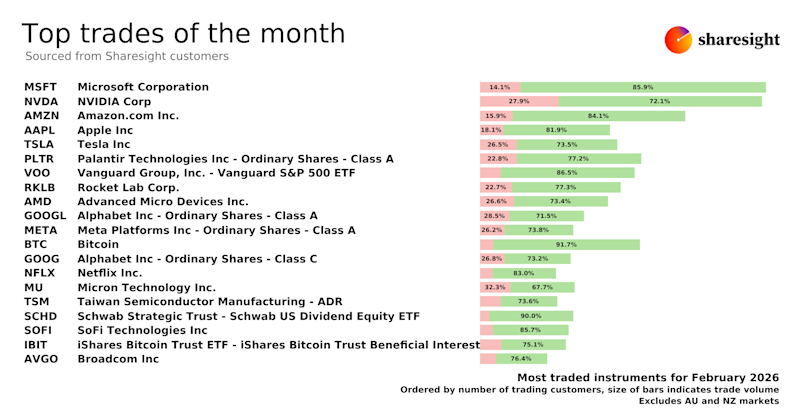

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

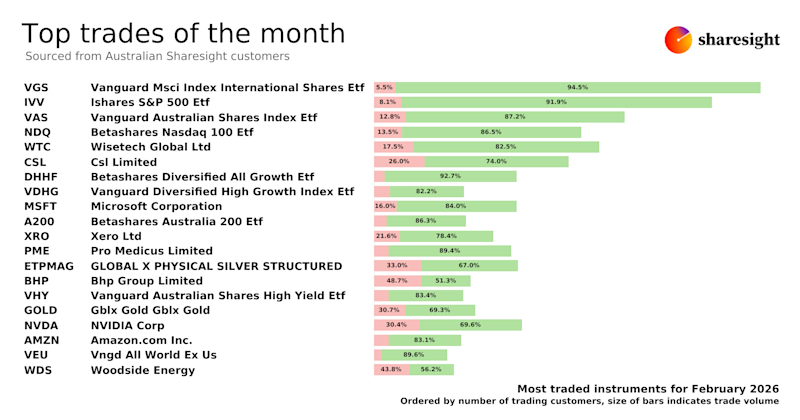

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.