Sharesight CEO a panelist at Computershare ETF Forum

Last month, I was invited to speak at the Computershare ETF Forum in Melbourne. The event brought together leaders from the asset management, research, accounting, and technology industries.

Computershare is one of Australia’s original tech companies, and by virtue of that most certainly one of the world’s first fintechs. Founded in the late 1970’s, they’ve gone on to become massive with a market cap of about $10B. A slow and steady approach has served them and their investors well.

A share registry might not come to mind when thinking about financial technology, and I’ll admit the investor experience of actually using a registry website isn’t exactly state of the art. I was, however, impressed by the questions being asked at the event and Computershare’s renewed focus on the ultimate end user, the mum and dad investor.

Sharpening this DIY investor focus is certainly the rise of ETFs.

Whether you’re new to investing or an institutional fund manager, chances are you’ve got an ETF in your portfolio. Their increasing popularity among investors has been well documented in the financial press. In fact, in 2018 21% of investors tracking their SMSFs on Sharesight bought or sold an ETF, a significant increase on just 3% in 2008. And because ETFs are listed investments, they’ve increased the interaction between investors and share registries.

ETF Forum issues important to investors

-

ETFs are still growing in popularity. Expect to see more exotic ETFs enter the Australian market, particularly actively managed and alternative ETFs.

-

Despite the Banking Royal Commission, fee pressure on financial advisors, and fintech alternatives, ETF policy is still being driven by the big end of town.

-

ETF manufacturers and distributors still seem tethered to legacy distribution channels like financial planning dealer groups and investment platforms (why no ETF ads during the Australian Open, for example).

-

Nobody understands how ETF distributions actually work (massive exception to this is the work Computershare and Sharesight have done jointly).

-

The AMIT regime has amplified the above complexity to the extent that even professional fund managers aren’t using it to lower their taxable exposure.

-

"So how is this making it easier for the end investor?" This question was asked by a senior Computershare executive and my favourite part of the day. While ETFs and their array of asset classes are great for the DIY investor, they’ve created a high administrative overhead.

Share registries’ fintech future

I’ve long advocated that share registries are sleeping giants in the fintech world. For decades, they’ve carried out boring, but critical registry functions on behalf their clients: listed companies and investment trusts. But all that time have been ammassing two valuable assets: users and data.

If the trend of DIY investors gaining more access and control over their investing future continues (which it will) using platforms like Sharesight. it will be interesting to see how Computershare might leverage this.

FURTHER READING

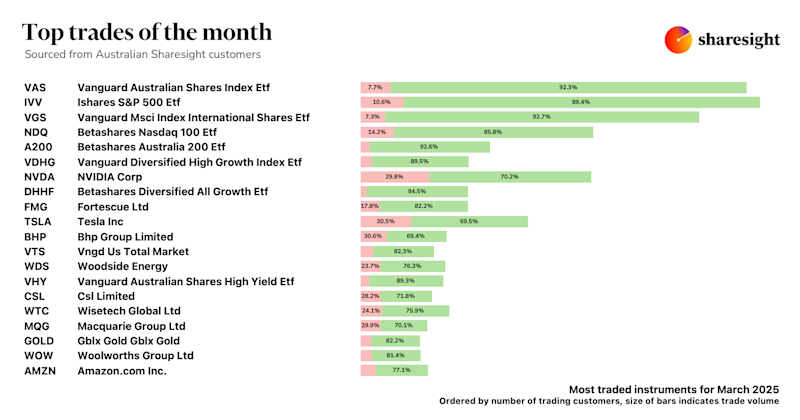

Top trades by Australian Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot for Australian investors, where we look at the top 20 trades by Australian Sharesight users.

Top 50 finance and investing blogs in 2025

Check out this list created by the Sharesight team, covering the 50 best personal finance and investment blogs from around the world.

Why property investors should use purpose-built software

We explore why property investors need a dedicated platform, and how connecting TaxTank and Sharesight can streamline portfolio management and tax reporting.