Sharesight at Intersekt 2018

I popped down to Melbourne for a couple of days to attend Intersekt, the Australian fintech industry’s annual conference.

It’s certainly encouraging to see how fintech has scaled in Australia over the past few years. The conference now attracts 400 plus attendees over three full days. Australia’s well-regulated banking system combined with the negative outcome of the Banking Royal Commission have continued to provide fertile ground for local startups and overseas entrants.

More attention on fintech leads to more startups, more curious bankers, more venture capital, more media, not to mention more traditional businesses calling themselves fintechs.

So as these events get bigger, it does become difficult to distill what it all means for Australian investors and consumers.

Here are some of the key things to watch out for:

Open Banking in Australia

As a consumer or investor, open banking will have an impact on your back pocket, but it will take time and is still very much a work in progress.

Let’s be honest, the average consumer probably doesn’t know what open banking is, nor will they care much about it when it’s a reality. How one implements it, and the quality of the data are still questions without answers.

Really, the onus will fall on fintechs to make use of the open banking legislation and deliver value to the market.

While there was good discussion regarding open banking, it seems that most players are still executing their own vision for what it means. I’ve yet to see a real (public) clash between banks and fintechs regarding access to an individual’s financial data.

Takeaways & tidbits overheard:

- Banks like open banking because they can make “smarter” (more aggressive?) loans by leveraging specialist data and cash flow companies. Yikes.

- Fintechs don’t necessarily want to “own” personally identifiable information - this comes with big IT and legal overheads.

- The horse may have already bolted. In the absence of a mature policy fintechs have already circumvented the banks with respect to accessing financial data and are already using it to offer real product alternatives. I heard “well, we’ve already sort of built that” numerous times (think about how your trading history has built up in Sharesight despite a lack of an “open broking” data policy).

- Don’t sleep on Macquarie Bank. They’ve had an open API for years and have already embraced open banking. We use their API at Sharesight, and while it has limitations, it’s an indicator of how Macquarie is thinking long term and how to commercialise open banking themselves.

Neo or Challenger Banks

This was my favourite topic at the conference, and one that I see as most applicable to Australian consumers. The term “neo” or “challenger” bank refers to startup banks that are branchless and 100% web and mobile based.

Chad West from Revolut, a UK-based banking alternative delivered an enthusiastic demonstration of their core banking features. While Revolut aspires to be your every day bank, it would seem that they are best known for their free peer-to-peer money transfer, foreign and cryptocurrency exchange.

Revolut (and other successful fintechs) have absolutely nailed the user experience (UX) - their product is beautiful and I’ve already signed up to their waitlist. They’ve also expertly leveraged things like push notifications, real-time data, and mobile - digital things that we’ve come to expect from services like Uber and Google, and not our banks, which is a key differentiator for them.

Takeaways & tidbits overheard:

- Revolut is launching in Australia in Q1 2019

- A mate from the UK tells me that he uses them only for foreign currency when on holiday, and isn’t quite ready to direct his salary there. He says the pain of switching and the fact that his every day banking is mostly OK are holding him back. Plus Revolut pays no interest.

- Revolut may launch a subscription model in which you’d pay a monthly fee to access a bundle of services. This is a novel twist on fees on each account / service, but in practice achieves a similar end result.

- Will Australian KYC and AML laws (know your client, anti money laundering) hold them back locally? You can open your Revolut account in a matter of seconds in Europe. Front and back photos of your ID and a selfie were all it took during the demonstration. I’m not sure if that’s because they operate as a “borderless” fintech or due to more progressive EU/UK banking laws, but if you know how difficult it is to open an account in Australia, I can imagine this being an issue.

- Revolut is also launching a share trading product - we’ll keep an eye on them for integration purposes!

Challenges and Opportunities Looking Ahead

Fintech is well and truly established and maturing in Australia. My unofficial “bankers-in-suits to founders-in-hoodies” ratio confirms this.

A common question came up during the conference regarding the elephant(s) in the room. That is, how much interest do Apple, Amazon, Google, Facebook, etc. have in the financial services space? Using China (e.g. Tencent) as a barometer would suggest that they will pounce on this market and may destroy some well-known fintechs in the process.

Australian bank reputations have been severely wounded by the Royal Commission, which has been Christmas-come-early for fintechs - especially those in wealth management.

There is still, however, a fundamental challenge facing industry: how to make consumers excited about financial products.

So much of the enthusiasm behind fintech comes from ex-industry heavyweights who understand how badly broken aspects of financial services are. Whether or not they can get the money-spending and investing public excited about their products remains to be seen.

FURTHER READING

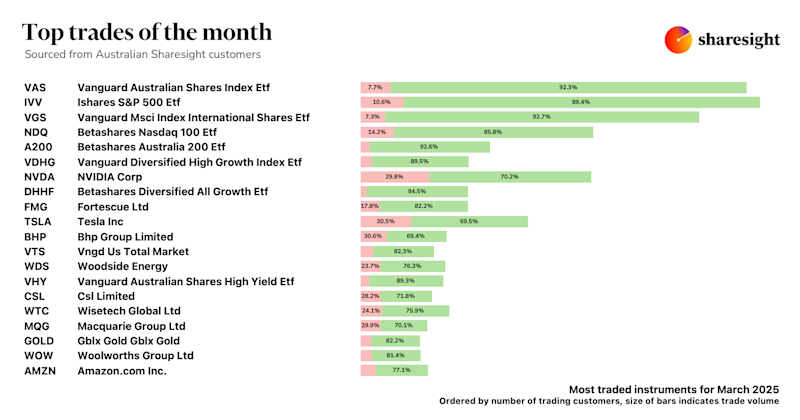

Top trades by Australian Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot for Australian investors, where we look at the top 20 trades by Australian Sharesight users.

Top 50 finance and investing blogs in 2025

Check out this list created by the Sharesight team, covering the 50 best personal finance and investment blogs from around the world.

Why property investors should use purpose-built software

We explore why property investors need a dedicated platform, and how connecting TaxTank and Sharesight can streamline portfolio management and tax reporting.