Save time and money by sharing your portfolio with your accountant

With Sharesight, it’s easy to save time and money at EOFY and tax time. One of the best ways to do this is by sharing portfolio access with your accountant, which allows them to see your trading activity, dividends, capital gains and more – all in one place. To learn more about Sharesight’s portfolio sharing feature and how you can use this to your advantage at tax time, keep reading.

Why you should share your Sharesight portfolio with your accountant

Sharing your Sharesight portfolio with your accountant is a simple way to save time (and hefty fees) at tax time. Not only does Sharesight eliminate the tedious portfolio admin associated with tracking your investments in a spreadsheet, but it also makes life much easier for your accountant by doing all the historical work for them. This means they can focus on getting you the best possible tax outcomes, while reducing back-and-forth communication over records and statements.

Tips to prepare your Sharesight portfolio for your accountant

By using Sharesight to track your investments, data such as your dividends and distributions, trading activity, capital gains and foreign currency impacts are automatically recorded – significantly reducing the time your accountant needs to spend collecting and verifying your records. To save as much time and money at tax time as possible, however, here are a few tips to ensure your portfolio is completely up-to-date and ready for your accountant:

-

Verify and confirm your unconfirmed transactions

-

Ensure your trades are recorded correctly

-

Check whether you need to manually record any corporate actions that weren’t handled automatically

-

Verify that the return of your portfolio is correct.

Dividends and adjustments are automatically generated by Sharesight, however you will be prompted to verify and confirm the details of these transactions to ensure the accuracy of your portfolio.

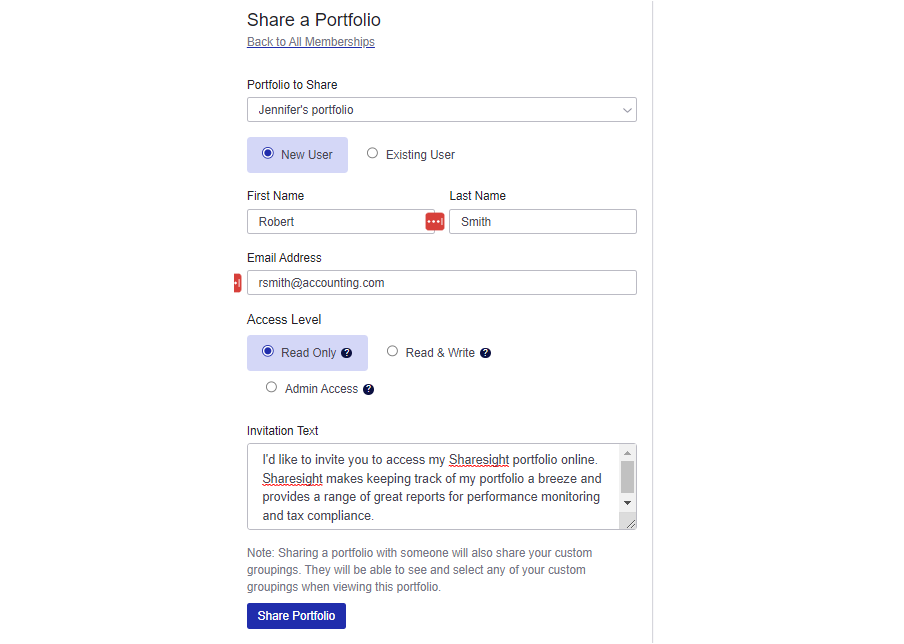

How to share portfolio access with your accountant

To share portfolio access with your accountant, all you need to do is access the Account tab and click 'Sharing and permissions', then select 'Share with a New User'. From here, simply enter your accountant’s name and email address to send them a secure, private login which they can use to access your portfolio.

Your accountant will have real-time access to your portfolio, with the ability to see your holdings, dividends, corporate actions and any trades you make.

Access to a portfolio can be withdrawn or modified to your liking. For example, as seen in the screenshot above, you can choose whether your accountant has "read only" access, or whether they can make edits to your portfolio. And if you have more than one portfolio, you can choose which portfolios your accountant has access to based on your needs.

For more information on how to share your portfolio, here is an instructional video:

Embedded content: https://www.youtube.com/watch?v=-vn4GJvKbdY

Take advantage of advanced tax reporting

Accountants and self-directed investors alike will benefit from Sharesight’s suite of advanced tax reports, including taxable income, capital gains (Australia and Canada), unrealised capital gains, historical cost and all trades. These convenient reports can all be run over custom date ranges, and are available to download in formats such as an Excel Spreadsheet, PDF or Google Sheets.

Taxable income

The taxable income report is particularly useful at tax time, as it compiles a list of the portfolio’s dividends and interest payments over the selected period, with the ability to view the total taxable income at a glance.

Capital gains

For Australian or Canadian tax residencies, the capital gains and unrealised capital gains tax reports are a quick and easy way to break down a portfolio’s capital gains, as well as the implications of tax loss selling.

Historical cost

For any financial statements that require mark-to-market accounting, the historical cost report is an easy way to view the closing value and market value of a portfolio’s holdings at a glance.

All trades

The all trades report gives a breakdown of a portfolio’s trading activity over any selected period, and is useful for any financial reporting that requires trades to be broken down by their cost base.

For unlimited access to all of these reports and more, accountants can sign up for Sharesight's professional plan– Sharesight’s portfolio tracker and reporting tool for financial professionals.

Save time and money with Sharesight

Thousands of self-directed investors are using Sharesight to track all of their investments in one place – eliminating tedious portfolio admin and saving time and money at tax time. Sign up for Sharesight today so you can:

-

Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-currency valuation, multi-period and future income (upcoming dividends)

-

Run tax reports including taxable income (dividends/distributions), capital gains tax (Australia and Canada), traders tax (capital gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

8 ways to use Sharesight's custom groups feature

This blog explains our custom groups feature, including strategies that can help you gain deeper portfolio insights and make more informed investing decisions.

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.