Rough week on the sharemarket?

It's been a bit of a rough week on the share market. Both in New Zealand and Australia. Currently we're up to 12 straight days of losses.

But, is it really all doom and gloom? I've been keeping a close eye on my portfolio using Sharesight. Sure, there's some red in there, but it's not that bad. The reason I'm not terribly depressed is because I get the full picture on my portfolio. That's capital gains, dividend payouts and also currency movements.

For many of my shares, I'm actually still ahead compared to this time last year. Take for example, my investment in Colonial Motor Company (CMO.NZ).

Including those 12 straight days of losses, I'm actually ahead by 8.5% Sure, if I only look at the capital gains or losses - it's a sad story. But, to get an accurate picture you have to look at all of the individual components that contribute to your total performance.

So I suggest if you're feeling a little down about your investments, take a closer look at all the components - Capital Gains, Dividends and Currency movements. I think you'll find it's not as bad as your initially thought!

If you don't already have a Sharesight account, sign up today!

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

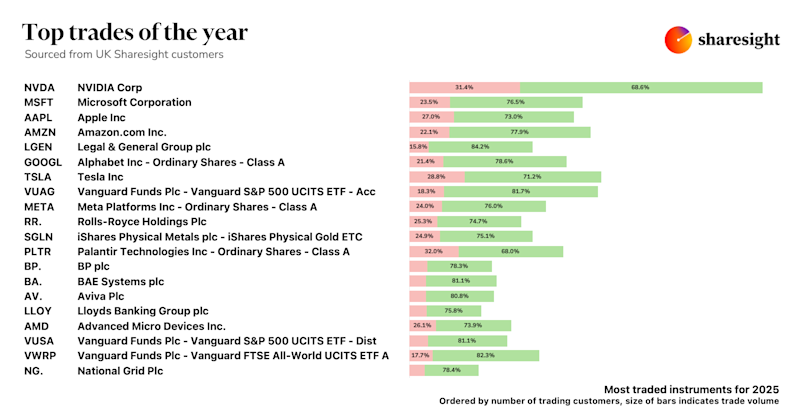

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

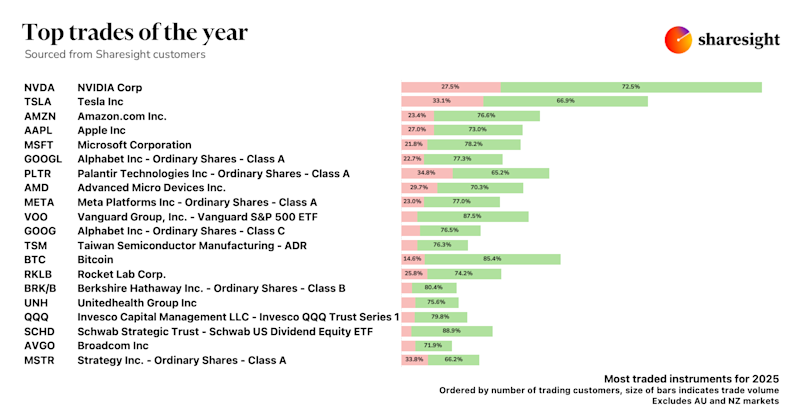

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.