Calculate portfolio risk with Sharesight's risk reporting tool

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

Scott and Tony Ryburn founded Sharesight primarily to address two key problems. The first being that as a hands-on stock market investor, record keeping for accounting and tax reasons was a nightmare and the second, that trying to calculate the true performance of your investments over time was virtually impossible, making it much harder to make sound investment decisions. There is however a third, equally important area for investors to understand and that is risk.

In this article, we will explain the concept of risk, how it is calculated and how Sharesight’s risk reporting tool is one way that investors can calculate risk in their portfolio.

Understanding risk

Taking a simple definition from Investopedia, risk is defined as the chance that an investment's actual return will differ from an expected return. The article goes on to explain that risk includes the possibility of losing some or all of an original investment.

One way to protect against risk is to diversify. For example, our diversity and exposure reports provide insights into your portfolio diversification that can help you make informed investment decisions in order to keep your portfolio aligned with your investment strategy.

However, in order to optimise your portfolio diversification as an investor, you need to be able to understand the risk of an investment, or group of investments. There are many ways to get a better handle on your portfolio risk, whether it’s reading company annual reports, understanding the macroeconomic environment or using tools such as standard deviation to understand the volatility of your investments.

Maximum drawdown as a measurement of downside risk

Another type of volatility is maximum drawdown (MDD), which is the maximum observed loss from a peak to a trough of an investment. MDD is a type of downside risk analysis, in that it highlights the potential loss of an investment, based on what has occurred previously. Unlike other risk assessment tools available, MDD is a difficult value to calculate. It needs to be re-calculated daily and across different time periods. If you have an investment's price history, it is plausible to obtain that investment's MDD using spreadsheet functions, but it is a difficult and time-consuming thing to do. This is where Sharesight comes in.

Introducing Sharesight’s risk reporting tool

We have built a powerful drawdown risk report that displays both your annualised total return alongside the MDD for each investment. This allows you to compare the performance of each of your investments or group of investments against the drawdown risk. As an investor, this will be useful in understanding your portfolio's risk profile and will allow for more informed portfolio rebalancing, depending on your risk tolerance.

Choosing your time period

In order to draw meaningful associations between your return and MDD of each investment, the report ensures that your performance figures and MDD calculations cover the same time period. To provide as much insight and flexibility as possible, we have introduced seven time periods: since 2019, since 2020, since 2021, since 2022, since 2023 (as at the time of publishing), year to date and max. It should be noted that the ‘max’ option will calculate your total returns since inception, open positions only. The max option in particular should be used with caution as the MDD calculated on this time period will go back to the first price records Sharesight holds for the given investment, sometimes 20 years or more. A three-year period is more commonly used for MDD calculations.

Evaluating your RoMaD scores

We have also provided a simple ratio for each investment which takes the return and divides it by the max drawdown. This ratio, Return over Maximum Drawdown (RoMaD) provides a form of risk-adjusted return for each of your investments. The higher the ratio, or RoMaD, the more attractive the investment. A simple example of this is if you have two investments with the same return, but one of those investments has twice the MDD, then based on this one risk metric, the investment with the smaller MDD (and thus, higher RoMaD score) is the better investment.

For instance, the screenshot below displays some of the drawdown risk report results for an investor’s portfolio. In this example, you can see that the investor’s shares in the Fidelity 500 Index Fund and BAE Systems have similar (percentage) return values, yet the max drawdown score for the Fidelity 500 Index Fund is lower, which creates a higher RoMaD score, indicating better risk-adjusted returns. This would suggest that for the chosen period in this investor’s portfolio, Fidelity is the better investment.

The drawdown risk report breaks down each of your investment holdings by their percentage return values, max drawdown and RoMaD scores.

Of course it should be noted that the results are dependent on how each asset has performed in your portfolio, rather than how the asset has performed in general. So what is a ‘good’ investment in one investor’s portfolio could be a ‘bad’ investment in another investor’s portfolio. This is also dependent on your personal risk tolerance and goals for your portfolio, as well as market context over the chosen period and how the investment is performing relative to other investments in your portfolio. In general however, you will want to see maximum drawdown scores that are half the annual portfolio return or less. So if the maximum drawdown was 10% over your chosen period, you would want a return of 20% (resulting in a RoMaD score of 2).

This brings us to the next point — how to interpret the drawdown risk report chart and what it means in terms of risk and return for the investments in your portfolio.

Understanding the risk report chart

The report displays all your investments, sized according to their current value on a graph that plots returns on the Y axis from smallest to largest and your MDD on the X axis. To understand what this means in terms of the risk and return of your investments, it is useful to consider the chart in quadrants.

The quadrants can generally be interpreted as follows:

- Upper left quadrant: Low risk, high return. These are the ‘best’ investments in your portfolio from a drawdown risk perspective, and in an ideal scenario, you will have a significant portion of your investments in this quadrant.

- Lower left quadrant: Low risk, low return. These investments may not provide you with significant gains in your portfolio, but they do allow you to hedge against market events that could impact other investments in your portfolio, so it could be useful to have some investments in this quadrant.

- Top right quadrant: High risk, high return. These are your growth stocks. The amount of growth stocks you want to see in your portfolio will depend on your risk appetite, investing strategy and goals.

- Lower right quadrant: High risk, low return. These are poorly performing stocks with high drawdown risk, making them an unattractive addition to your portfolio. In an ideal scenario, you won’t have any of your investments in this quadrant.

An example of a portfolio with a large majority of investments in the lower left quadrant of the chart, indicating that the majority of investments in this portfolio have low drawdown risk, but also low returns.

Other notable features of the drawdown risk report

- Group the results by the classification of your choice: If you run the report on its default setting, the results will be ungrouped, however you may choose to organise the results by market, currency, sector, industry, investment type, country or a custom grouping. This could be a useful way to compare the overall drawdown risk associated with different asset allocations in your portfolio.

An example of a portfolio grouped by sector, where the portfolio’s finance sector investments have the most favourable RoMaD score, while the portfolio’s consumer durables investments have the least favourable RoMaD score. This suggests that as a sector, consumer durables is performing poorly over the chosen period in this investor’s portfolio.

- Benchmark your results: If you have a benchmark added to your portfolio, you can see the RoMaD score of your benchmark, as well as its position on the chart, giving you additional context into your portfolio's results.

- Interactive legend: In the legend below the chart, you can click on different investments (or investment categories) to hide or display them in the chart. This is useful if you want to deep dive into particular parts of your portfolio and exclude elements that aren’t relevant to your analysis.

- Zoom functionality: On a desktop, if you click and drag your mouse over a particular section of the chart, you can view a zoomed in version of the chart that only displays that particular section. This is especially relevant if you have a large number of investments clustered in one section of the chart and you would like to zoom in to better compare the drawdown risk of these investments, relative to each other.

Like all forms of risk analysis, this new report does have its limitations and should be used in conjunction with your other risk assessment tools. It should be noted that MDD only measures the size of the largest loss and it is silent on how often they occur, or the time it took to recover from these losses.

Depending on the popularity of this report, there are variations to RoMaD that we may explore moving forward, such as the Calmar Ratio which is similar to RoMaD except that it only considers returns beyond the risk free rate of return (a common example of a ‘risk-free’ investment being US Treasury Bonds). Another risk measure we are exploring is the Sharpe Ratio, which unlike the Calmar Ratio uses Standard Deviation rather than MDD when determining volatility.

The drawdown risk report is just the beginning of our exploration into risk analysis. We are excited to introduce this powerful new feature and hope it proves to be a useful tool in your investment toolkit moving forward.

See the drawdown risk report in action

Become a smarter investor with Sharesight

Thousands of investors like you are already using Sharesight to track the performance of their investments and get insights on their portfolio. If you’re not already using Sharesight, what are you waiting for? Sign up and:

- Track all of your investments in one place, including global stocks, ETFs, mutual/managed funds, property and even cryptocurrency

- Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, future income, exposure, multi-period and multi-currency valuation

- See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

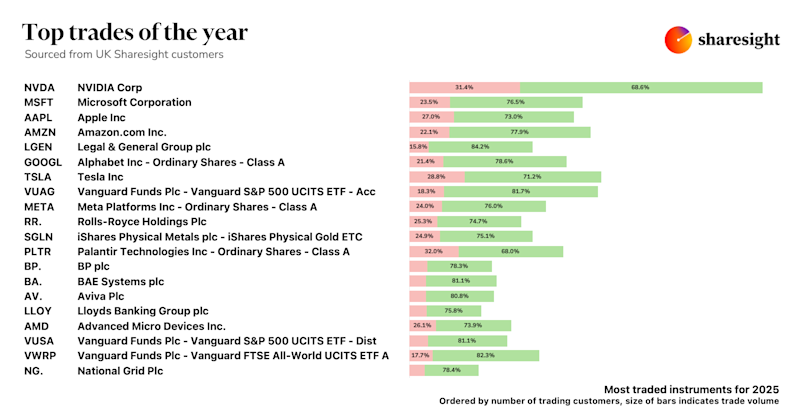

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

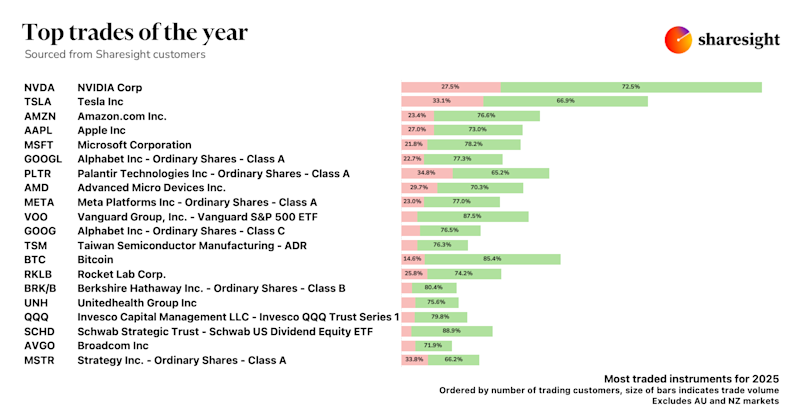

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.