Record-keeping requirements for Australian investors

Disclaimer: The below article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

Whether you’re filing your own tax return or working with an accountant, you are the one responsible for keeping up-to-date and accurate records of your share holdings. This can be daunting, especially if you are a frequent trader or receive dividends from numerous stocks or funds via multiple share registries. Thankfully, Sharesight’s online portfolio tracker makes it easy to stay on top of your records, with automatic dividend tracking (including DRPs) and the ability to attach digital statements to the holdings in your portfolio. This article will go through the records you need to keep as an investor, plus tips on how to stay organised using Sharesight.

The ATO's record-keeping requirements for investors

The Australian Taxation Office (ATO) is very clear in terms of the records investors are required to keep.

| The records you must keep | How long you must keep them |

|---|---|

| Your 'buy' and 'sell' statements (also known as trade confirmations or contract notes) |

Keep these records for five years from the date you dispose of your shares |

| Your dividend statements | Keep these records for five years from 31 October or, if you lodge later, for five years from the date you lodge your tax return |

You will receive most of the records you need to keep from:

- The company that issued the shares

- The relevant share registries for your investments

- Your stockbroker or online share trading provider

- Your financial institution, if you took out a loan to buy the shares.

Using Sharesight for investment record-keeping

Keeping accurate, ATO-compliant investment records is easy with Sharesight. To get started, first sign up for a free Sharesight account and add your holdings. Once you’ve set up your portfolio, you can:

1. Record the trade confirmation statements from your broker

To record your buy and sell statements, simply attach them to your trade records in Sharesight:

By clicking into holdings in your portfolio, you can edit trades to attach records of the relevant trade confirmations.

You can further automate this step by having your trade confirmation statements forwarded to Sharesight. By enabling this feature, your ongoing trades (and trade confirmation statements) are automatically recorded in real-time with no additional effort on your part.

Note: To see a list of all your trades, simply run the all trades report (pictured below) over the time period of your choice.

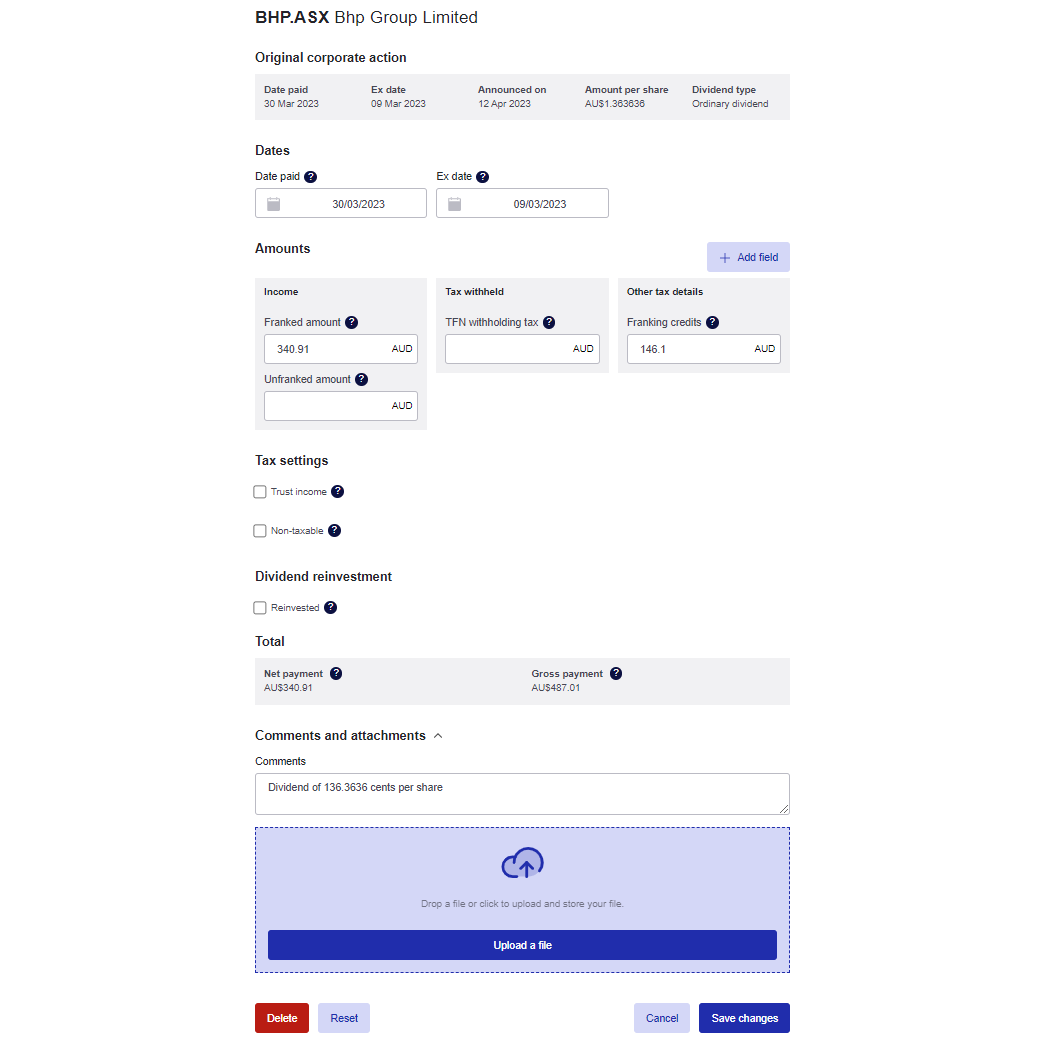

2. Record your dividend income statements

When you add a trade to Sharesight, the system will automatically backfill past dividends and continue to add new ones as they are announced. You have the ability to edit any of the suggested data and attach your official dividend statements to the respective dividend entry. This ensures that all your dividend records are safely stored and organised in one place (instead of across your email, filing cabinet, shoebox, etc.)

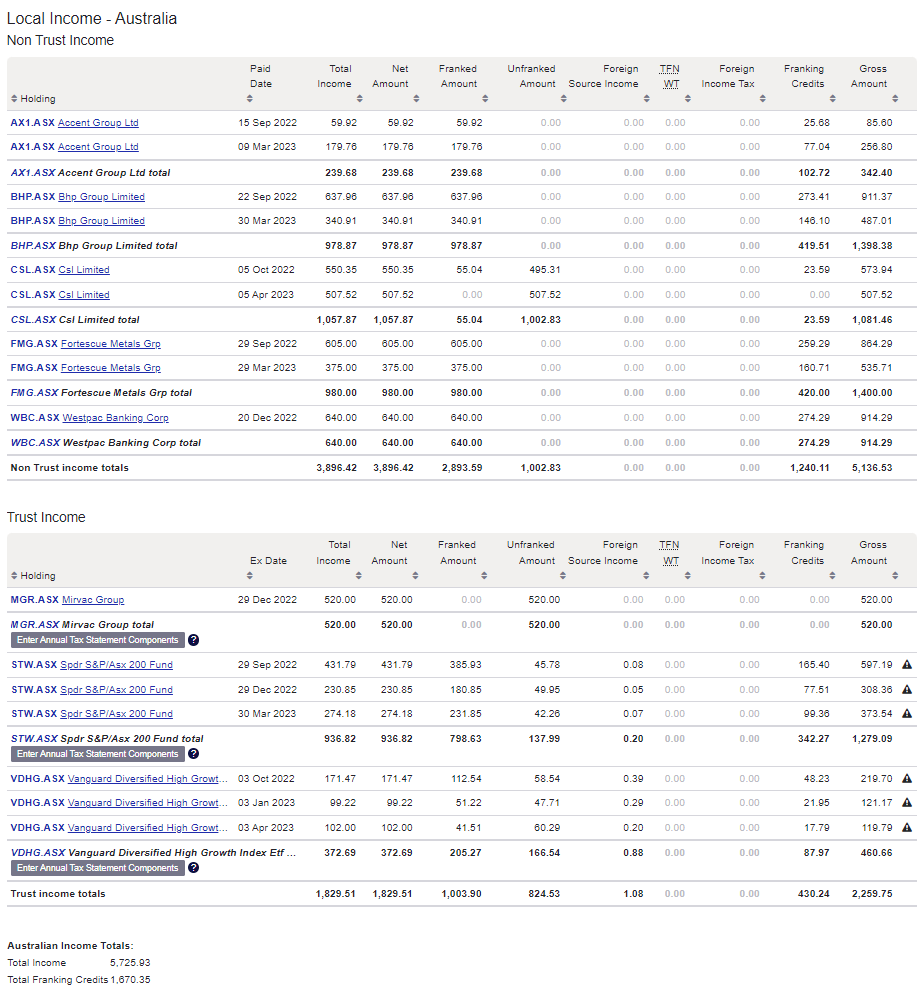

Note: You can see all the dividends you’ve received over the time period of your choice by running the taxable income report (pictured below).

3. Track the impact of reinvested dividends on your cost base

According to the ATO, if you opt into a dividend reinvestment plan (DRP), “for tax purposes you treat the transaction as though you had received the cash dividend and then used it to buy more shares”.

This means the dividend must be declared as income in your tax return, the additional shares will be subject to capital gains tax (CGT) and the acquisition cost of the additional shares is the amount of the dividend payment used to acquire them.

With Sharesight’s portfolio tracker, you have the ability to automatically track DRPs for any of your Australian or New Zealand holdings by switching on the dividend reinvestment feature for that particular holding. For holdings outside of ANZ, you can track your DRPs by manually entering a DRP trade at the correct reinvestment price. Either way, you’ll have a complete record of all your reinvested dividends and their tax implications.

When clicking into an individual holding, scroll down to the Holding Settings to turn on the Auto Dividend Reinvestment feature.

4. Share your records with your accountant

Sharesight allows you to securely share portfolio access with anyone you choose, from family members to financial advisers and accountants. This is especially useful at tax time, as your accountant will have everything they need in one place — no more paper chase, shoeboxes full of statements, or lost email attachments.

Track all your investments in one place with Sharesight

Join thousands of Australian investors already using Sharesight to manage their investment portfolios. With Sharesight you can:

- Automatically track your dividend and distribution income from stocks, ETFs, LICs and mutual/managed funds, including the value of franking credits

- Use the dividend reinvestment plan (DRPs/DRIPs) feature to track the impact of DRP transactions on your performance (and tax)

- See the true picture of your investment performance, including the impact of brokerage fees, dividends and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful tax reports to calculate your dividend income with the taxable income report

- Plus calculate your CGT obligations with Sharesight's Australian capital gains Tax Report and unrealised capital gains tax report

To get started for free, simply sign up, import your holdings and watch as dividends and prices are automatically updated. If you decide to upgrade, you’ll unlock advanced features and everything you need to run your tax reports and gain unparalleled insights into your portfolio performance throughout the year.

Plus, as an Australian tax resident, you can save even more by claiming your Sharesight subscription fees on your tax return.1

FURTHER READING

- 5 ways Sharesight helps Australian investors at tax time

- Capital gains tax calculator for Australian investors

- 7 reasons why Sharesight is better than a spreadsheet

1 If you derive income from the share market, your Sharesight subscription may be tax deductible. Check with your accountant for details.

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.