Latest posts

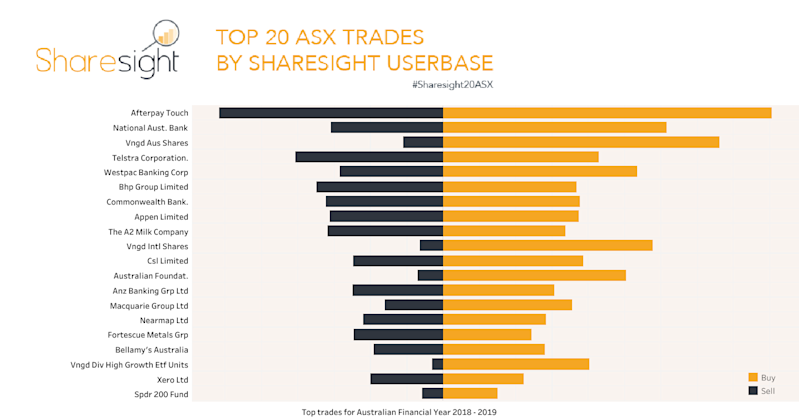

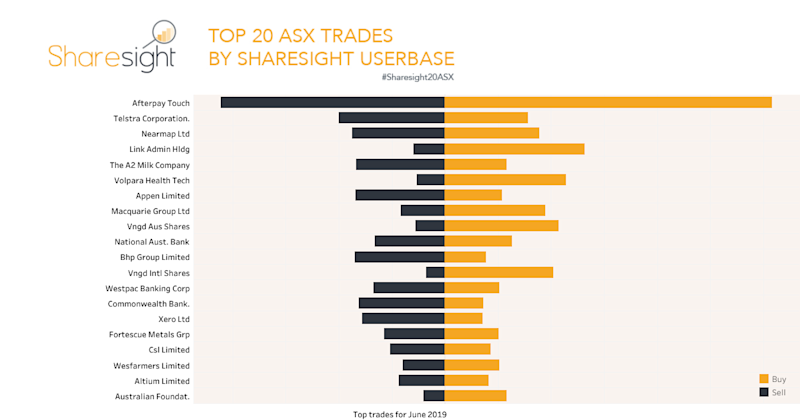

Sharesight20 top 20 trades on ASX - FY18/19

Here we look at the top 20 most traded shares on the ASX by Sharesight users during the Australian 2018/19 financial year.

How to evaluate and record stock buybacks

As an investor, it’s important to understand why stock buybacks occur, how to evaluate them, and whether you should participate in them -- even at a discount.

3 tips to maximise your retirement savings

Your retirement may be decades away, but there’s no time to waste in building your retirement income with these three tips for investors.

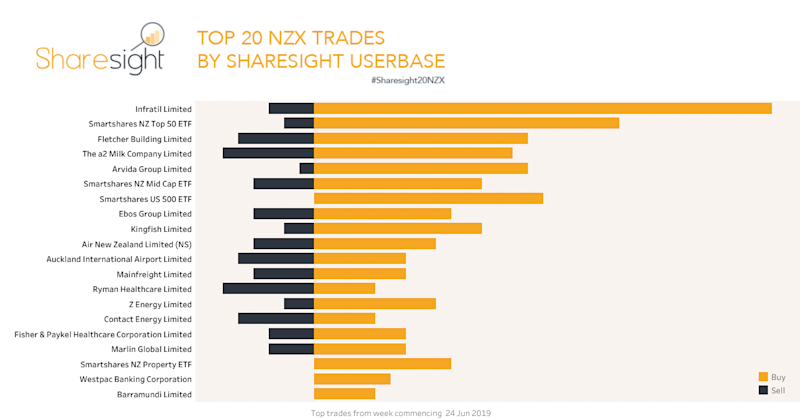

Sharesight20NZX top 20 NZX trades - 8th July 2019

After strong interest over the last month, Infratil Limited (NZX: IFT) dropped out of our Sharesight20NZX snapshot of the 20 most traded shares on the NZX.

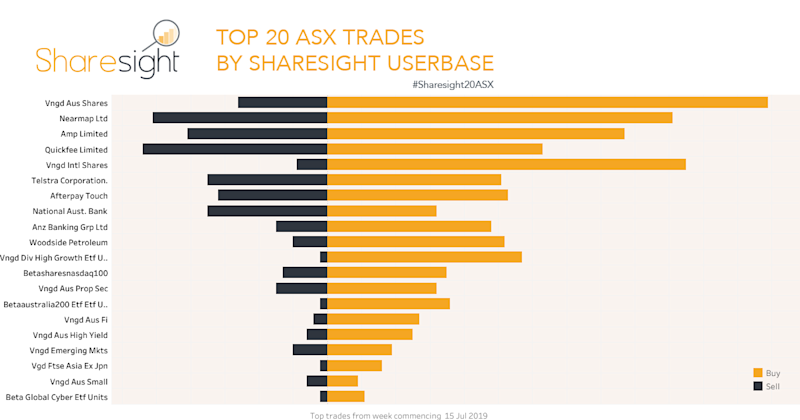

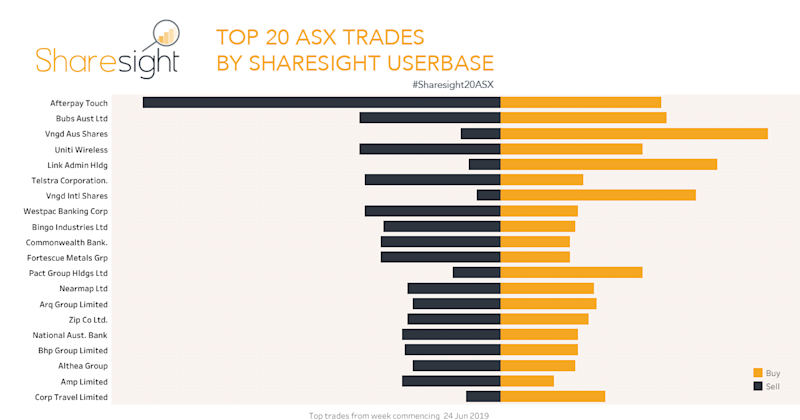

Sharesight20ASX top 20 ASX trades - 8th July 2019

Investors again heavily sold down Afterpay Touch (ASX: APT) as they looked to realise capital gains either side of the Australian end of financial year.

Sharesight release notes - June 2019

The Sharesight development team in June continued work on our Interactive Brokers integration, improved chart load speed, date pickers, plus a lot more.

ASX Investor Day Sydney 2019

Approximately 800 attendees had the opportunity to listen and learn from some of the best people in the investing world at the ASX Investor Day in Sydney.

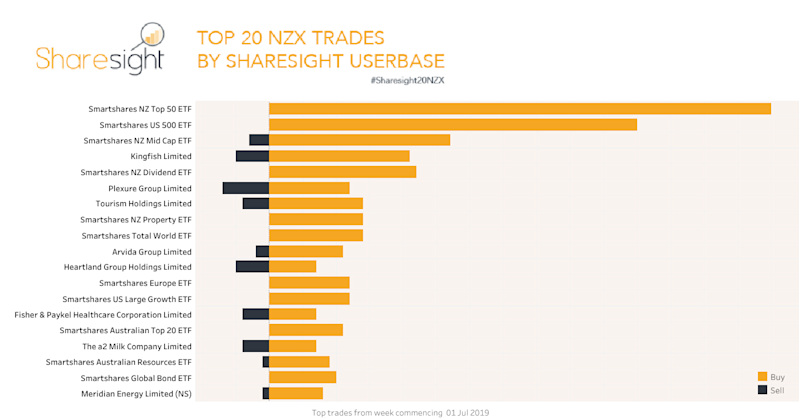

Sharesight20NZX top 20 NZX trades - 1st July 2019

Investor interest in Infratil Limited (NZX: IFT) continued over the pending Vodafone acquisition, with the stock again topping our Sharesight20NZX snapshot.

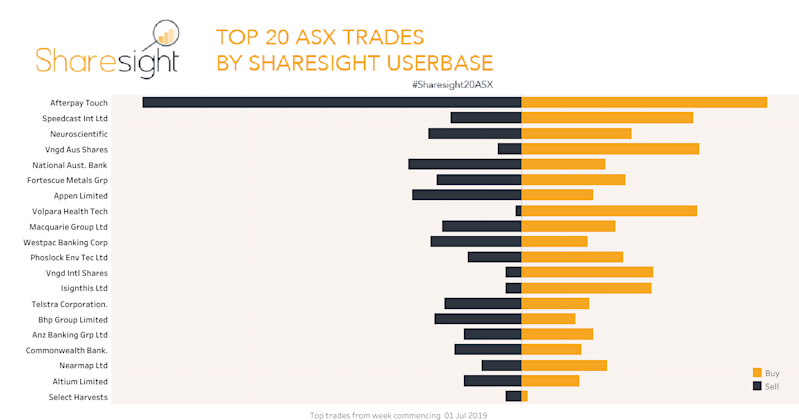

Sharesight20ASX top 20 ASX trades - 1st July 2019

Investors using Sharesight locked in capital gains made by Afterpay Touch (ASX: APT) before EOFY in the latest Sharesight20ASX snapshot.

Sharesight20 top 20 trades on ASX & NZX - June 2019

We look at the top 20 trades on both the ASX and NZX markets tracked by the Sharesight user base during the month of June 2019.

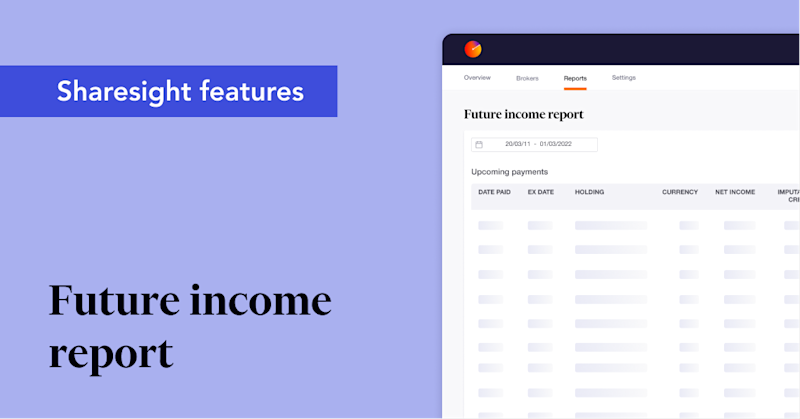

How to see upcoming dividends with Sharesight

Sharesight’s future income report helps investors see all of the expected dividends (or distributions) announced to the market for stocks in their portfolios.

What is a dividend yield trap?

While investing in high dividend yielding stocks can be a good strategy, it can lead to what’s known as a yield trap, dividend trap, or dividend yield trap.