Latest posts

Sharesight20NZX top 20 NZX trades - 19th August 2019

Investors using Sharesight saw an opportunity to buy Air New Zealand (NZX: AIR) at a discount after the airline revealed a data breach affecting members.

The case for investing in Asia: Sharesight event wrap-up

Is there a case for investing in Asia? The answers were revealed during an event hosted by Sharesight in association with Aberdeen Standard Investments.

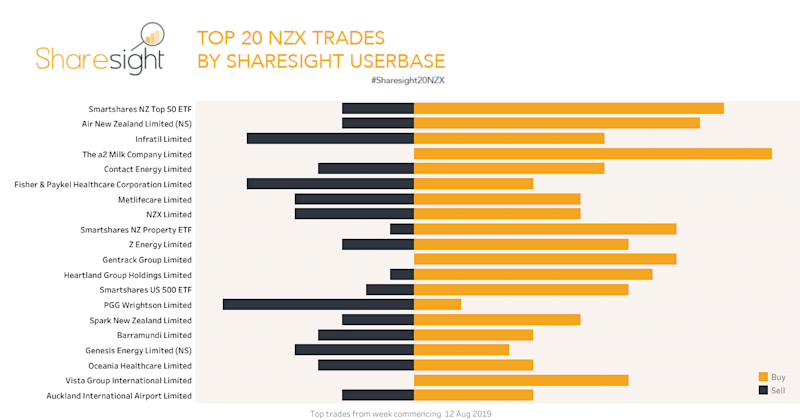

Sharesight20NZX top 20 NZX trades - 12th August 2019

ETFs dominated the Sharesight20NZX this week and took out 8 of the top 10 places, so we've added a BONUS Sharesight20NZX snapshot with ETFs removed.

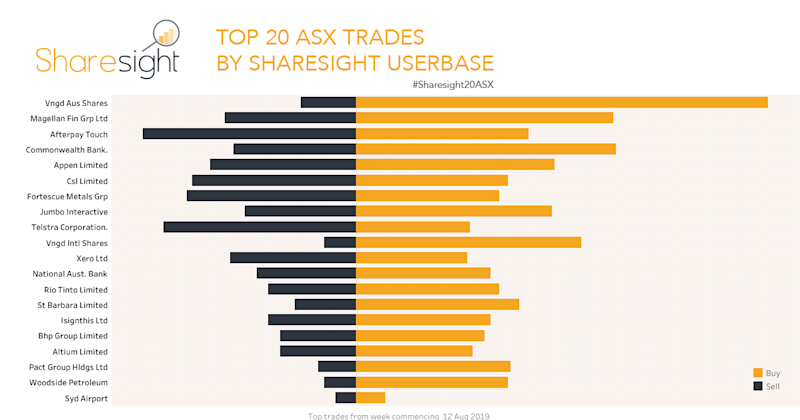

Sharesight20ASX top 20 ASX trades - 12th August 2019

REIT Rural Funds Group (ASX: RFF) made its first appearance in our Sharesight20ASX snapshots this week at number 1 after being targeted by short sellers.

Sharesight release notes - July 2019

The key milestone for Sharesight in July was the release of our Interactive Brokers integration for all retail users. Read our full release notes for July:

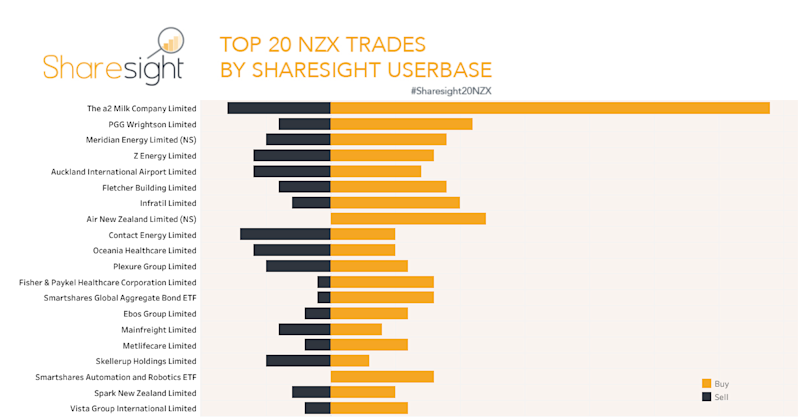

Sharesight20NZX top 20 NZX trades - 5th August 2019

Sharesight users sold down a2 Milk Company and Auckland International Airport (NZX: AIA) in this week's Sharesight20 snapshot of the NZX.

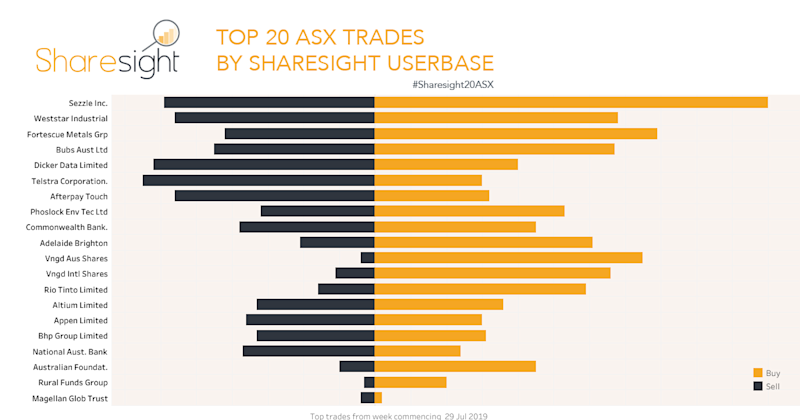

Sharesight20ASX top 20 ASX trades - 5th August 2019

Investors using Sharesight jumped on the IPO of US based Afterpay clone Sezzle (ASX: SZL) during this week's Sharesight20 snapshot.

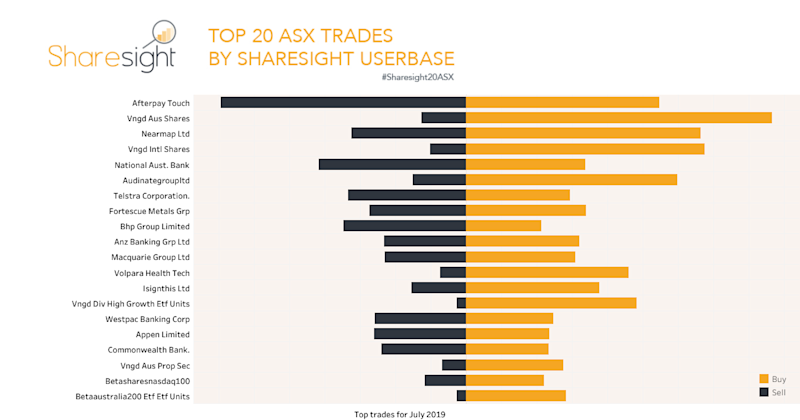

Sharesight20 top 20 trades on ASX & NZX - July 2019

We look at the top 20 stocks on both the ASX and NZX traded by Sharesight users during July, and dig a little deeper into the news behind these movements.

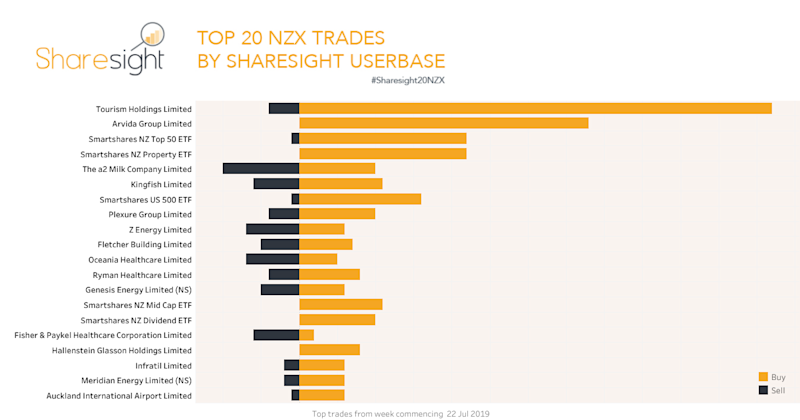

Sharesight20NZX top 20 NZX trades - 29th July 2019

Tourism Holdings Limited (NZX: THL) made strong gains and surged to the top of our Sharesight20NZX snapshot of the 20 most traded shares on the NZX this week.

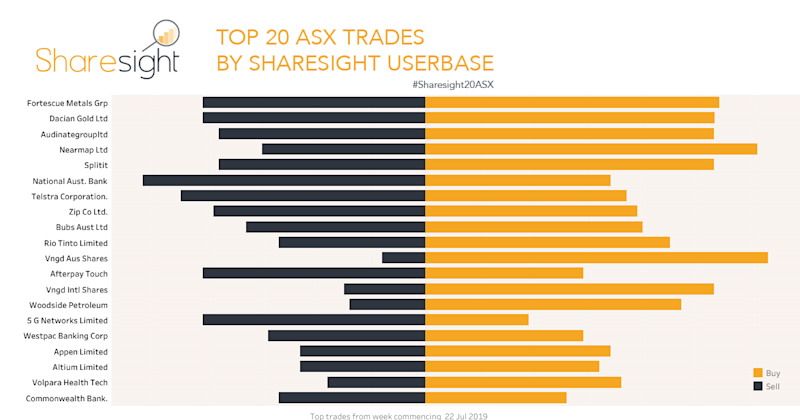

Sharesight20ASX top 20 ASX trades - 29th July 2019

It was a big week for ASX listed resource companies, with Sharesight users jumping on Fortescue Metals Group (ASX: FMG), Dacian Gold Ltd (ASX: DCN) and others.

Should you invest in early-stage companies or VC funds?

Sharesight CEO Doug Morris moderated a panel of angel investing, VC and crowd-funding platform experts. Here's what they told him about early-stage investing.

Get The Motley Fool Singapore insights in Sharesight

Investors can now access insights from The Motley Fool Singapore directly within Sharesight for stocks listed on the Singapore Stock Exchange (SGX).