Latest posts

How to track exchange-traded funds (ETFs)

In this article we discuss the history of ETFs, some of the tax considerations for investors and how you can track the performance of your ETFs with Sharesight.

Sharesight product updates – September 2024

This month's focus was on improving our investment search function, expanding our broker support and taking further steps towards customisable reporting.

Going global with ETFs: Strategies for international investing

Australian investors once focused on the ASX, but the success of US tech stocks and rise of international shares ETFs has changed the investing landscape.

Have big earnings season moves made way for opportunities?

Morningstar looks at the biggest market reactions this ASX earnings season and what their analysts think about the companies.

Australian ETF distribution components now available for FY23/24

Sharesight now has updated ETF distribution component information for the FY23/24 Australian tax year for most Australian ETFs.

Building a multi-asset portfolio with ETFs

ETFs offer a cost-effective, flexible way to access diverse assets, helping investors build portfolios aligned with their risk tolerance and goals.

Sharesight and Betashares team up for an exciting ETF education series

We're thrilled to launch a month-long collaboration between Sharesight and Betashares to educate investors on everything they need to know about ETF investing.

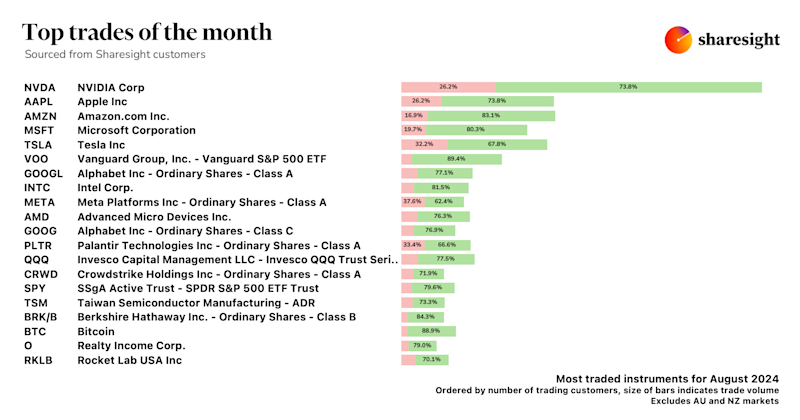

Top trades by global Sharesight users — August 2024

Welcome to the August 2024 edition of Sharesight’s trading snapshot for global investors, where we look at the top trades by Sharesight users around the world.

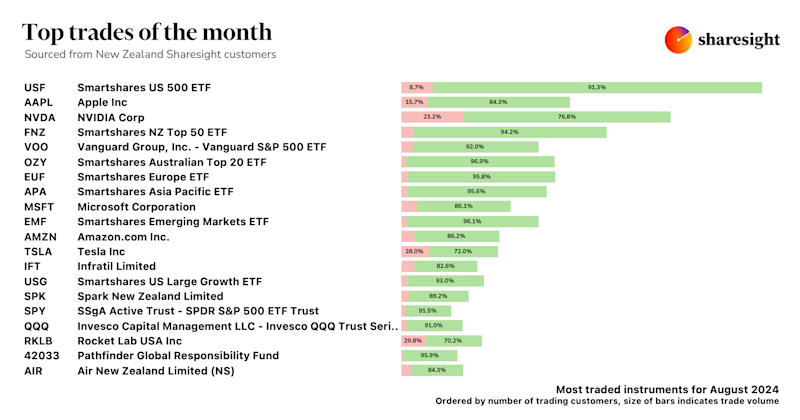

Top trades by New Zealand Sharesight users — August 2024

Welcome to the August 2024 edition of Sharesight’s trading snapshot for New Zealand investors, where we look at the top trades by our New Zealand userbase.

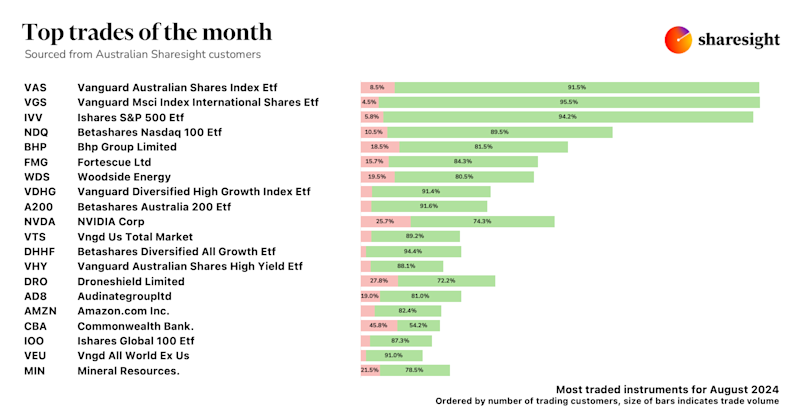

Top trades by Australian Sharesight users — August 2024

Welcome to the August 2024 edition of Sharesight’s trading snapshot for Australian investors, where we look at the top trades by our Australian userbase.

Track investments from leading Canadian brokers

If you’re a Canadian investor, you can easily import your trades in stocks, ETFs and mutual funds directly into Sharesight from a range of leading brokers.

6 key metrics every dividend investor must track

This blog explains six key metrics that dividend investors should be tracking to achieve success, and how they can be tracked in Sharesight.