Optimise your portfolio at tax time: Success favours the prepared

The analysis and optimisation features in Diversiview can be tested for free for one portfolio of up to five securities. Sharesight users can use the code SHS2021 to get a 35% discount on Diversiview subscriptions.

As the financial year ends and tax returns are being sent to the Australian Taxation Office (ATO), some people may receive a tax refund. Investing that money is an excellent opportunity, but the question is, where to invest it? With over 2,200 securities on the ASX alone, finding the security that works for your portfolio and your goals is not an easy task.

Moreover, once you decide on that additional investment, how do you allocate your money? You could simply place all your extra cash into that investment, or you could try to reallocate some of the money in the portfolio and reshuffle the allocation of your securities. Which one works best?

There is no silver bullet in investing, but we argue that it is critical to realistically assess how each additional investment would impact on your portfolio performance.

In this article we consider a test portfolio and look at three different scenarios of investing a potential tax refund, that is:

-

Allocation to the most popular security (no optimisation)

-

Allocation to a popular security with high average return (no optimisation)

-

Allocation to a popular security with low risk / volatility (no optimisation).

We will also compare these three scenarios with an optimised asset allocation for the same set of securities, and with the original allocation. Note that other investment scenarios surely exist but only these three will be covered in this article.

To select the securities for the test portfolio and for all scenarios listed above, we used the top 20 ASX trades from Sharesight users between 1 July 2021 to 30 June 2022 (see Figure 1).

Figure 1: Top 20 ASX trades sourced from Sharesight users during financial year 2021-2022

An overview of the top 20 trades in FY22

Before analysing the test investment scenarios mentioned above, let’s first look at how the top 20 trades in FY22 compare with the top 20 trades in FY21.

Figure 2: Top 20 ASX trades sourced from Sharesight users during financial year 2020-2021

The first observation is that 55% of the top 20 preferences in FY21 (Figure 2) continued to be preferred by investors in FY22.

The proportion of sell transactions in FY22 is also lower than the proportion of sell transactions in FY21, which indicates that investors may have taken a long-term view in FY22 and focused on buying suitable securities rather than selling the underperforming ones.

The number and the variety of preferred industries for direct shares has also decreased in FY22, from nine industries in FY21 to only five in FY22 (see Figures 3 and 4). Additionally, the number of preferred ETFs increased from five in FY21 to nine in FY22, indicating a preference shift to less risky, more diversified investment instruments.

Figure 3: Top 20 ASX trades during FY22, allocation by industry groups

Figure 4: Top 20 ASX trades during FY21, allocation by industry groups

Market capitalisation

If we look at the market capitalisation for the top 20 trades in FY21 and FY22, we see a similar distribution of the preferences with the majority being small and mid-caps, and several large-caps (see Figures 5 and 6).

Figure 5: Top 20 ASX trades during FY22, by rank (X axis) and market capitalisation (Y axis)

Figure 6: Top 20 ASX trades during FY21, by rank (X axis) and market capitalisation (Y axis)

A notable appearance is BHP, a mega-cap that comes 6th in the list for FY22 while not even making the list in FY21. Also notable is the fall of Z1P from 1st place in FY21 to 16th in FY22, indicating investors’ decreased level of confidence in the BNPL sector.

Expected performance

During FY22, investors traded in securities with low-to-medium expected return. That is, 16 out of the top 20 securities have positive expected returns but all under 20% (see Figure 7).

Figure 7: Top 20 ASX trades during FY22, by ranking (X axis) and expected return (Y axis). (Size of circles indicates volatility)

Only two securities have high expected returns, but they are also very volatile (that is, FMG and PLS).

At the same time, we can see that two securities in the top 20 list have a negative expected return (WBC and MFG). MFG also had high volatility which makes its 19th place in the top 20 preferences in FY22 quite difficult to explain.

Sharpe ratio

The Sharpe ratio is a well-known ratio used to assess investment performance. Typically, investors expect a Sharpe ratio higher than 1. That is, they expect to get more return per unit of risk taken.

If we plot the Sharpe ratio at present time for the top 20 trades in FY22, the results are quite interesting. That is, all 20 securities currently have a Sharpe ratio lower than 1.

This means that investors will take more risk than the expected return if they continue to invest in these securities.

Moreover, WDS has a Sharpe ratio close to 0, and MFG has a negative Sharpe ratio.

Figure 8: Top 20 ASX trades during FY22, by ranking (X axis) and Sharpe ratio (Y axis)

Sharpe ratios plotted in Figure 8 are calculated as at the end of June 2022. If you compare these results with the ratios shown for Jan-Mar in our previous article, you will notice that the Sharpe ratios of BHP and three ETFs (VAS, NDQ, ETHI) are in worse positions compared to three months ago.

Test portfolio and investment scenarios

As mentioned previously, when we looked at several scenarios for a test portfolio, we hypothesised that an investor wanted to invest their tax refund (or any other extra cash for that matter) and they wanted to test different approaches to compare outcomes.

Assumptions for this test are:

-

To minimise selection bias, all securities for the test portfolio and for the test scenarios will be taken from the top 20 ASX trades from Sharesight users during FY22 (Figure 1)

-

The original test portfolio includes all top 20 preferred securities, with equal allocations (that is, 5% each) and a total value of $100,000

-

The extra cash to be invested (e.g. tax refund) is $10,000

-

The investor would like to have no less than 2% and no more than 40% allocated to any given security.

Scenario 1

The investor places the 10k extra cash in the most popular security which is VAS (1st place in the top 20 FY22 list).

Scenario 2

The investor places the 10k extra cash in a popular security with high expected return, which is FMG (highest average return in the past three years, from the top 20 FY22).

Scenario 3

The investor places the 10k extra cash in a popular security with low risk, which is AFI (lowest volatility in the past three years, from the top 20 FY22).

Table 1 below shows the money allocation for each of these scenarios, and for the original portfolio.

Table 1: Money allocation in the original portfolio and three surplus investment scenarios

After analysing the original test portfolio and the three test scenarios in Diversiview, we can extract the indicators listed in Table 2 below.

We also analysed the optimised asset allocation for the same set of 20 securities.

Table 2: Portfolio performance indicators in each scenario

As can be seen in Table 2, Scenario 2 (investing the 10k in FMG) would give the highest expected return (11.86%) at the expense of the highest volatility (61.42%).

We can also see in Table 2 that the optimised allocation for the set of securities gives the lowest volatility (27.38%) and a reasonable expected return ($7.72).

The expected return for the optimised allocation is higher than the expected return in Scenario 1 (investing the 10K in VAS), slightly lower than Scenario 3 (investing the 10K in AFI) and approximately 4% lower than Scenario 2.

At the same time, the optimised allocation gives the best Sharpe ratio (although quite low at only 0.15) which indicates the best return for each unit of risk taken in this test. The optimal allocation also gives the lowest portfolio Beta at 0.85 which indicates that a portfolio with that optimised asset allocation is expected to be less volatile than the entire market.

Table 3 below shows the optimised asset allocations for the set of securities considered in the test portfolio, and the respective values calculated for a portfolio of $110,000 (in our example, the original amount $100,000 plus $10,000 extra cash).

Table 3: Optimised asset allocation for the test portfolio

Comparison and benchmarking

As mentioned at the beginning of the article, the purpose of running various tests is to allow comparison and benchmark the results so the investor can make an informed decision.

We have compared the following portfolio scenarios over 12 months starting with 12/07/2021, and plotted the results (see Figure 9):

-

$100K invested in the original test portfolio (5% in each of the 20 securities)

-

$100K invested in the optimised portfolio (allocation in Table 3), assuming optimal allocation applied on 12/07/2021 and maintained over the 12 months

-

$100K invested in Scenario 2 test portfolio (with highest expected return and highest volatility)

-

$100K invested all in STW (SPDR S&P/ASX 200 Fund)

Figure 9: Plotting a $100K portfolio in four different test scenarios, from 12/07/21 to 12/07/22

As can be seen in Figure 9, the optimised portfolio allocation gives the highest average return (compound) over the 12 months considered, at -7.07%, followed by:

-

STW: average return -9.16%

-

Test portfolio (original; equal weights): average return -10.58%

-

Test portfolio (Scenario 2; extra cash reinvested in FMG): average return -11.5%

The actual portfolio value at the end of 12 months is highest for the optimised test portfolio, at $92,950.

The negative returns for all scenarios in this test are generalised as all returns have been impacted by the recent market crash due to international energy, gas crisis and geopolitical circumstances. Among all test portfolios, the optimised scenario shows the lowest decrease in this bearish market.

Conclusions

The purpose of this article was twofold: on one side we looked at the profile of the top 20 investment preferences in FY22, and on the other side we looked at several test scenarios starting from the top 20 preferences.

The conclusion from the test scenarios is that by optimising the asset allocation, the returns can be improved significantly compared with other potential scenarios.

Note: While the top 20 list is real and factual, based on Sharesight users’ preferences, all test scenarios in this article are for exemplification purposes only. The results obtained should not be taken as advice to invest in or divest from any of the securities mentioned.

We have made several assumptions which may not reflect the reality for an investor, and any other assumptions or constraints will produce different results.

Technology is here to help investors run as many scenarios as they need and make their next investment decision better informed. The calculation of the optimal asset allocation was performed using Diversiview, a portfolio analysis and optimisation application.

Optimise your portfolio with Sharesight and Diversiview

If you’re not already using Sharesight and Diversiview, what are you waiting for?

Sign up for a free Sharesight account to get started tracking your portfolio’s performance, and sync your portfolio to a Diversiview account to get deep insights into your portfolio’s diversification and risk profile.

The analysis and optimisation features in Diversiview can be tested for free for one portfolio of up to five securities. Sharesight users can use the code SHS2021 to get a 35% discount on Diversiview subscriptions.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

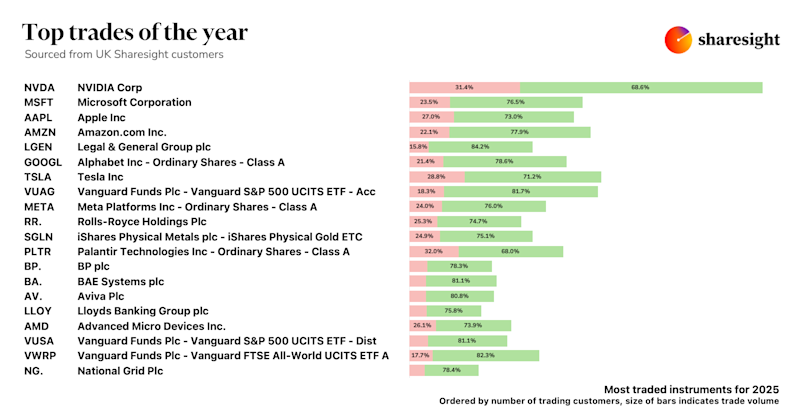

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

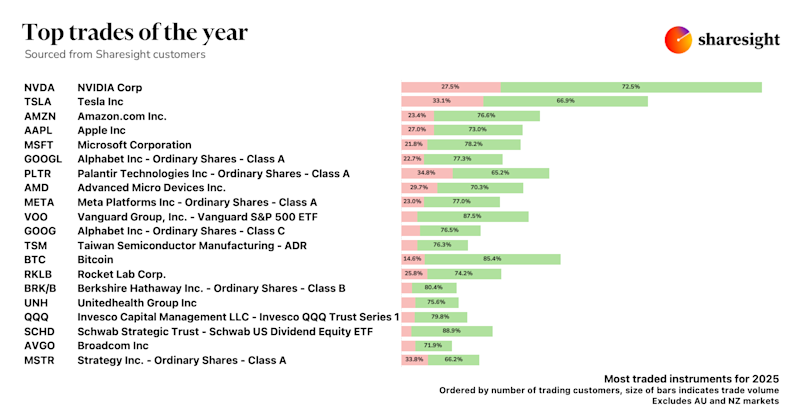

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.