Offshore investing – tips to get you started

The thought of investing overseas often seems risky and difficult but with the strength of the Aussie dollar and international equities currently outstripping their Australian counterparts, it makes sense that many share investors are thinking of taking at least part of their portfolios offshore. The question is, what is the best way to go about it?

Below are key factors to consider when turning your mind to investing overseas.

Research

It may seem obvious but research is crucial to offshore investments. Try sites like Morningstar, which not only provides investment research for international equities but also gives DIY investors a local perspective on the global situation.

How to go about it – and the pros and cons

Should you decide to invest, there are the mechanics to consider. Here’s a summary of the most popular options.

Direct via local broker or online service

Most major Australian-based brokers offer this service. It is relatively straightforward – especially if you are already trading with that provider – with the added advantage that the foreign exchange issues are taken care of for you, so you can trade in Aussie dollars. However, brokerage fees can be high, which can eat into returns if you make a lot of trades.

Direct offshore investing

After the requisite initial paperwork, it is simple to open and run an offshore trading account. By trading direct, you can significantly reduce brokerage fees. This option may suit an investor who has already tried an Australian-based broker and has already begun trading heavily overseas.

Pooled investment

Choosing to a pooled investment vehicle such as an international Exchange Traded Fund (ETF) or a managed fund offers smaller investors the benefit of exposure to a wider range of shares that they might be able to access directly. The ETF option can be cost effective and, because it is listed on the local exchange, has the added advantage of being tradeable through your local broker or online trading service. Both ETFs and managed funds are available in hedged or unhedged options, so you can decide how to address the potential positive or negative effects of currency fluctuations on the value of your investment.

Once you decide where and how to invest, it’s a matter of using a portfolio management system that will enable you to address factors such as currency shifts and the offshore taxation requirements.

The good news is that Sharesight offers a range of tools that take care of these important details for users who invest overseas:

-

International data feeds , including NASDAQ, NYSE, London Stock Exchange and New Zealand Stock exchange, keep investors up to speed the latest dividend and corporate information.

-

Currency conversion , which is automated for the user, so you can see your true Australian dollar position.

-

Taxation issues – Sharesight captures information relating to, for example, withholding tax from offshore markets so you can record and claim relevant tax credits with ease. Do make sure you register with the appropriate authority when you purchase international shares because, if you don’t, in markets such as the US an additional penalty tax may be applied to your earnings.

Our international investment tools have been extremely popular with our New Zealand clients, who often include overseas shares in their portfolios due to the relatively small size of the local market. So we’ve designed and built the tools to offer real value and benefit to real investors. In other words, we know what overseas investors need and we know that it works! So if taking the international plunge is right for you, remember that Sharesight makes it easier than it’s ever been.

FURTHER READING

My investment portfolio used to be gold bangles

For International Women’s Day, Morningstar's Shani Jayamanne explores the ways that women have taken back financial control.

Simplify property tax & investment tracking with TaxTank + Sharesight

Simplify property tax management with the Sharesight + TaxTank integration—track CGT, investment income, and tax data in one seamless, automated platform.

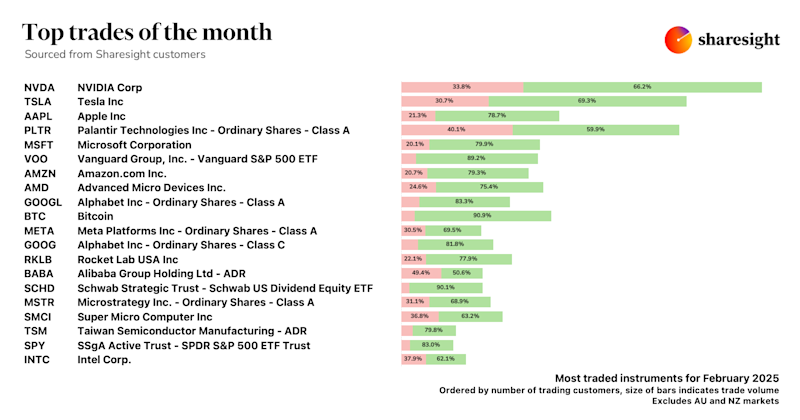

Top trades by global Sharesight users — February 2025

Welcome to the February 2025 edition of Sharesight’s trading snapshot for global investors, where we reveal the top 20 trades by Sharesight users worldwide.