New functionality for Consolidated Views

We recently expanded the functionality of the Consolidated Views feature within Sharesight. Read on to learn what’s changed, and how to leverage these changes to gain additional insights into your investment portfolios.

What is a Consolidated View?

The Consolidated View feature allows you to “group” multiple portfolios within Sharesight and run a selection of reports across them:

Embedded content: Using Consolidated Views - Sharesight Portfolio Management

For more information on Consolidated Views (including the differences between a Portfolio and a Consolidated View), visit our help page on Using Consolidated Views.

What’s changed?

Once you’ve created a Consolidated View, you may then:

1 -- Group by Portfolio

This expanded functionality allows you to easily compare the performance of portfolios at a glance, without having to switch back and forth between them.

From the Portfolio Overview page, select “Group by: Portfolio” from the advanced options menu:

This will chart your consolidated, as well as individual portfolios:

It will also group your holdings by portfolio, and display their individual returns:

The "Group by Portfolio" setting is also now available on the following reports:

2 -- Run a Contribution Analysis Report

You may now also run a Contribution Analysis Report on a Consolidated View:

Previously unavailable for Consolidated Views, the Contribution Analysis Report provides insights into the drivers of your portfolio’s performance, be they particular stocks, assets, or exposure to certain countries, sectors, or industries. In the example above, we’re learning which sectors have had the biggest impact on our family’s consolidated portfolio returns.

For more information on this feature, visit our Contribution Analysis Report help page.

Sign-up for a FREE Sharesight account, then upgrade to try the premium features mentioned in this article.

FURTHER READING

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

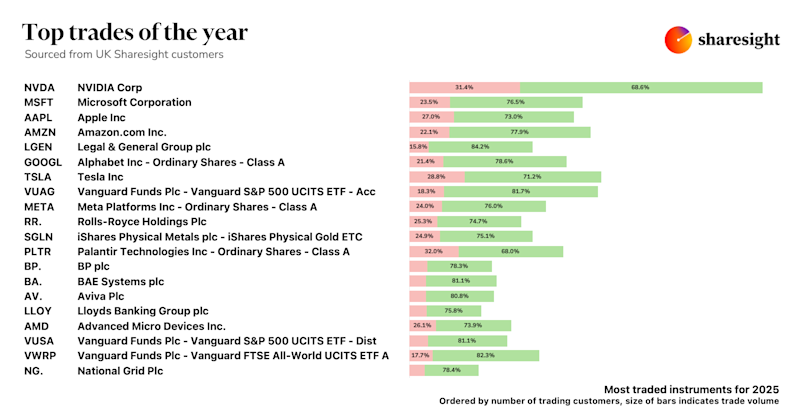

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

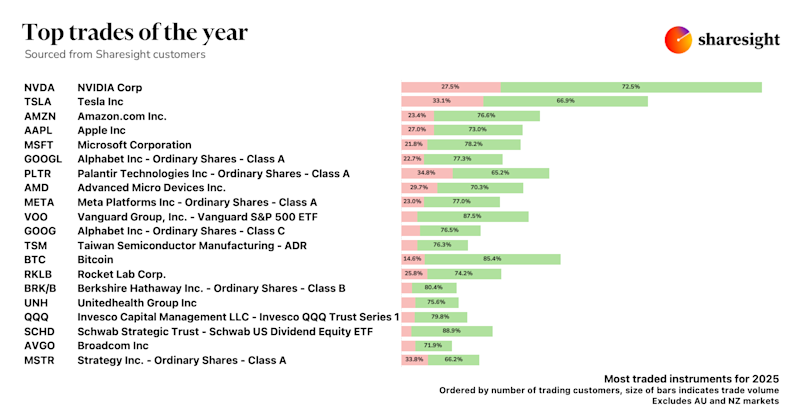

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.