New feature: Carry forward loss

Based on your comments in the Sharesight Client Forum, we’ve built and released a new carry forward loss feature found on the Capital Gains Tax report for Australian clients and on the Traders Tax report for New Zealand users.

This new feature allows Sharesight Retail and Pro clients to enter a carry-forward amount from the previous reporting period ($) that can now be included in the current report totals. You’ll find the amount towards the bottom of the reports as a dedicated line item. Currently this value is not saved and must be re-entered when you re-run the report.

Carry-forward feature on AU CGT report, example shows a carry-forward loss of $1,000

Ideas for future enhancements include:

-

Saving the carry-forward value against each financial year so that the amount is pre-populated when you re-run the historical report. This could get tricky as currently the report date range and lock periods are not restricted to a financial year.

-

Pre-populating the carry-forward amount if a CGT loss was calculated in the previous financial year (this is probably only useful if you don't have CGT gains/losses outside of your Sharesight portfolio).

As always we're keen to get your feedback!

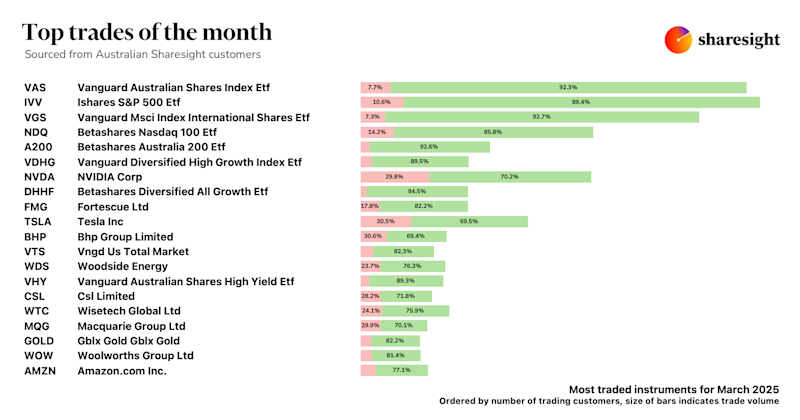

Top trades by Australian Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot for Australian investors, where we look at the top 20 trades by Australian Sharesight users.

Top 50 finance and investing blogs in 2025

Check out this list created by the Sharesight team, covering the 50 best personal finance and investment blogs from around the world.

Why property investors should use purpose-built software

We explore why property investors need a dedicated platform, and how connecting TaxTank and Sharesight can streamline portfolio management and tax reporting.