New! Categorise your shares

This week we have released our new labelling and report filtering functionality to customers on the Sharesight Expert plan.

This allows you to create your own set of labels and apply them to shares in your portfolio. It is then possible to report on specific categories of shares within a portfolio based on the labels that you have defined.

Labels can be anything you like and you can apply more than one label to each share. For example, you may choose to label your shares based on which broker or advisor recommended them and also label them based on investment profile (eg income vs growth).

The Performance Report can be filtered to include only shares that match the label(s) you specify. For example you could separately compare the performance of shares recommended by Broker A vs those recommended by Broker B.

We would be interested to hear how you use labels to categorise your shares and which other reports you would like to be able to filter. Share your feedback via the community forum.

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

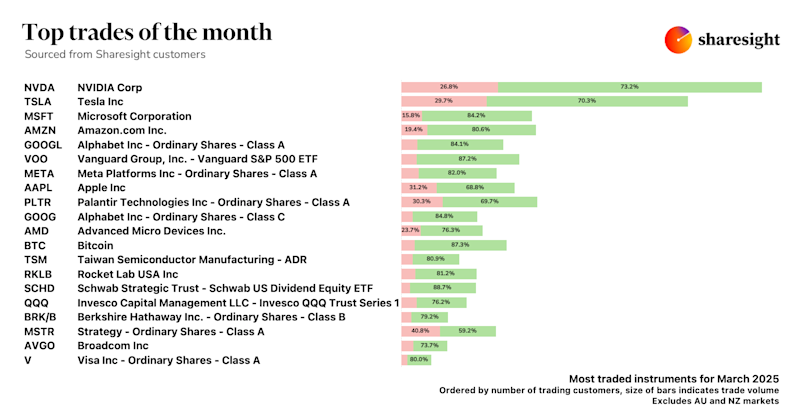

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.