New and improved Sharesight features in 2017

2017 was a busy year for Sharesight - we celebrated our tenth birthday, we were nominated for and won a number of awards, and we added a suite of new and improved features in order to improve Sharesight and make tracking the true performance of your share portfolio easier than ever.

Let’s dive into the details of the key Sharesight enhancements in 2017:

Contribution analysis report

We launched our contribution analysis report feature to clients on Expert and Professional plans. The Contribution Analysis Report allows investors to analyse the drivers behind a portfolio’s performance, be they stock selection, asset allocation, or exposure to certain countries, sectors, or industries.

We further enhanced the Contribution Analysis Report feature in October, allowing the report to be run across a consolidated view of multiple portfolios.

20-minute delayed pricing

We launched both 20-minute delayed pricing for NZX holdings in addition to 20-minute delayed pricing for ASX holdings to allow investors to track performance throughout the day in near-real time.

This means that the add holding, add/edit trades and share checker screens now display the latest 20-minute delayed intraday price we’ve received from both the NZX and ASX!

New Partner Centre

2017 was a massive year for Sharesight Partner news. Underpinning our commitment to supporting the vibrant ecosystem of Sharesight Partners, we launched the Sharesight Partner Centre. It showcases our industry-leading data and research partners, and lets you easily find innovative brokers, robo-advisers, accountants and advisors that can help you on your investment journey.

Canadian mutual fund support

We launched a massive addition to our portfolio database: over 38,000 Canadian mutual funds were added, with 10 years of historical prices plus ongoing price and distribution data updated automatically.

This is in addition to the nearly 10,000 ASX and NZX managed funds available on Sharesight since 2014.

New and improved help website

We launched our new help website, with a fresh design that works across desktop and mobile devices, localised content for various regions, and an easy-to-use search function.

The new help website has been regularly updated with new help content since launch, with help pages specific to your region, including help on our dedicated tax reports that conform to New Zealand’s Inland Revenue Department (IRD), Australian Taxation Office (ATO) and Canada Revenue Agency (CRA) rules (with more countries on the way).

New tools to import your trading history into Sharesight from more places

We built tools that make it easy to import your trading history from:

- Google Finance

- Yahoo Finance

- Canadian broker Questrade (Massive news for Canadian investors!)

Sharesight20 trading insights

We launched the Sharesight20 weekly trading snapshot - a weekly update of the top 20 shares traded by the Sharesight userbase on the NZX and ASX markets over the previous 7 days.

We also launched a deeper dive into the news and corporate actions driving the activity across the top 20 shares traded in these markets with a monthly Sharesight20 trading update.

We made it easier to manage corporate actions

Sharesight handles the vast majority of corporate actions – such as dividends and share splits – automatically. But when two companies merge into one (commonly known as a takeover or merger) it can mean a bit of manual portfolio admin for investors. To help alleviate that pain, we built the the merge holding feature.

More sources for company news in your portfolio

In addition to Google News and Livewire updates, we partnered with Firstlinks to bring their exclusive investing insights directly into your Sharesight portfolio.

Public Portfolios

We launched public portfolios, which allows sharing of a “Sharesight light” portfolio that can be viewed by anyone -- no login required. These will be used to track the upcoming Sharesight 2018 stock picking competition. Stay tuned for more details!

Here’s to an even bigger 2018!

These are just a few of the new and improved Sharesight features from 2017. We also made a number of behind the scenes improvements, such as moving to an Amazon Aurora Database, and improving the speed of performance calculations by almost 5x in some cases.

We’ve got a pipeline full of new features planned for 2018. We thank you for your support in 2017 and look forward to bringing these to you in the new year.

Further information

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

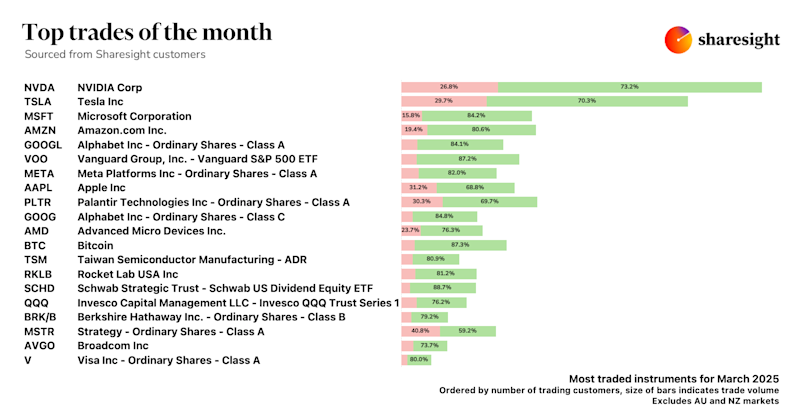

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.