How to navigate market volatility with Sharesight and Stockfox

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

The share markets are experiencing their longest period of weakness in decades. The US market recently fell for 8 consecutive trading days, the longest decline since 1923. A ‘perfect storm’ of economic and geopolitical events are causing havoc with people’s portfolios, making it more important than ever to monitor your investments and be ready to react to rapidly changing circumstances. Keep reading to learn more about some of the factors causing stock market volatility and how investors can keep their portfolio on track.

What is causing volatility in the stock market?

At any given time, there are countless factors that can contribute to volatility in the stock market, but the main factor is usually uncertainty. Anything from political instability to economic policy changes tends to create instability in the stock market, causing stocks to experience dramatic price swings. The current situation is no different, with inflation, rising interest rates and geopolitical tensions causing many investors to reconsider the composition of their portfolios.

"Contrary to the popular notion that financial markets are efficient, I have learned from my 30 years’ experience in the markets that sentiment can play a major part in how assets are valued. Simple greed and fear can make investors act irrationally, which is why people should be greedy when others are fearful and fearful when others are greedy", says Stockfox founder and CEO David McEwen.

How investors can navigate volatile markets

Market volatility often causes investors to panic and sell out of their stocks. This is a short-sighted approach however, and is not necessarily the best strategy for investors hoping to maximise their returns over the long-term. Here are a few strategies investors may wish to consider when faced with volatile markets.

Focus on value, not price

By investing in solid businesses that produce goods and services that people will continue to use during a recession, investors can weather a serious market correction. For example, food and agriculture, medical and healthcare, and utilities and energy are some key sectors that are likely to benefit from current economic trends, or be resilient during a market downturn. This is because no matter what state the world is in, people will always need to feed themselves, access health services and keep water and electricity running in their households.

An example of this effect is New Zealand utility Meridian Energy (NZ: MEL). In the past six months, during which time the NZX50 Index fell by 5%, MEL’s share price has risen by 5% – a 10% outperformance. In Australia, Ramsay Healthcare (AU: RHC) has also risen by 15% in the past six months, while the All Ordinaries index is down by around 2%.

Some of these businesses will also pay attractive dividends. In particular, as a company’s share price declines, its dividend yield increases. For example, some 13 of the NZX50 and 15 of the ASX200 shares now offer a gross dividend yield of 5% or greater. Investing in companies with a high dividend yield can be a good way to ride out short-term price movements until the market turns around, especially if you are able to invest in companies that pay you a dividend greater than the interest you could earn by having your money in the bank.

Start shorting weak shares

Shorting is when you sell a share that you don’t own, and buy it back later. If the share goes down, you make a profit. Shorting can help you keep your portfolio out of the red because you can use short positions as a buffer against losses on your long positions, reducing net losses significantly. If the market turns the other way suddenly, the long positions will offer a buffer against losses on your short positions.Sooner or later you will need to decide which way the market is trending and invest accordingly, but shorting can be a useful tool when markets are proving volatile.

Diversify your portfolio

Portfolio diversification is one of the most common ways investors can lower their risk amid market volatility. The aim of diversification is to reduce the risk of damaging losses from the poor performance of a singular company, sector or asset class, while benefiting from exposure to better performing assets.

To ensure they are appropriately diversified, it is important for investors to carefully consider their portfolio’s asset allocation. For instance, one common strategy is holding a mixture of riskier growth assets such as individual shares and real estate, as well as defensive assets like government and investment grade bonds, or cash. Another common strategy is to invest across different geographies and markets, even within the same asset class.

"While it is possible to overdiversify, research has found that spreading your investments across differing assets reduces the risk of experiencing a serious loss," says McEwen.

"This is because some assets move in different directions to each other under the same conditions. An example of this is when higher oil prices means the value of assets in the oil industry go up, while hurting the value of assets, such as trucking firms, that need to spend more on their input costs."

For investors looking for an easy, automated way to determine their asset allocation, Sharesight allows investors to track their investments using self-defined asset allocation categories. When combined with the diversity report tool, this gives investors a detailed breakdown of the asset allocation in their portfolio and allows them to see how their portfolio is tracking against their asset allocation target. This gives investors the information they need to adjust their assets, selling off any assets that are over-exposed or investing in assets that are under-represented in their portfolio.

Investors seeking advice on diversifying their portfolio can also leverage expert market insights from share advisory app, Stockfox. With ‘buy’ and ‘sell’ tips covering NZX, ASX, NASDAQ and NYSE-listed companies across a variety of industries ranging from agriculture to healthcare and infrastructure, plus a range of risk levels, Stockfox makes it easy to make investment decisions.

Investors can save time and avoid confusion by letting Stockfox’s share market experts do the research for them – all they need to do is receive the ‘buy’ and ‘sell’ tips from Stockfox and act on them if the advice aligns with their trading strategy. No more putting all your eggs in one basket – Stockfox helps investors spread the load, diversify their portfolios and assist them in making the most of the share market.

Track your portfolio against market benchmarks

In times of market volatility, it’s important that investors not only track their performance, but put that performance into context with the broader market. One way of doing this is by choosing a benchmark for the portfolio that aligns with the investor’s goals or strategy. For example, investors may choose an ETF or fund that tracks a certain index, or one that tracks a basket of stocks in a particular industry that will give them a like-for-like comparison with their own portfolio.

When benchmarking a portfolio, the idea is to aim to outperform the benchmark over the year. And if the investor finds they are consistently underperforming compared to the benchmark, they may decide to direct their investments into the ETF or fund instead, which could be an easy way to earn better returns.

This can be done automatically with Sharesight’s benchmarking tool, which allows investors to benchmark their portfolio against over 240,000 stocks, ETFs and funds from around the world. The tool makes it easy to see whether an investor’s portfolio is following the same market trends as the benchmark, which is a good way to determine whether an investor’s portfolio is underperforming due to their own investment decisions, or whether it has been caused by broader market events, for example.

Navigate volatile markets with Sharesight and Stockfox

Get expert share market advice and award-winning portfolio performance reporting by connecting Stockfox and Sharesight.

To get started using Stockfox’s share market advice app, click here to start your free 14-day trial.

Or if you’re a Stockfox user wanting to get started with Sharesight, sign up for a free account here.

Once you’ve signed up for Sharesight and Stockfox, you can easily connect your Sharesight portfolio to your Stockfox account to get actionable investment tips on your portfolio.

FURTHER READING

Why Sharesight is the best multi-asset portfolio tracker

We explore how Sharesight helps you stay on top of your portfolio, optimise your performance and set yourself up for a successful year of investing.

Automatically import Invest Direct trades to Sharesight

You can directly connect your Invest Direct account to Sharesight, allowing you to automatically sync your trades to your Sharesight portfolio.

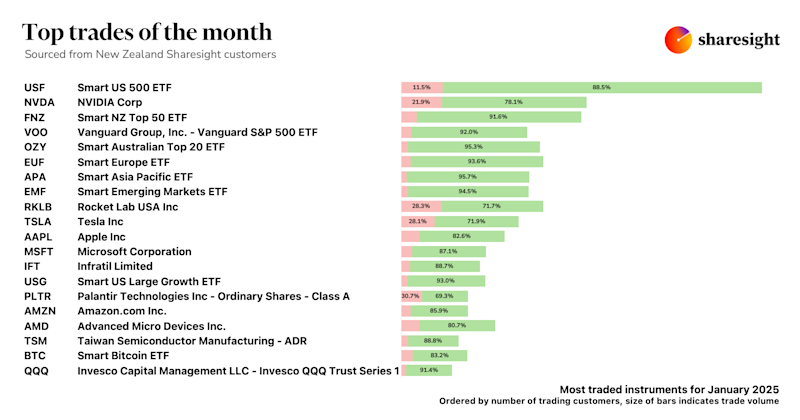

Top trades by New Zealand Sharesight users — January 2025

Welcome to the January 2025 edition of Sharesight’s trading snapshot for New Zealand investors, where we look at the top trades by New Zealand Sharesight users.