How to handle the NAB renounceable rights offer

In early 2015, NAB announced that it would be undertaking an accelerated Renounceable Entitlement Offer, in order to raise roughly $5.5 billion in capital. The offer gave eligible retail NAB shareholders to right to purchase 2 NAB shares, at an issue price of $28.50, for every 25 NAB shares they held.

Eligible NAB shareholders had the options of either:

-

Taking up the offer , meaning they could purchase X number of NAB shares (based on what their entitlement was) at the issue price of $28.50.

-

Selling their rights (or even purchase more) on the rights market, under the code NABR.ASX.

-

Doing nothing and having NAB sell their entitlements through a retail bookbuild process.

Whichever option you chose at the time, Sharesight allows you to easily account for this within your portfolio.

Follow these steps to handle the NAB renounceable rights offer

Taking up your entitlement offer

If you decided to take up the offer, you simply need to enter a new Buy transaction within your NAB holding, as follows:

-

Sign up for a FREE Sharesight account and add your NAB holding.

-

Within the ‘All Trades and Adjustments’ section, click on ‘Enter a new Trade or Adjustment’.

-

Enter the trade date as 11/06/2015 (issue date of the new shares). The share purchase price will be $28.50 (the offer issue price). You can enter a comment explaining this purchase was part of the offer.

Selling your entitlements on market

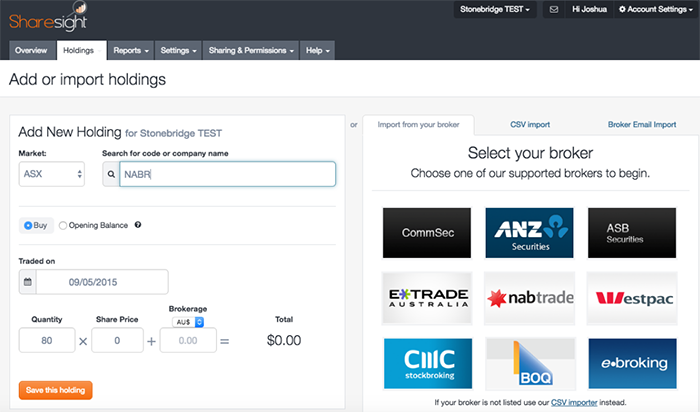

If you decided to sell your rights/entitlements on market, you will need to add a holding under the code NABR (rights code) and then enter a Sell transaction against it.

-

Sign up for a FREE Sharesight account and add your NAB holding.

-

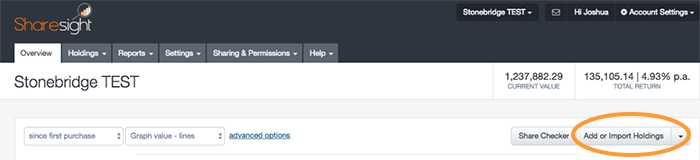

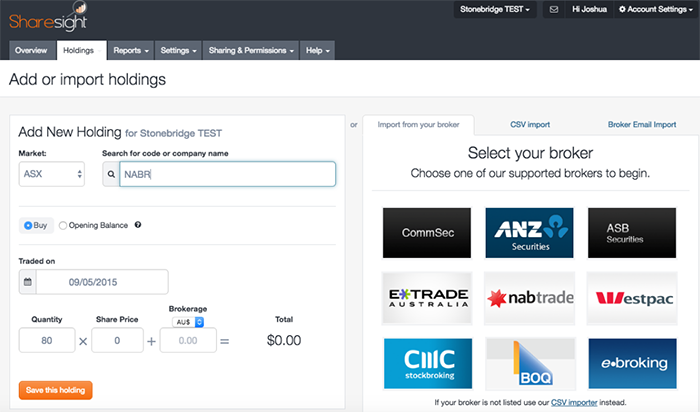

To add the rights holding, from the ‘Overview’ page click ‘Add or Import Holdings’.

-

Using a ‘Buy’ trade, enter the code NABR ( ASX), and ‘Trade Date’ as 09/05/2015. The quantity will be your NAB quantity divided by 25, then multiplied by 2. For example, if you hold 1000 NAB shares - (1000 / 25) x 2 = 80. Share price will be $0. Note - you can return to this transaction at a later stage to enter a comment.

-

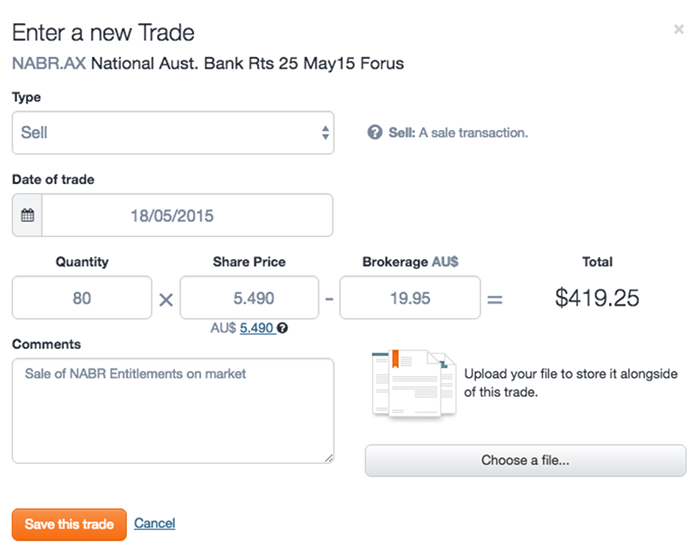

Once you’ve saved this new holding, you will be taken to the ‘Overview’ page, where you should now be able to see your new holding NABR. Clicking on the new holding you will be taken to the ‘Holding’ page for NABR.

-

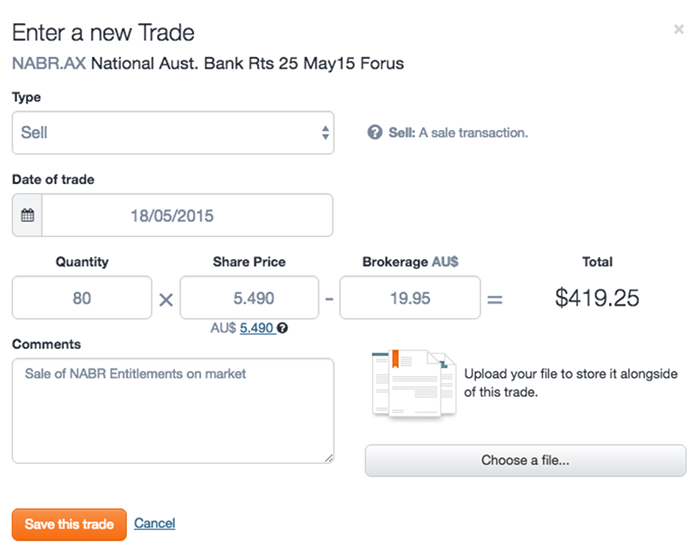

From the ‘Holding’ page, under the ‘All Trades and Adjustments’ section, click ‘Enter a new Trade or Adjustment’. In this new window, change the ‘Type’ to Sell, enter the trade date, full (or partial if applicable) quantity, Sell price and comments (if applicable). For some of this information, you may need to refer to your Trade Confirmation Email / contract note from your brokerage account. You can also upload any related Trade Confirmation Emails for future reference.

If your entitlements were sold through the bookbuild process (i.e. no action)

If you decided to do nothing and allowed NAB to attempt to sell your entitlements through a retail bookbuild process, you would have likely received a nice little payment of $3.10 per entitlement. The best way to account for this would be to create a new ‘unfranked’ dividend payment for your NAB holding. To do so:

- Sign up for a FREE Sharesight account and add your NAB holding.

- From the ‘Overview’, click into your NAB holding.

- On the NAB ‘Holding’ page, scroll down to the ‘All Income’ section and click ‘Enter a new Dividend’.

- In this new window, per your Payment Summary document received directly from NAB, enter the amount you received into the ‘Unfranked Income’ section. If you do not have your Payment Summary, you can use - Entitlement Quantity x $3.10 = payment received.

Note - Figure of $3.10 per entitlement was obtained from NAB and other research sources. It is always best to refer to your Payment Summary for exact amounts.

For most investors these corporate actions can be time consuming and confusing. Sharesight provides you with the tools and technology to help keep your portfolio up to date. Remember to check our community forum to interact with other investors and learn how they approach these issues.

Please note that we always advise you to consult your financial advisor or accountant regarding corporate actions, especially for tax purposes, as we are not authorised to provide financial advice. The information above, including the dates is subject to change. We encourage you to review the offical Nab Retail Entitlement Offer document for full details.

GET HELP

- Help -- Renounceable Rights

- Blog -- Corporate actions and your investment performance

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

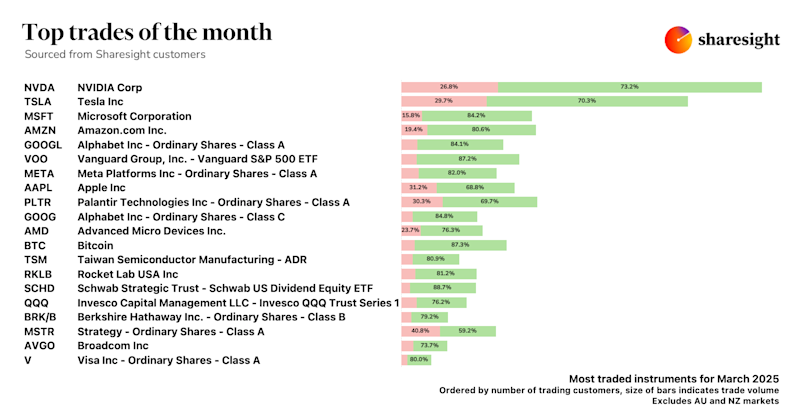

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.