How to create a multi-generational wealth plan

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

For high-net-worth individuals, building wealth is just one part of the financial equation. The next critical step is creating a strategy to preserve and pass on that wealth to future generations. Having a multi-generational wealth plan not only secures the financial future of your descendants but also ensures your family's values and legacy are carried forward.

In this article, we explore key approaches to developing a strong multi-generational wealth plan, focusing on three core pillars: Education, legacy planning and family governance structures.

Start with financial education

Financial literacy is a fundamental component of any multi-generational wealth plan. Educating the next generation on managing, preserving and growing wealth is crucial for the plan's long-term success. Without proper understanding and knowledge, even substantial inheritances can quickly diminish.

To avoid this, you’ll need to start conversations about money and wealth management early, incorporating age-appropriate lessons. Younger children can learn the basics of saving and budgeting, while older children can be introduced to investing and understanding the family's financial philosophy.

You should also consider supporting advanced education in finance, economics or business for those who show interest. Leveraging professional financial advisors or private courses is another way to provide valuable insights into complex financial concepts. It’s also a good idea to encourage the next generation to participate in family financial discussions or observe meetings with financial advisors. This gives younger family members practical experience and fosters a sense of responsibility — empowering future beneficiaries to make informed decisions that align with the family’s values and goals.

Establish a legacy plan

Legacy planning goes beyond just distributing assets. It's about defining what you want your wealth to achieve over generations and ensuring that your values, beliefs and philanthropic goals are embedded in your financial plan.

If you’re looking for a place to start, the first step is to define your vision by considering what you want your wealth to represent. Is it a means to provide for education, support charitable causes, or maintain family-owned businesses? Clarifying these goals can help guide your legacy planning decisions.

It’s also worth considering whether you want to use trusts in your legacy planning, perhaps with specific conditions that align with your family’s values or philanthropic aspirations. For example, you could establish a charitable remainder trust to provide income to family members while also benefiting a charity of your choice. You could also incorporate philanthropic activities into your wealth plan by establishing a family foundation or donor-advised fund, allowing you to support charitable causes and involve future generations in philanthropic efforts.

Develop a family governance structure

Family governance structures are formal frameworks that help manage family dynamics, decision-making and communication. These structures are especially important for families with significant wealth, where differing opinions or misunderstandings can lead to conflict and jeopardise financial plans.

To create a family governance structure, there are a few important steps you must take. Firstly, it is recommended that you create a family constitution. Essentially, this is a written document that outlines your family’s mission, values and guidelines for financial management and decision-making. It can also specify rules regarding family business involvement, distribution of assets and philanthropy.

Another key step is to form a family council consisting of selected family members who meet regularly to discuss family matters, such as investments, business decisions and succession planning. This body provides a formal platform for communication, ensuring everyone’s voice is heard.

Finally, it is essential that you implement a succession plan. The plan should outline who will manage the family’s wealth, businesses and trusts. It should be transparent and flexible, allowing for adjustments to be made as circumstances change or as new generations come of age.

By having a robust governance framework in place, you can reduce the risk of miscommunication or disputes, ensuring a smooth transition of wealth and responsibilities.

Regularly review and update your plan

A multi-generational wealth plan is not static — it should evolve with time and changing circumstances. Regularly reviewing and updating your plan ensures that it continues to align with your family’s goals and the ever-changing legal and financial landscape.

With that in mind, you should make sure to:

- Schedule regular check-ins: Conduct annual or biannual reviews with family members and your financial advisor to assess the plan’s effectiveness and make necessary adjustments.

- Stay informed about legal changes: Tax laws, estate regulations and investment opportunities frequently change. Keep yourself and your family updated on these changes to optimise your wealth plan accordingly.

- Adapt to family changes: Life events such as marriages, births or deaths may necessitate changes to your plan. Be ready to adapt to these changes to maintain harmony and fairness in wealth distribution.

Leverage technology for transparency and management

Managing a multi-generational wealth plan involves a lot of moving parts. By incorporating tech solutions into your wealth management practices, you can reduce tedious manual admin and human error, increase security and improve transparency among family members.

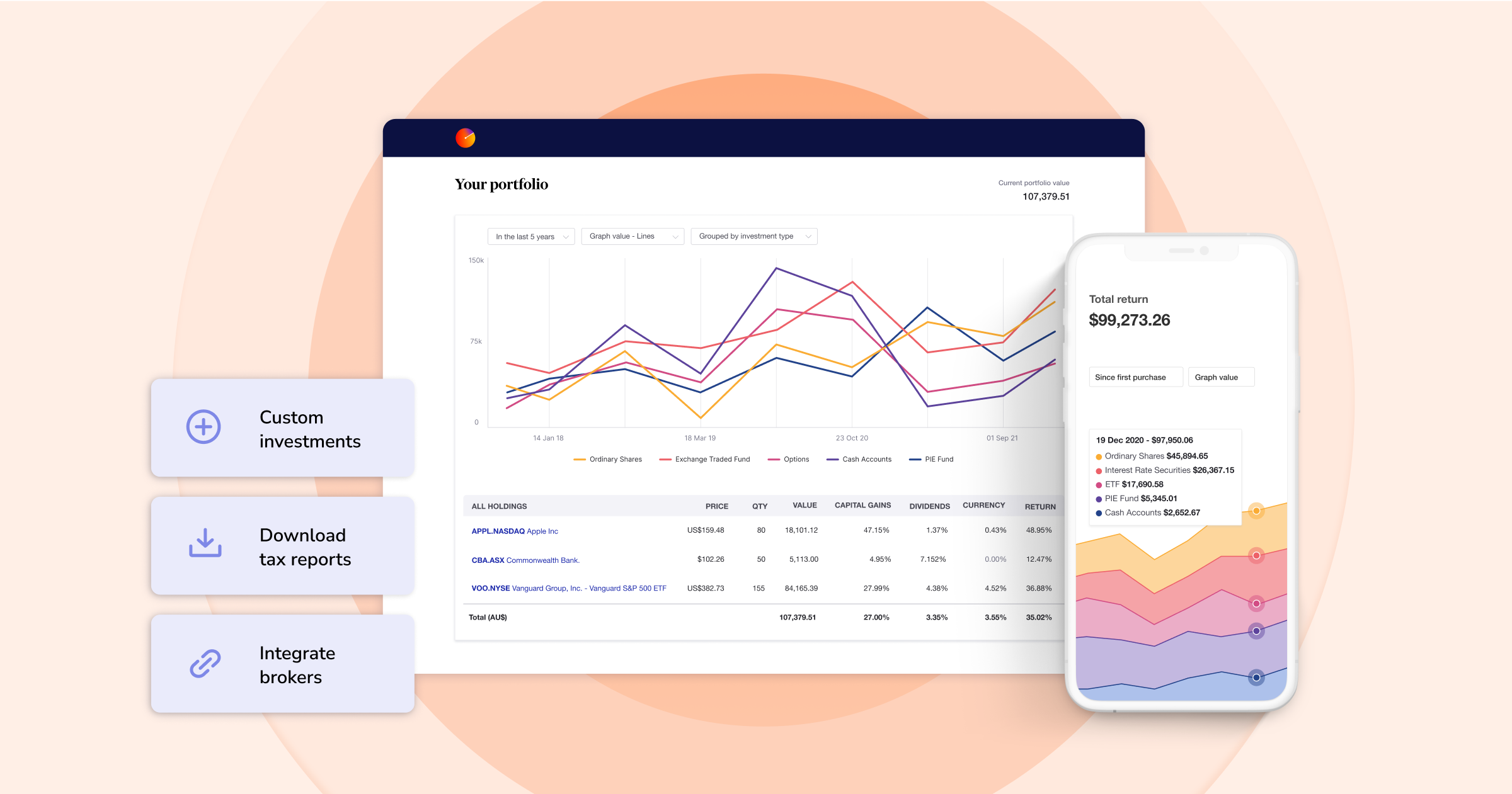

For example, using a digital tool like Sharesight’s portfolio tracker allows you to track all your investments in one place, from stocks, ETFs and funds to cryptocurrency and even unlisted assets such as real estate or collectibles. Sharesight also enables you to securely share portfolio access with family members (plus track multiple portfolios within the family), with the option to grant different levels of access based on their needs. This is a good way to ensure that family members have real-time visibility into the family’s financial status. The ability to run and download a range of reports detailing the portfolio’s performance, asset allocation and tax implications also makes it easy to keep family members informed.

In terms of security, it’s important that you store financial records and data in encrypted formats to ensure accessibility and prevent the loss of crucial information. By doing this, you can also simplify the process of updating wills, trusts and other legal documents. With Sharesight’s enterprise-grade security (including 2FA, TLS encryption and automated online backups), you can rest assured that your family’s financial data is safe and secure.

The takeaway

Building a multi-generational wealth plan requires a mix of education, strategic legacy planning and structured family governance. By empowering your descendants with knowledge, clearly defining your legacy goals and establishing a governance framework, you can help ensure that your family's wealth and values endure for generations. Harnessing modern, secure tech solutions and regularly reviewing and adapting your plan will make it even stronger, helping you create a legacy your family can rely on for generations.

Track your wealth with Sharesight

If you’re not already using Sharesight, what are you waiting for? Join hundreds of thousands of investors using Sharesight to track their portfolios and make better decisions about their investments. Sign up today so you can:

- Track all your investments in one place, including stocks and ETFs in over 60 major global markets, mutual/managed funds, property, and even cryptocurrency

- Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation, exposure and future income (upcoming dividends)

- Easily share access to your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments as you do

Sign up for a FREE Sharesight account and get started tracking your wealth today.

FURTHER READING

8 ways to use Sharesight's custom groups feature

This blog explains our custom groups feature, including strategies that can help you gain deeper portfolio insights and make more informed investing decisions.

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.