How to handle the Michael Hill restructure

In June 2016, Michael Hill shareholders approved a corporate restructure that saw the company move to Australia and subsequently obtain a primary listing on the ASX, while maintaining its listing on the NZX. Michael Hill saw this as a logical move, given that its business was primarily conducted out of Australia and Australia was its biggest market.

As part of the Scheme of Arrangement, the company delisted from the NZX under the code MHI and listed again under MHJ. It also obtained approval for a primary listing on the ASX, trading under MHJ. Eligible shareholders received shares in the new company on a 1:1 basis, based on the number of units they held in the original company. These same shareholders also had the option to either receive ASX or NZX-listed MHJ shares.

As an eligible shareholder, whatever your decision, Sharesight makes it easy to account for this restructure within your portfolio.

Unfortunately Michael Hill has not yet released information pertaining to the cost base information, for the new shares. The example below will assume the new shares are entered at the closing market price on the first day of trading. There is no official ATO Class Ruling for this corporate action, however, Michael Hill have advised that eligible Australian shareholders can apply for roll-over relief.

How to handle the Michael Hill restructure if you are a resident of Australia for tax purposes

-

Sign up for a FREE Sharesight account and add your Michael Hill holding.

-

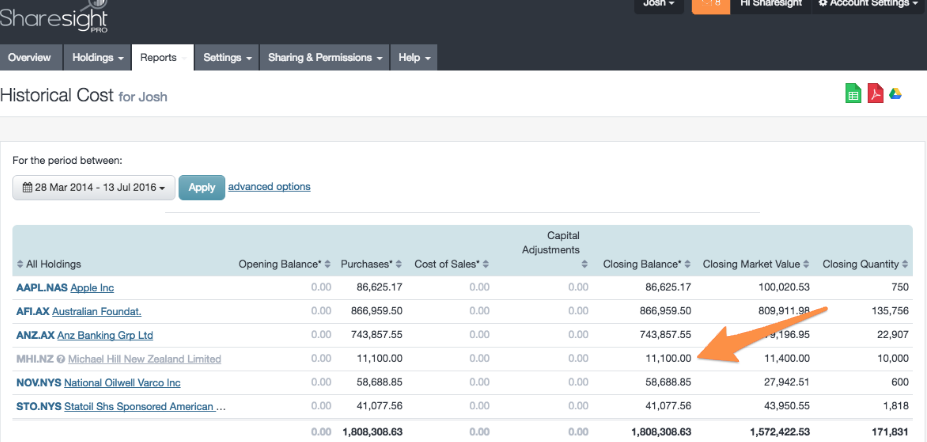

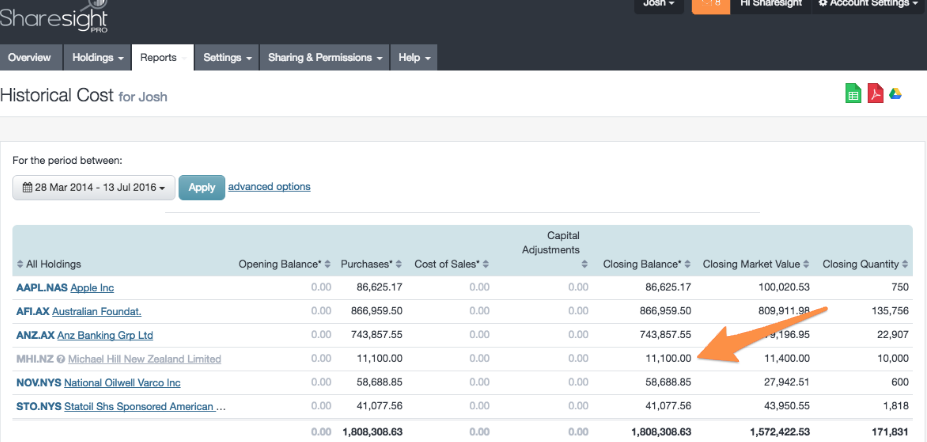

From there, you'll need to obtain your original cost base of your Michael Hill (MHI.NZX) shares. To do so, run the Historical Cost Report in Sharesight and locate MHI.NZX. Change the date range to ‘Since Inception’ and note the ‘Closing Balance’ figure. This figure will be used when adding the new holding on either the ASX or NZX.

-

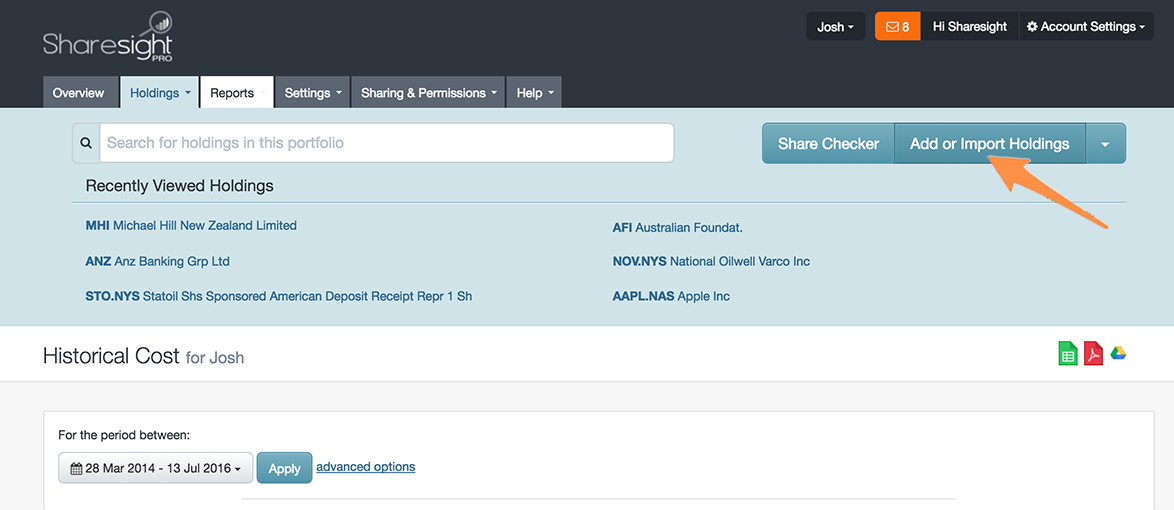

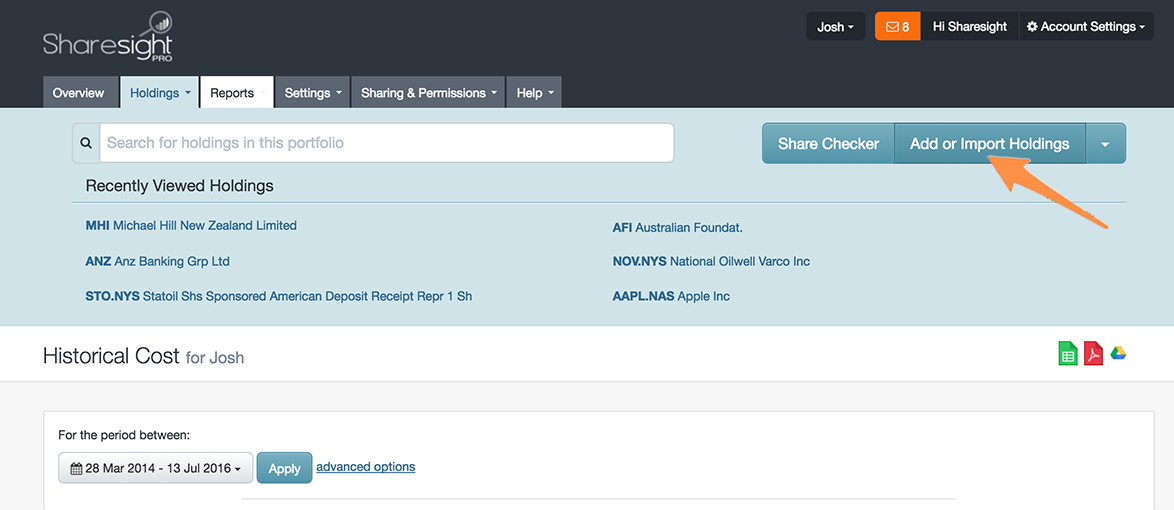

Click on the ‘Holdings’ tab at the top of the page. The tab should drop-down and you will see a button to ‘Add or Import Holdings’, which you will need to click:

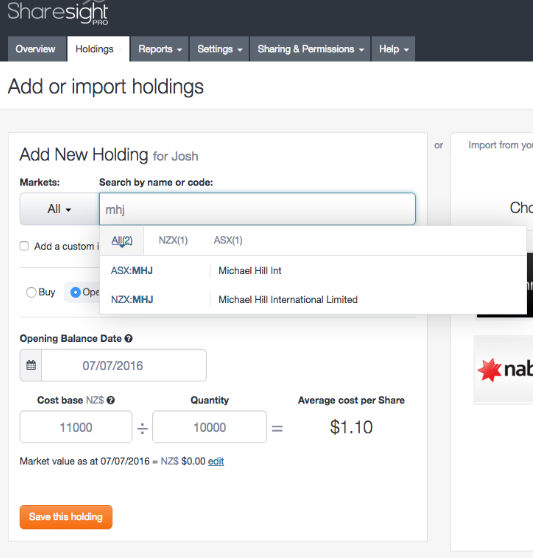

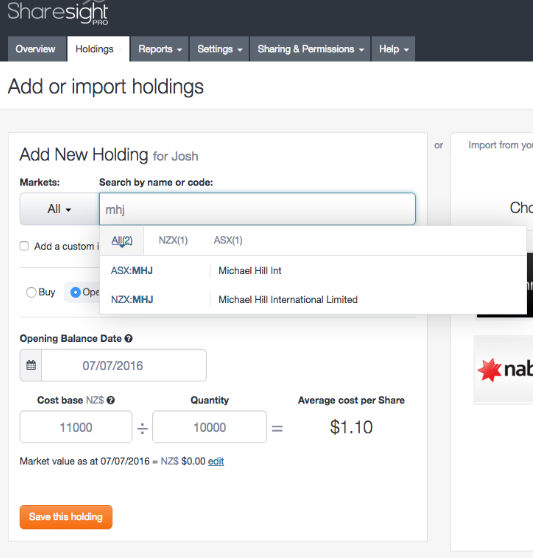

This will take you to the Add Holdings page. On this page, type ‘MHJ’ in the search bar. A number of different listings will show, by market. You will need to select either MHJ.ASX or MHJ.NZX, depending on what you have received per the corporate action. Then enter the following information:

This will take you to the Add Holdings page. On this page, type ‘MHJ’ in the search bar. A number of different listings will show, by market. You will need to select either MHJ.ASX or MHJ.NZX, depending on what you have received per the corporate action. Then enter the following information:Transaction Type: Opening Balance

Date: 07/07/2016 (Implementation date)

Cost Base: Use the Closing Balance figure obtained from the Historical Cost Report

Quantity: Same as your original holding

-

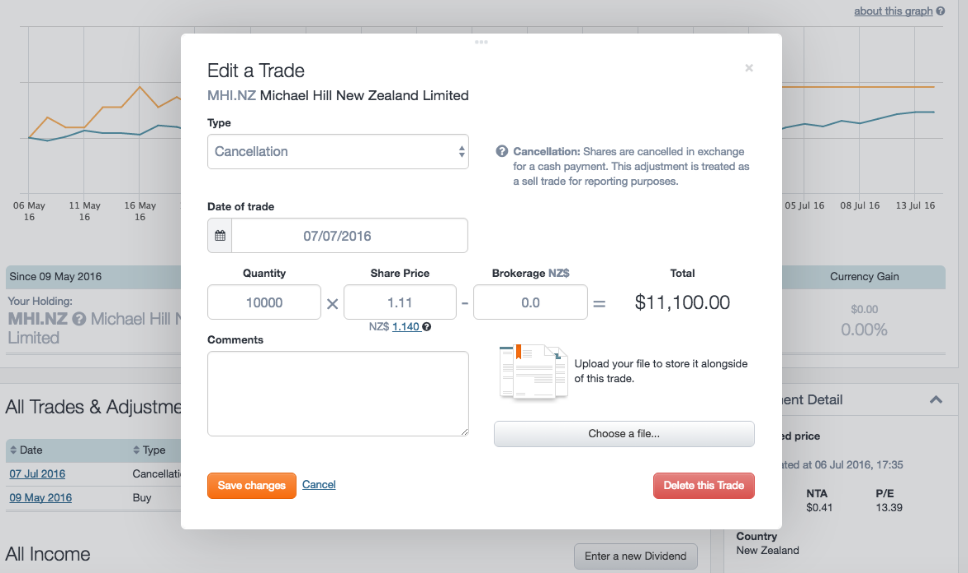

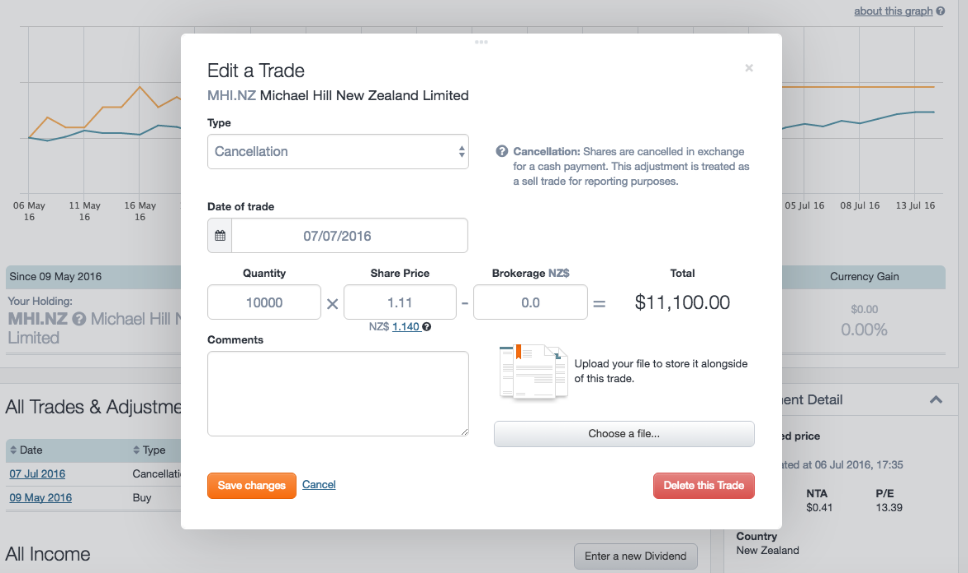

Once you’ve added the MHJ holding, you should be taken back to the Portfolio Overview page. From there, click into your original MHI holding. On the MHI Holdings page, click ‘Enter a new Trade or Adjustment’ and enter the following details:

Transaction Type: Cancellation

Date: 07/07/2016

Quantity: Same as your original holding

Share price: Enter your original purchase price (or cost base per unit) for MHI. This way no gain is recorded on the disposal of these shares. If you feel that there should be a gain and that your statement (from Michael Hill or Computershare) advises a different price for disposal, you can use that.

Given the presence of rollover relief, it is important to note that the steps above may not account for any applicable CGT discounts, when running the CGT Report, if you sell within the next 12 months. We suggest to add comments against these transactions as a reminder when running CGT reports.

How to handle the Michael Hill restructure if you are a resident of NZ for tax purposes

If you held MHI shares, as an NZ resident for tax, we suggest doing things a little differently to the above steps.

-

Sign up for a FREE Sharesight account and add your Michael Hill holding.

-

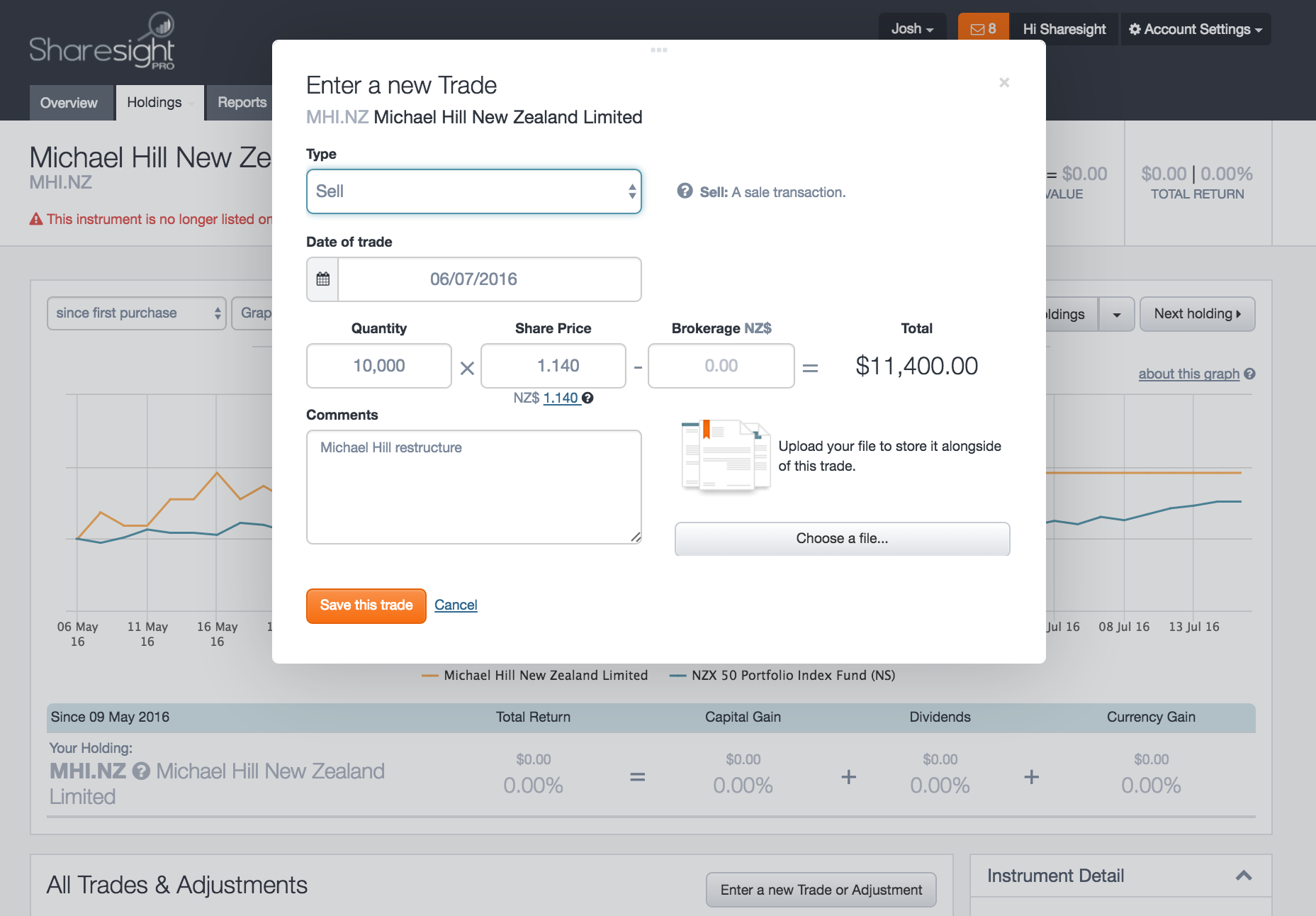

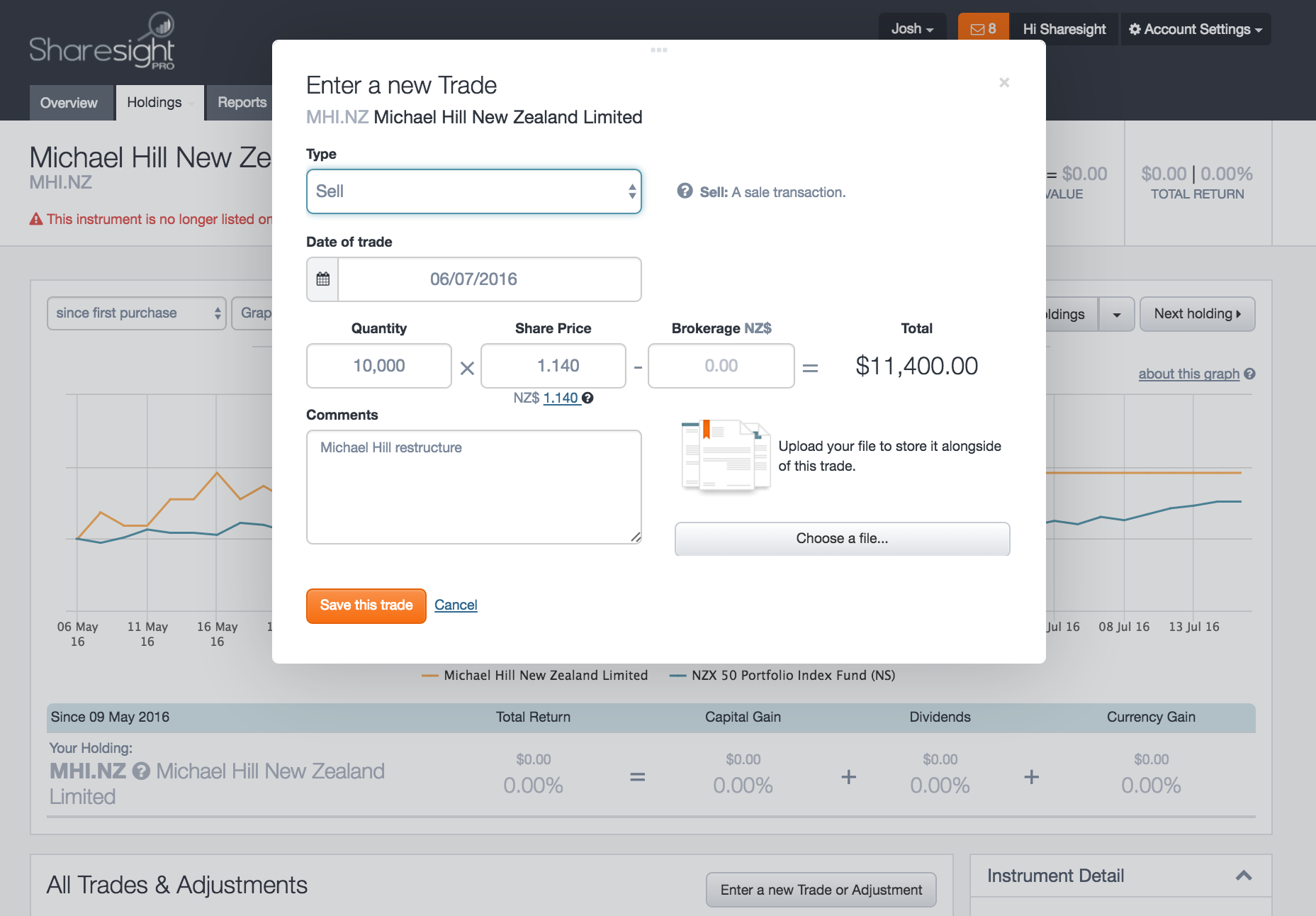

From the ‘Overview’ page, click into your MHI.NZX holding. On the MHI.NZX holdings page, click ‘Enter a new Trade or Adjustment’ and enter the following information:

Transaction Type: Sell

Date: 06/07/2016

Quantity: Same as your original holding

Share price: $1.14This is to remove the MHI.NZX holding. It might be a good idea to leave a comment against that transaction to advise why you are recording the ‘sell’.

-

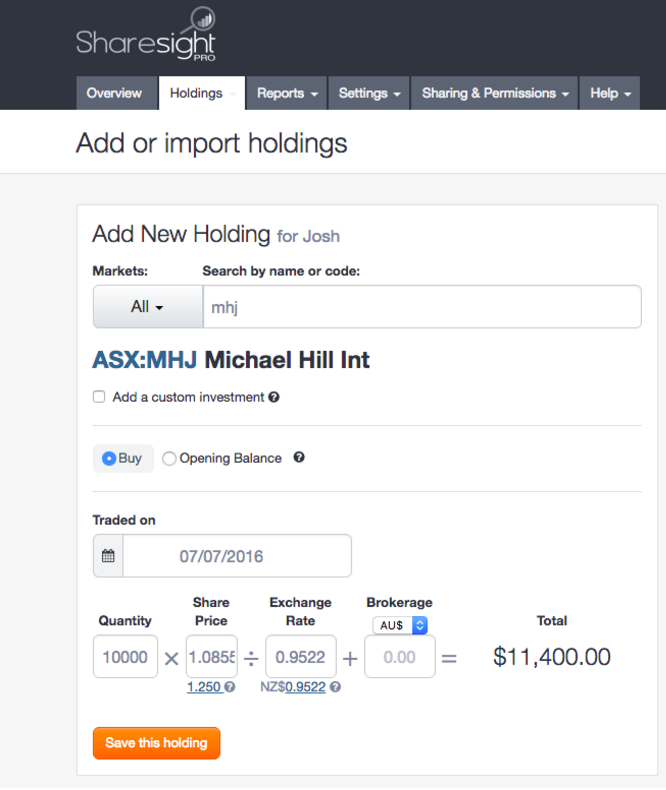

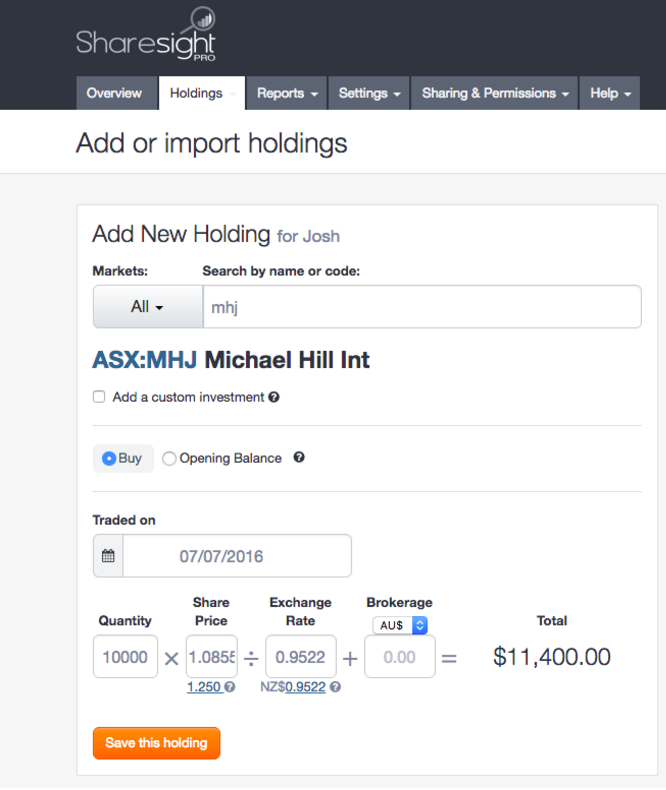

Once you’ve done this, you should still remain on the MHI.NZX holdings page. To the top-right, you will see a button ‘Add or Import Holdings’, which you will need to click. This will take you to the Add Holdings page, from which you will create a new holding for your new MHJ shares. Type ‘MHJ’ into the search bar and select either the ASX or NZX listed shares, depending on what you received.

Transaction Type: Buy

Date: 07/07/2016

Quantity: Same as your original holding

Price: If you hold MHJ.NZX, you can enter the price as $1.14.If you hold the ASX-listed stock, you can use Sharesight’s given exchange rate of ‘0.9522’ and then a price of $1.085508, to reflect NZ$1.14, as below:

Please note that we always advise you to consult your financial advisor or accountant regarding corporate actions, especially for tax purposes, as we are not authorised to provide financial advice. For further information regarding this Scheme of Arrangement and information on the tax implications, please refer to the official Scheme Booklet.

GET HELP

- Community Forum -- Corporate Action: How to handle the Michael Hill restructure

- Help -- Corporate Actions

FURTHER READING

8 ways to use Sharesight's custom groups feature

This blog explains our custom groups feature, including strategies that can help you gain deeper portfolio insights and make more informed investing decisions.

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

This will take you to the Add Holdings page. On this page, type ‘MHJ’ in the search bar. A number of different listings will show, by market. You will need to select either MHJ.ASX or MHJ.NZX, depending on what you have received per the corporate action. Then enter the following information:

This will take you to the Add Holdings page. On this page, type ‘MHJ’ in the search bar. A number of different listings will show, by market. You will need to select either MHJ.ASX or MHJ.NZX, depending on what you have received per the corporate action. Then enter the following information: