Key duties of a company director

A company director oversees a company’s management affairs and makes commercial decisions that chart the business’ course. As a director, there are several duties you must comply with or else risk receiving significant penalties, including disqualification from acting as a company director, fines or jail time. This article explores the key duties of a company director to help you understand your position as a director.

Who is a director?

When incorporating a business and registering as a company with ASIC, a company must appoint its first director(s). However, a company can appoint new directors at any point in its life. A public company must have a minimum of three directors, two of which must usually reside in Australia. A private company must have at least one director who usually resides in Australia.

In certain circumstances, a person might be regarded as a shadow director or de facto director, even if they are not formally appointed as one. This will mostly depend on how much power and influence they have over the company’s affairs. Notably, director duties will still apply to shadow or de-facto directors.

What are the directors' duties?

Director duties are prescribed rules and behaviours that a person must follow when acting as a company director.

Director duties at law are derived from the following sources:

- The Corporations Act 2001 (Cth) (‘Corporations Act’);

- Common law and equity (rules derived from court cases); and

- Other statutes, such as the Work Health and Safety Act 2011 (Cth) and the Superannuation Guarantee (Administration) Act 1992 (Cth).

A director may have additional obligations prescribed under a company’s corporate governance documents, including its constitution and shareholders agreement.

Main duties of a company director

Let us explore the key duties of a director under the Corporations Act and at common law and in equity.

1. Duty to act for a proper purpose

Directors are not allowed to abuse their authority and powers for an improper purpose. They must vote with the company's best interests in mind and cannot use their vote to advance their own objectives.

For instance, a company constitution typically grants directors the power to issue shares. A proper purpose of that power would be to raise capital for the business. However, issuing shares intending to significantly dilute the power of one or more shareholders would be improper.

2. Duty to Act With Care, Diligence and Skill

A director must exercise the same level of care, effort, and ability in carrying out their duties as you would expect of an ordinary person in the position of a director in a like company.

When considering how an ordinary person in a like situation would act, a court will consider the following:

- The company’s circumstances, such as its size; and

- The director's position and responsibilities.

Practically, performing their role with care, diligence and skill means that directors must be able to:

- Take reasonable steps to guide and monitor the company’s management, including:

- Being familiar with the business and how it is run;

- Adequately overseeing or auditing management;

- Reviewing financial reports; and

- Attending all board meetings (unless there are exceptional circumstances);

- Read and understand the content of reports related to the company;

- Consider whether statements are consistent with their knowledge of the company’s profits;

- Make necessary enquiries; and

- Adequately perform their tasks.

3. Duty to avoid conflicts of interest

The duty to avoid conflicts of interest means a director cannot place their interests ahead of the company’s interests. Such interests may be:

- Personal;

- Of some substance or value; and

- Have a realistic ability to influence the director’s decisions in administering the company’s affairs and voting.

If a conflict of interest arises, directors must disclose any ‘material personal interests’ in transactions involving the company's affairs. Consequently, a director may be unable to enter the transaction without shareholder consent.

Additionally, a director cannot improperly use their position to advance their own or another person's interests or harm the business in any other way. Finally, directors are prohibited from improperly using information they have access to, by virtue of their position, for their own gain or to harm the firm.

4. Duty to prevent insolvent trading

Directors have a duty to prevent the business from operating while insolvent. A company is insolvent when it cannot pay its debts as they are due.

You will breach this duty if:

- You were a director when the company incurred the debt;

- The company was insolvent or became insolvent because of that debt; and

- You knew or should have known that the company had debts due and could not pay them on time.

You should consider your company’s overall financial situation and ability to repay to determine its solvency. If you reasonably suspect your business is at risk of becoming insolvent, you should halt operations until your financial situation has improved. It is also good practice to seek advice from a financial and legal advisor on how best to proceed.

Notably, certain exceptions may apply. For instance, a director might take reasonable steps to stop the debt from arising or else have a reasonable belief that the business is solvent.

Additionally, a ‘safe harbour’ exception may apply where a director chooses a course of action more likely to produce a favourable result for the firm, creditors and shareholders instead of appointing an administrator or liquidator and immediately winding up the company. Ultimately, the safe harbour exception encourages directors to restructure their businesses or sell certain assets to alleviate their debt rather than abruptly stopping operations.

When assessing whether a certain course of action will succeed, a director should carefully consider the company’s financial situation and seek professional advice.

5. Administrative duties

Further, directors have several administrative duties in managing a company, including:

- Ensuring that their company keeps adequate records of financial information, minutes, resolutions, books and accounts;

- Maintaining the company’s registers (members registers, options registers, etc.);

- maintaining the company’s ASIC register (e.g. lodging Form 484 for changes to the company’s members, address or directors);

- Ensuring the company is holding a shareholder annual general meeting; and

- Ensuring that any meeting is being called and held per the terms of the constitution or shareholders' agreement.

6. Duties under statute

Statute includes written laws that formally detail your legal obligations and the consequences for non-compliance. In particular, there are some laws where a director can be personally liable for breaching them.

Under the Work Health and Safety Act 2011 (Cth) (‘WHS laws’), you have legal obligations to ensure the health and safety of workers while at work and others at a workplace, like customers and visitors. Duties under WHS laws will arise if you are:

- A person conducting a business or undertaking (PCBU), such as an employer;

- An officer, such as a business owner or CEO; or

- Worker or other person in the workplace.

As a company director, you will typically be an officer and, therefore, have a duty to exercise due diligence to ensure your business or undertaking complies with its duties under the model WHS laws.

Further, you may also have personal liability for unpaid ‘Pay As You Go’ (PAYG) tax or Superannuation Guarantee Charge (SGC) amounts the company has not paid under the Australian Tax Office’s Director Penalty Regime. In such a case, a director may receive a director penalty notice from the ATO.

Consequences of breaching your duties

There are serious consequences for failing to fulfil your duties as a director. Possible penalties include:

- Personal liability (legal responsibility) for any loss or damage the company or a related individual suffers due to your breach. This could include a company’s tax or superannuation liabilities);

- Prohibition from managing a company for a specific period or permanently; and

- Investigation for criminal proceedings, which can attract a fine or imprisonment.

Key takeaways

As a director, you occupy a special position of authority and trust. Due to your position of power and influence, you have legal obligations to promote good corporate governance and to place the company’s interests before your own. The key duties of a company director are to:

- Act for a proper purpose in the company’s best interests;

- Exercise your role with due care, diligence and skill;

- Avoid conflicts of interest;

- Prevent insolvent trading;

- Comply with various administrative duties; and

- Comply with various statutory regimes.

For more information about your legal duties as a company director or assistance limiting your personal liability, LegalVision’s experienced corporate lawyers can assist as part of their membership, which includes unlimited consultations with lawyers and unlimited document drafting, among other benefits. Call LegalVision on 1300 544 755 to learn more.

FURTHER READING

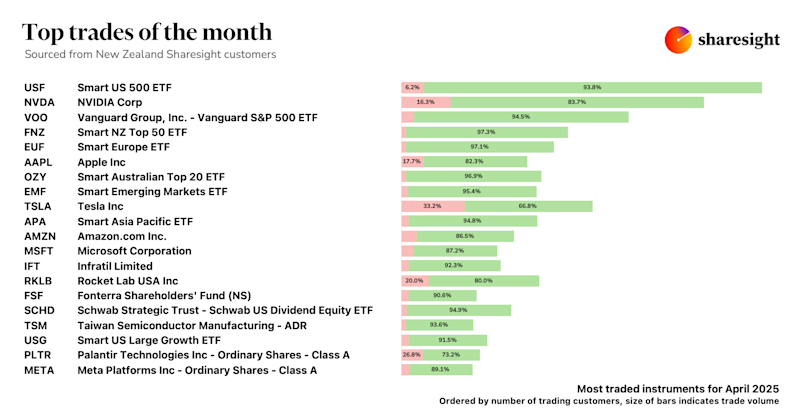

Top trades by New Zealand Sharesight users — April 2025

Welcome to the April 2025 edition of Sharesight’s trading snapshot for New Zealand investors, where we look at the top 20 trades by NZ Sharesight users.

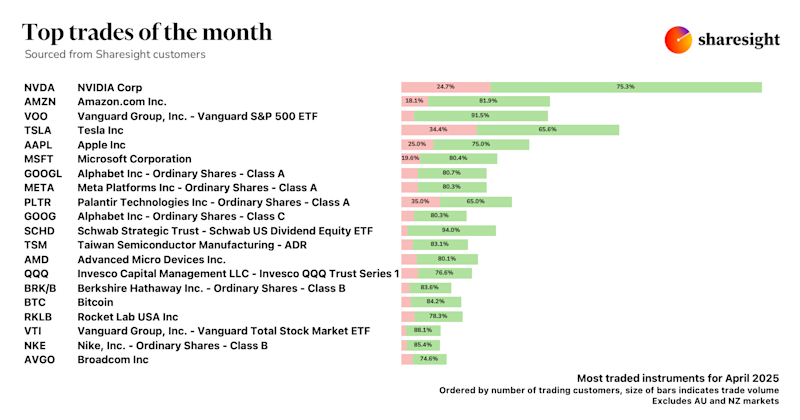

Top trades by global Sharesight users — April 2025

Welcome to the April 2025 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades by Sharesight users worldwide.

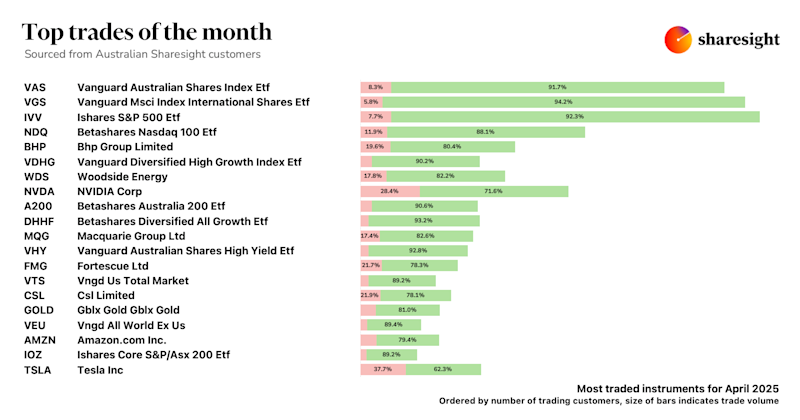

Top trades by Australian Sharesight users — April 2025

Welcome to the April 2025 edition of Sharesight’s trading snapshot for Australian investors, where we look at the top 20 trades by Australian Sharesight users.