Is DIY Investing For You?

Here at Sharesight, we often have conversations with people who are interested in DIY share market investing, but haven’t yet taken the plunge.

These people are interested in taking more control of their financial affairs, but are often unsure of exactly what it involves and – most importantly – if it’s for them.

So, Is DIY investing for you? It’s a question that people can only answer themselves, but here are four areas to consider if you’re wondering if DIY investing is for you.

Personal interest

Interest in investing is by far the most important factor to consider. In my experience, the most successful DIY investors find managing their financial affairs intellectually stimulating and see investing as something of a hobby.

If you’re the sort of person who’s interested in the business world, reads the financial press, and already does some basic household budgeting, then you have the foundations for DIY investing. But if you think you would have to force yourself to make the effort to manage your affairs properly, DIY investing probably isn’t for you.

A note on budgeting: if you don’t budget, it’s hard to make investment plans since you don’t know how much you have available to invest in the first place. I always found budgeting a bit of a chore, but Xero and its automatic uploads from my bank statements have been a real game changer.

Available funds

One of the big questions people have is how much they need to get started in DIY investing. ASX recommends a minimum of A$2,000 for direct share investing, however, I would say that you generally need at least A$10,000 before you can start creating a diversified portfolio of stocks you pick yourself. This is because brokerage when you buy and sell your stocks (typically anywhere from A$15 – 25 at a time) can quickly take a large chunk out of your funds if you’re trading low volumes. Brokerage should ideally be no more than 1 per cent of the value you trade.

Time to spare

I’ve also been asked how many hours per week people need to have to dedicate to DIY investing. This is a tricky question to answer as it really does depend on the individual.

However, what I would say is that you need to make sure you’re maximising whatever time you do have. Paperwork and administration can swallow up an inordinate number of hours, but using a service such as Sharesight can keep admin burden to a minimum – freeing you up to spend time on the interesting business of managing your investments and researching your next move.

And timeframe...

The magic of compounding means that the earlier you start investing, the better. I also subscribe to the theory of dollar cost averaging, which states that investing regularly (even a small figure such as $100 per month) is more effective over the long term than trying to pick the market with larger lump sum investments. This not only brings discipline to your investing, but also smooths out volatility (in theory at least) by balancing purchases made in 'bad' times with those made in the 'good'.

Decided DIY isn’t for you?

If going it alone isn’t for you, you may wish to think about engaging a financial planner. But you will need to do your homework to find one to suit you: shop around, get some recommendations from friends, and source at least three quotes.

But I’m a strong believer that nobody cares more about your finances than you do - and a little bit of 'hands on' goes a long way for anyone. Even if you delegate the management of your financial affairs to a planner or accountant, you need to take ownership of what you’re delegating.

Do you think there are any other points potential DIY investors should consider?

This information is not a recommendation nor a statement of opinion. You should consult an independent financial adviser before making any decisions with respect to your shares in relation to the information that is presented in this article.

My investment portfolio used to be gold bangles

For International Women’s Day, Morningstar's Shani Jayamanne explores the ways that women have taken back financial control.

Simplify property tax & investment tracking with TaxTank + Sharesight

Simplify property tax management with the Sharesight + TaxTank integration—track CGT, investment income, and tax data in one seamless, automated platform.

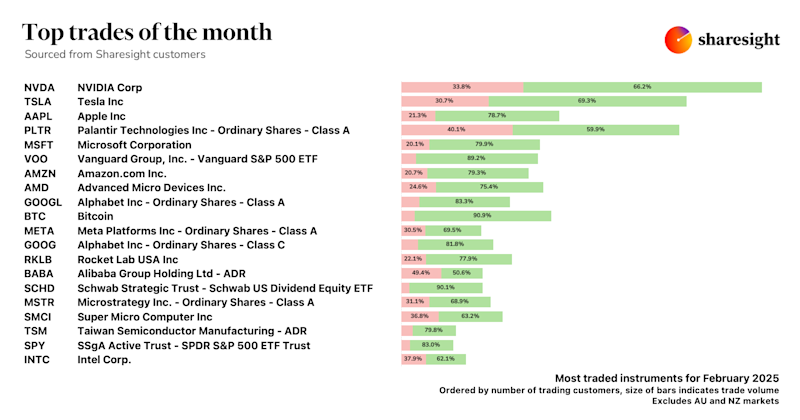

Top trades by global Sharesight users — February 2025

Welcome to the February 2025 edition of Sharesight’s trading snapshot for global investors, where we reveal the top 20 trades by Sharesight users worldwide.