Investors need to break these 3 bad habits once and for all

NOTE: A version of this article first appeared in XU Magazine.

Old habits die hard. When it comes to share investing, investors either spend too much, or too little time on “portfolio admin”. Investing is hard enough. Picking the right investments, setting an asset allocation strategy, and knowing when to buy and sell shares are all fraught with risks -- and unique to one’s circumstances. But, whether you’re an individual investor, accountant, bookkeeper or financial advisor, the administration side of investing can be even worse.

True performance metrics and on-demand tax reports elude most investors, and lead to poor returns.

Price to price calculations are simple, and charting tools ubiquitous, but annualising returns to add real-life context and to compare to alternative options is difficult.

What about dividends? Last year the ASX 200 generated almost 7% in dividend income. How do you track the dividend impact on your return, let alone if you’ve opted in to a dividend reinvestment plan?

Accounting for corporate actions is not something that lends itself well to manual tracking either. Takeovers and demergers have a significant impact on an investment’s cost base and may force an investor to rethink their exposure.

All of this has an impact on a portfolio’s tax obligations. It’s not just a matter of knowing which shares were bought and sold, and at what price. Holding periods have a significant impact. Short-term capital gains (income made by buying and selling holdings within the same year) are taxed differently than those bought and sold over a longer period. Dividend income from trusts is treated differently than listed companies to say nothing of tax breaks like franking credits.

To track and report on these things, investors and finance professionals have traditionally relied on a handful of methods. Unfortunately this had led to bad habits forming. Here are the top 3 that need be broken once and for all.

Tracking investments with a spreadsheet

Maybe it’s due to their DIY nature, but 70% of our customers come to Sharesight having previously tracked their portfolio in a spreadsheet. We can’t blame them -- until we built Sharesight, we did the same thing. But manually tracking all those holdings, trades, and dividends in a spreadsheet is a laborious and error-prone methodology. We’ve met clients who spent years perfecting the “perfect” portfolio spreadsheet, only to realise that their calculations had been off the whole time -- leading them to believe that they were doing much better than they actually were. An awkward (if not heartbreaking) conversation to say the least!

Even if an investor’s spreadsheet is technically sound, it’s important to have an honest look at the actual time spent manually tracking all those data points. This is valuable time that could be better spent on things things like research, education and tax planning.

Relying on online brokers

Many investors rely on their online broker to calculate their portfolio performance or capital gains. But because online broker don’t take corporate actions into account, their performance numbers can mislead them into thinking they’re doing better (or worse) than they actually are. One of our own team members realised this recently when her first share split resulted in her broker misreporting her performance (down 48% when she was actually up nearly 5%).

This can be especially difficult for investors who have used multiple online brokers. How do they calculate their overall performance, across their various portfolios? The short answer is that they usually don’t bother, or end-up pulling everything into a spreadsheet -- resulting in the same issues we’ve already discussed.

Online brokers should be relied on to do what they do best: trade execution. Dividend, performance and tax reporting should be entrusted to a dedicated (and ideally, independent) application.

Waiting until EOFY to talk about tax

If you’re reading this blog, I probably don’t have to sell you on the power of the cloud. Yet the reality is that many investors and finance professionals still take a very “old school” approach to tracking share portfolios. We still hear of accountants chasing after mounds of investor-related paperwork at tax time, and frantically reconstructing share portfolios in order to sort-out their clients’ investing positions and tax obligations. This is especially time-consuming for larger portfolios or those dependant on income-generating stocks.

It helps everyone when investors can stay on top of their “portfolio admin” throughout the year, rather than chasing their tail at EOFY. For example, checking-in on capital gains tax implications every now and then can not only minimise tax bill surprises, but can lead to better data-driven investing decisions throughout the year. And with Sharesight simplifying portfolio admin for accountants and finance professionals, they can focus on proactive activities, while investors get peace of mind knowing how their portfolio is performing year round.

Break these bad habits with Sharesight

While it can be difficult to break old habits, thankfully there are new technology solutions that make it much easier to let go. Using a cloud-based portfolio tracking solution such as Sharesight is a great start. It automatically tracks share prices, buy/sell dates, dividends, brokerage fees and currency fluctuations -- and then leverages this information to produce powerful performance and tax reports. This provides unmatched tracking and insight into investment portfolios. With everything in one place, there’s no need for tedious portfolio reconstruction at tax time. And it provides accountants everything they need to prepare and file tax returns. Tasks that normally took hours or even days can now be done in minutes, in just a few clicks. So rather than spending copious amounts of time looking back over the year’s activities and preparing tax returns, investors can have forward-looking tax discussions with their accountant instead.

Taking it a step further, when investors sync their investment portfolios to Xero, details of share purchases, sales, and dividends flow into Xero automatically so they can be easily reconciled against bank statements and incorporated into personal wealth and budgeting pictures. With portfolio data flowing into Xero in real-time, both investor and accountant are on the same page -- so there’s no paper-chasing and repetitive data entry work required. It’s a seamless investment portfolio management and accounting solution made possible by a growing fintech ecosystem of connected applications.

When it comes to investing, understanding a portfolio’s true returns and the resulting tax implications is key to making informed investing decisions. When investors and their trusted finance professionals have access to this information at any time, and from anywhere, they’re able to focus on the big picture instead of always trying to fill the gaps.

Sign up for Sharesight and break these bad habits today.

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

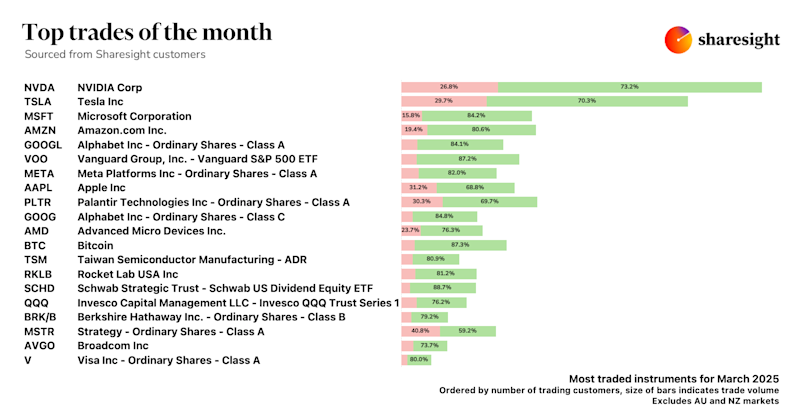

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.