Investment insights from Livewire

If you’re a Sharesight subscriber, you may have noticed an email in your inbox inviting you to try Livewire. If you missed it, this is your second chance. We encourage all of our clients to sign up to Livewire. It’s top notch.

Livewire is a constantly-updated financial insights website. Imagine Twitter for investing, but with a curated news feed from industry-leading contributors. Topics range from general, macro views to deep dives on specific companies. Their stable of commentators include:

- Hamish Douglass (Magellan)

- Marcus Padley (Marcus Today)

- Geoff Wilson (Wilson Asset Management)

- Roger Montgomery (Montgomery Investment Management)

- Anton Tagliaferro (Investors Mutual)

If you wake up to an inbox crammed with milquetoast "market updates," showing nothing more than overnight market performance, then Livewire's Trending on Livewire email digest is a breath of fresh air. Personally, it's the first investing-related email that I open each day.

For example, a quick scroll through this morning's feed contains info on the Chinese currency devaluation, the Australian Future Fund's risk position, the Aussie economy in general, and a 17 page deep-dive on AHAlife, a US-based e-commerce platform.

Livewire is Sydney-based, and we've gotten to know the co-founders personally. Bringing together two complementary fintechs is a win for investors.

Here’s a short video Livewire has put together that outlines the key features of Livewire’s platform where they demonstrate how to set up and manage alerts, save and bookmark content for later and share your favourite articles with friends.

Embedded content: https://www.youtube.com/embed/zGKkMpFrVI4

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

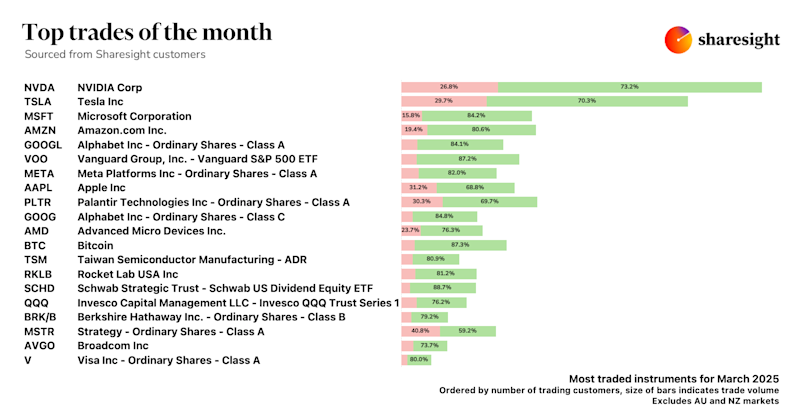

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.