International shares + manual entry now available!

The latest good news from Sharesight is that we now support international shares! And that's not all. You can now manually enter investments that Sharesight does not cover (for example unlisted shares, managed funds, and shares on other international exchanges).

Better yet, this new functionality is available to all Sharesight customers at no cost - your subscription stays the same.

International shares

Sharesight now supports shares on the New York (NYSE), NASDAQ, and London (LSE) stock exchanges. You can now add these shares into your portfolio just as you would for an ASX or NZX share. Simply choose the appropriate exchange from the drop down list when adding a new share.

Create and maintain your own instruments

To record an unlisted instrument or one that is listed on an exchange that Sharesight does not currently support, select 'OTHER' in the 'Market' drop down box. To create a new instrument on the 'OTHER' market, ensure that the 'Add New?' tick box is selected.

Once you have added a share on the 'OTHER' market you can manually record dividends and trades against it just like any other share in Sharesight.

To get up-to-date performance information all you need to do is enter the latest price. Simply go to the detail page and click 'enter a price' in the right hand sidebar. Click 'show prices' to view or edit historical prices.

The 'Show Prices' page allows you to enter new prices and modify existing prices (simply click on the prices to edit them). This page also contains an 'Upload Bulk Prices' function which allows you to import a CSV file containing share prices (such as the historic price files that can be obtained via the Google finance or Yahoo finance websites).

FURTHER READING

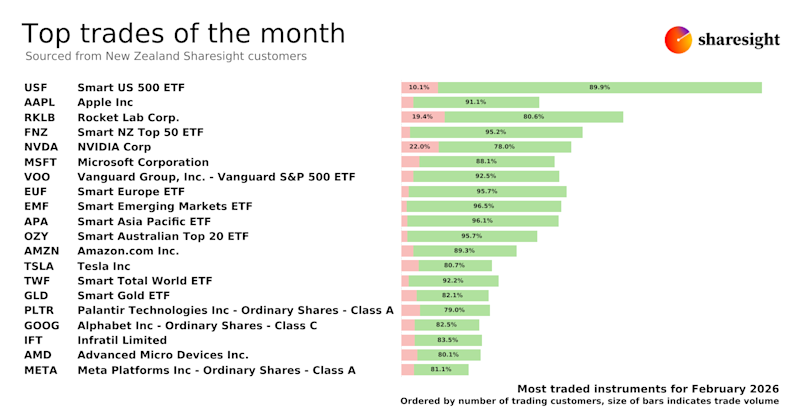

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

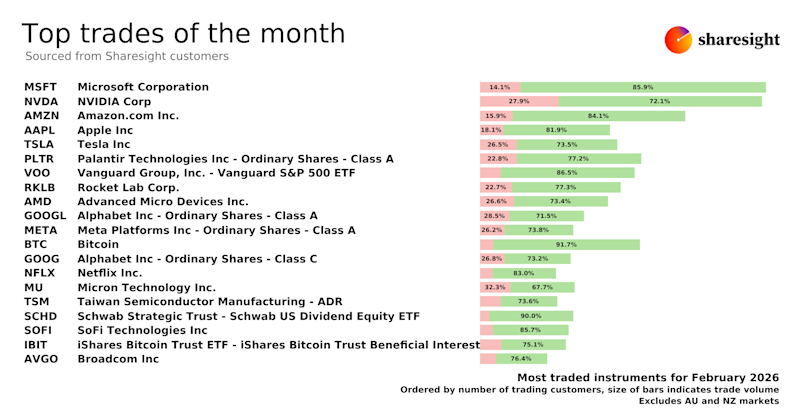

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

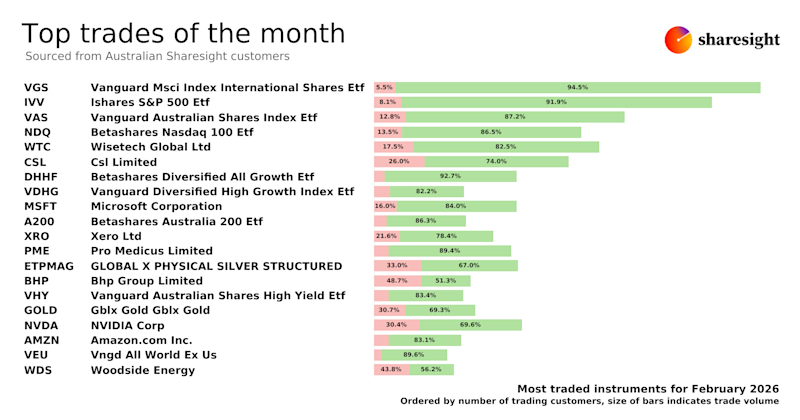

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.