Automatically import your Questrade portfolio to Sharesight

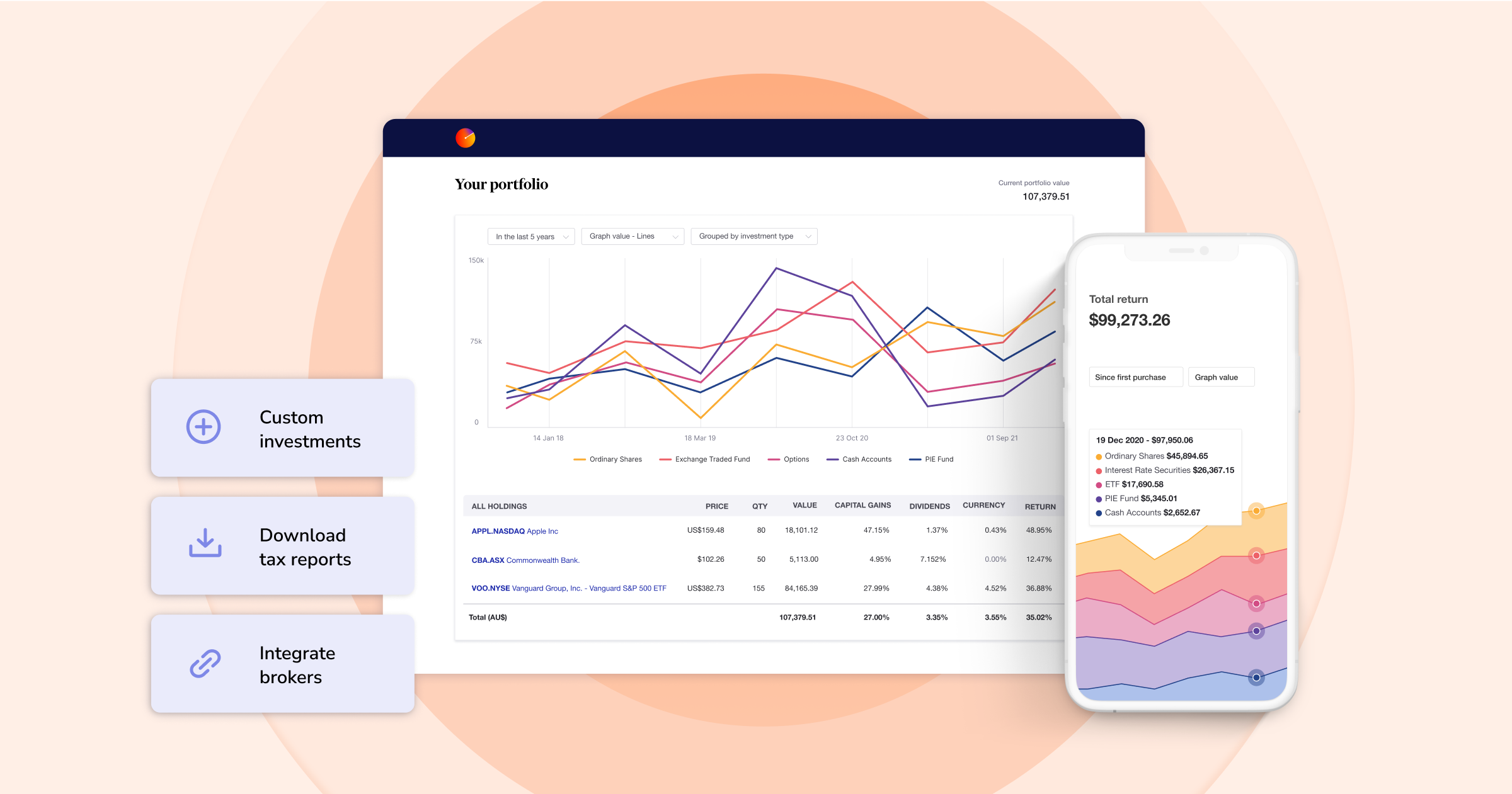

Canadian investors trading with Questrade can sync their brokerage account with Sharesight via SnapTrade to automatically import historical and ongoing and historical trades in stocks, ETFs and funds to their portfolio. With support for over 200 global brokers and automatically updated price and dividend information on more than 500,000 global stocks, ETFs and mutual funds, Sharesight is the ultimate tool for Canadian investors to track all of their investments in one place. Keep reading to learn more.

Who is Questrade?

Established in 1999, Questrade is a Canadian-based brokerage and wealth management firm with an online trading platform. Questrade allows investors to trade stocks and ETFs on Canadian and US exchanges, as well as Canadian mutual funds, which are supported by Sharesight. Other key features include research tools such Intraday Trader, a trading pattern recognition software, and news feeds, research and analysis from Questrade’s partners.

Why you should track Questrade trades with Sharesight

By importing your Questrade trades to Sharesight (along with the rest of your investments), you can easily track your investment performance across different brokers, asset classes and over 60 global markets, including the TSX, TSXV and CSE. Sharesight also offers a range of powerful reports for investors such as performance, portfolio diversity, contribution analysis, exposure, multi-period and multi-currency valuation, plus a Canadian-specific capital gains tax report. The ability to track cash accounts, property, cryptocurrency and over 40,000 Canadian mutual funds is just another reason that Canadian investors should consider using Sharesight to track their investment portfolio.

Track your dividend income

Unlike other portfolio trackers, Sharesight automatically tracks dividend and distribution income (including dividend reinvestment plans) and takes this into account when calculating your investment return. In the screenshot below for example, dividends make a significant contribution to this stock’s returns, highlighting the importance of a portfolio tracking solution that includes more than just capital gains in its performance calculations.

![]()

Calculate your capital gains tax

Sharesight’s capital gains tax report is the ultimate CGT calculator for Canadian investors. The report automatically determines capital gains made on sold shares as per the Canadian tax rules, eliminating the need to make manual calculations, which can be complex and subject to error. Other convenient features include the ability to optimise your tax position by carrying losses forward, as well as a breakdown of your portfolio’s short-term and long-term capital gains and losses.

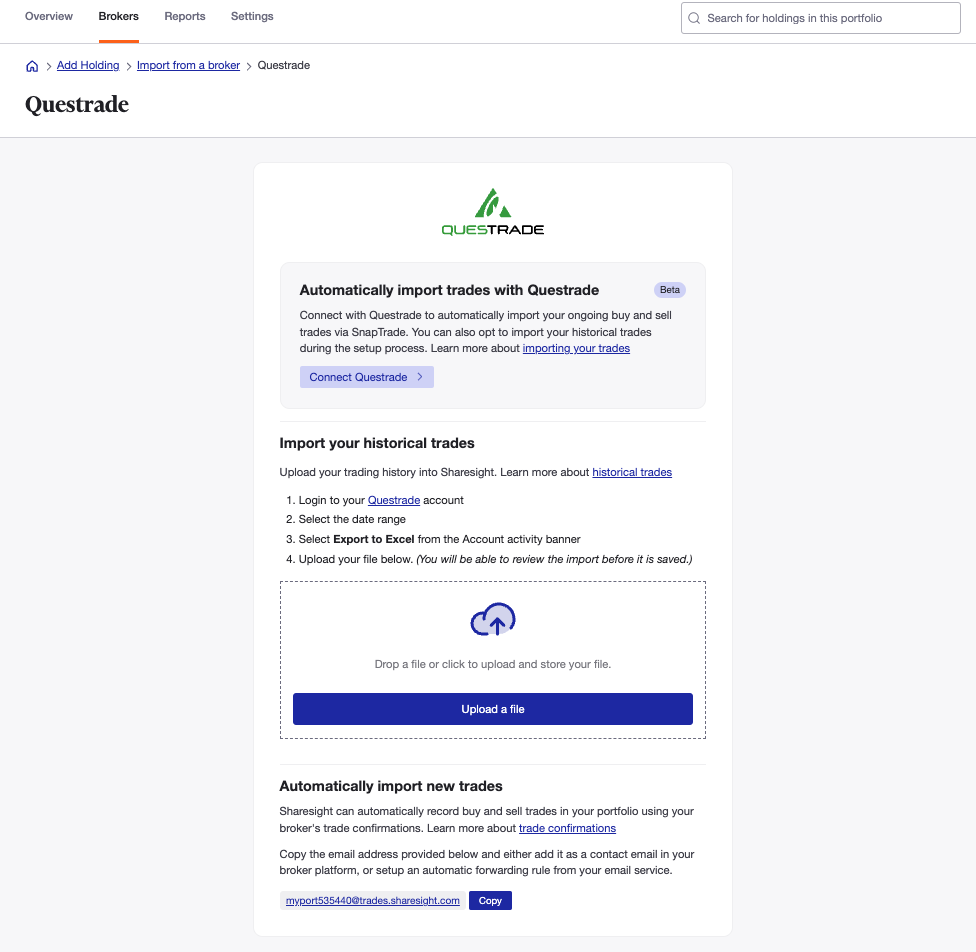

How to import your Questrade trades to Sharesight

If you trade through Questrade, you can establish a secure connection between your Questrade and Sharesight accounts, which will automatically sync historical and ongoing trades to your portfolio. If you do not wish to link your Questrade and Sharesight accounts, you can also capture historical trades by uploading a spreadsheet of trades to Sharesight.

Connect your Questrade account to Sharesight via SnapTrade

Sharesight leverages SnapTrade’s integration with Questrade to allow you to automatically import your trades to your Sharesight portfolio.

If you’re new to Sharesight, you can get started by signing up for a free account.

Once you’re logged into your Sharesight account, simply enter your portfolio, select ‘Brokers’ at the top of the page and search ‘Questrade’. Once you’ve clicked into the Questrade broker tile, click ‘Connect Questrade’ and follow the instructions to link your Questrade account to Sharesight.

Import historical trades via spreadsheet

For your convenience, it is recommended that you connect your Questrade account to Sharesight as outlined above. However, if you do not wish to establish a connection between your Sharesight and Questrade accounts, you can also import historical trades by uploading a spreadsheet file of trades from your Questrade trading account. As long as the file contains all the required information, you can upload it to Sharesight and quickly bulk import the trading data you wish to see in your portfolio.

Start tracking your Questrade trades with Sharesight

Thousands of investors like you are already using Sharesight to track their investment portfolios. What are you waiting for? Sign up to Sharesight so you can:

- Track all of your investments in one place, including Canadian and international stocks, mutual funds, property and even cryptocurrency

- Track your TFSA, RRSP and RRIF investment accounts with tax calculations built to CRA rules

- Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, exposure, multi-period, multi-currency valuation and capital gains tax

- Easily share access to your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments that you do.

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.