How using Super to buy a house robs your future self

Politicians are incentivised by winning elections, which can lead to bad policy based on short-term incentives.

Those in Canberra don’t tackle the hard stuff because it costs them votes in key demographics. This isn’t an Australian-specific problem. The US Congress is on the verge of another shutdown and can’t even agree on how to name new post offices.

Zoom out wide enough, and you’ll realise most major legislation to actually improve people's lives was passed shortly after World War II when the world was on the brink and people just wanted normalcy.

The proposal to let young Australians divert money from superannuation to their first home purchase is a terrible idea that reeks of short-term thinking.

This guarantees younger Australians will be poorer in the future and will further increase house prices. The politicians responsible float band-aid policy like this because voters struggle to grasp long-term financial concepts. Those same politicians will be long-gone by the time this becomes a reelection issue.

Here’s a simple example. Take Malcolm, a young lawyer making $100,000 per year. He wants to buy a house, but is struggling to find something affordable. Under the proposed policy, Malcolm diverts money towards a “home savings account” for three years.

Malcolm’s balance after three years is $58,710 assuming a 1.5% yield, the current 9.5% super contribution rate, and the post-tax dollar matching the government will mandate.

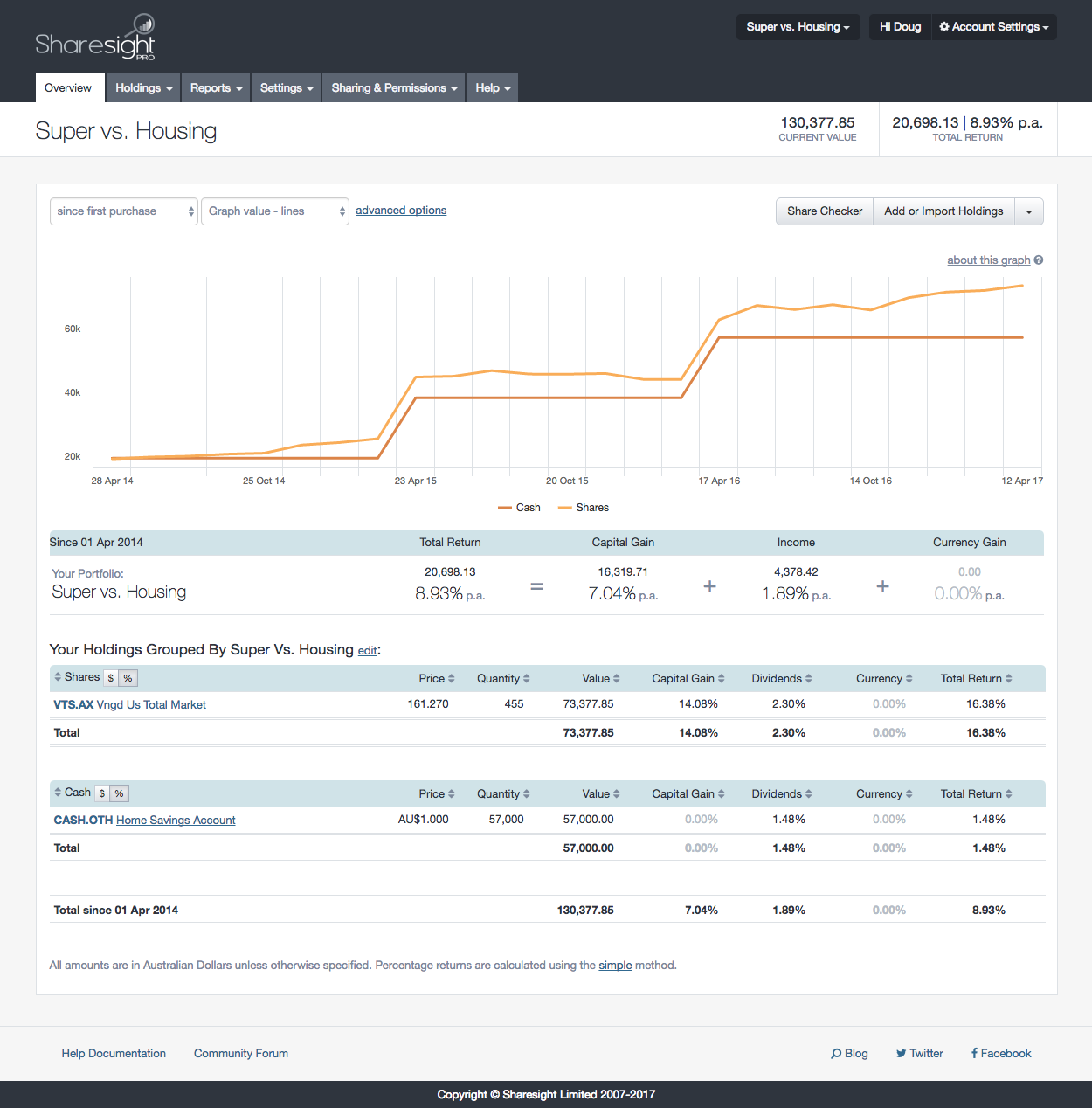

Malcolm thinks, “Wow! Nice chunk of cash,” which is correct, but uninformed. Malcolm’s hard earned money generated just $1,710 - a return of 1.48% using Sharesight’s money-weighted annualisation methodology. That’s less than a week’s pay on his salary.

If Malcolm had invested in an ETF tracking the US stock market (VTS) - a more diversified option than investing solely in Australia - his $57,000 contribution would have done far better over the three year savings period.

| Return % | Capital Gain $ | Income Gain $ | |

|---|---|---|---|

| Home Savings Account | 1.48% | $0 | $1,710 |

| Vanguard US Total Market (VTS) | 16.38% | $16,318 | $4,378 |

Return % is annualised.

A look at the value of each investment over time shows the widening disparity between the US equity ETF and cash. Remember, this is only the three year savings window!

That $20,000 Malcolm's ETF generated in this short-term window will roll into the future generating compound returns - the best way to grow a portfolio over time.

An investor must think about time horizon, expected return, and risk when making a decision.

Malcolm’s ETF could have lost value during his three year saving period.

However, Malcolm’s ultimate intention - and what the proposed policy will force him to do at the end of the savings period - is to buy a house. This extends the time horizon of this investment, but it forcibly reallocates his portfolio from cash to property.

Blistering house prices are dominating the headlines and Malcolm, left out of BBQ talk, wants in on the action.

According to the ABS the weighted national house price average increased 7.7% in 2016.

But here’s the truth nobody talks about - in order for a house to double in value over 10 years, it needs to average a 7% return every year. A 7% return on a stock portfolio would be a passing grade for most investors, but nobody would call it blistering.

Most economists expect house prices to grow “in the single digits.” The historical annualised growth figure from 2002 to 2016 is less than 2% nationally. Don’t forget Cate Blanchett’s property investment experience.

Additionally, Malcolm will be taking out a mortgage (which has fees) in an environment where the borrowing rate is as low as it’s ever been in Western democratic history. His mortgage will get more expensive as rates rise. And he’ll need to sink time and money into maintaining his house too.

A house can generate middling returns, which is fine, as long as you’re not solely counting on it to retire.

In theory a house gives you a place to live (economic utility) and ought to give you some kind of capital return to supplement your next life stage, alongside superannuation, and other savings.

In reality, the government is telling Australians to rush into a market at its peak, and to concentrate their savings in an asset that won’t lose value.

This might be true if your house appreciates by at least 7% every year, if rising interest rates allow you to keep up with your mortgage repayments, if negative gearing and capital gains tax rates remain favourable, and if you can find a buyer when you need to sell.

Taking money away from super decades before it has a chance to compound rips a hole in your savings and means your house will need to do more than double each decade.

FURTHER READING

8 ways to use Sharesight's custom groups feature

This blog explains our custom groups feature, including strategies that can help you gain deeper portfolio insights and make more informed investing decisions.

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.