How to track monthly dividend income from your investments

If you’re a dividend income or dividend growth investor, tracking the value of dividends from your investments over time is essential, particularly if you rely on dividend income to fund your lifestyle. While there are a number of ways to track dividend performance in Sharesight, one of our users shared a trick he uses to track his dividend income on a monthly basis to help manage cash flow.

We love it when investors find creative ways to use Sharesight, and we found this method so useful that we thought it was worth sharing with you.

Get all your investments into Sharesight

The first step for any dividend investor is to get all their investments into Sharesight, including any investment property and fixed income securities.

Use the Future Income Report to see income on a monthly basis

In this particularly unique method, our user shared how he uses the Future Income Report to look at historical dividends.

This differs somewhat from the typical use of the Future Income Report, which is to view upcoming declared dividends. Because of this, the default time period for this report is set to the following 12 months.

However, using the date filter you can set the date range for the report to any time period, including the past. To view a monthly snapshot, just set the date range as the start and end of the month in question.

With the date filter set, the report will show every dividend and distribution paid by investments in your portfolio. The report also includes the date each dividend was paid, the ex-dividend date, the total value of the dividend, plus the value of any tax or franking credits (as applicable to some ASX-listed stocks).

To view a summary of just the total dividend income received each month, you can change the Future Income Report view using the "advanced options" menu to instead just show monthly totals over your set time frame.

After selecting the ‘show monthly totals’ filter, your dividend income is calculated by month over the date range.

Export it to a spreadsheet to build your monthly dividend income statement

Any report in Sharesight can be exported to a spreadsheet in Excel or Google or to a PDF. Using a Google spreadsheet, you could look to build a monthly income graph to see if your dividend income fluctuates in predictable ways at certain times each year -- allowing you to better smooth out this cash flow variability over the long term.

Sharesight – built for dividend investors

Sharesight was built for the needs of dividend investors just like you to make tracking dividend income portfolios easy. With Sharesight you can:

-

Automatically track your dividend and distribution income from stocks, ETFs, LICs and Mutual/Managed Funds – including the value of franking credits

-

Use the Dividend Reinvestment Plan (DRPs/DRIPs) feature to track the impact of DRP transactions on your performance (and tax)

-

See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful tax reports to calculate your dividend income with the Taxable Income Report, Capital Gains Tax obligations (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income (NZ)

Sign up for a free Sharesight account and start tracking the impact of dividends on your investment portfolio today!

FURTHER READING

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

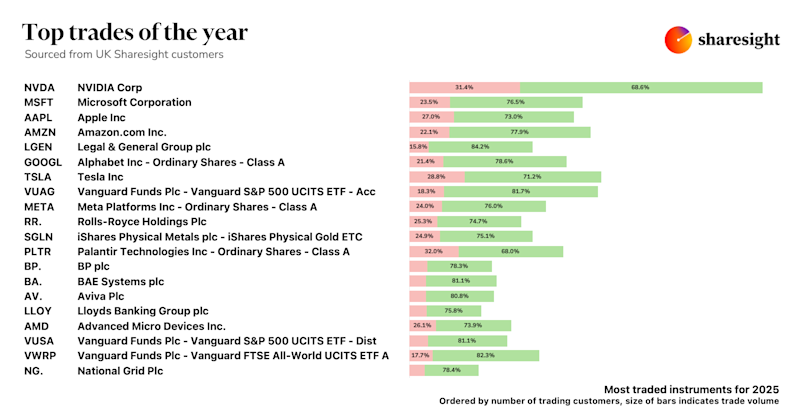

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

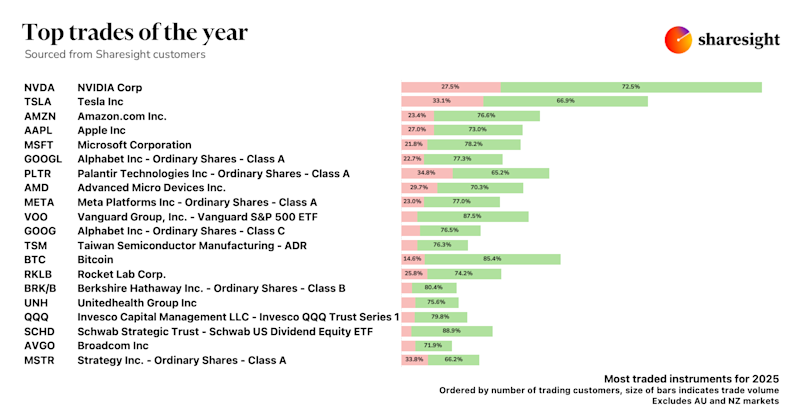

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.