How to track an investment property in Sharesight

As a multi-asset class investor, I like to track all my investments on the same basis. Before I started using Sharesight, and the money-weighted methodology, if someone asked me whether my investment property was a good investment, I would look at the performance purely in terms of capital gains and would’ve concluded it was "doing okay" as an investment.

With Sharesight you can do so much more, in this example we show how to get the full picture of your investments, by adding a property investment to your Sharesight portfolio.

This article covers:

- How to record the purchase of an investment property in Sharesight

- How to track investment property rental income in Sharesight

- View all your rental income in Sharesight

- How to update your investment property valuation

- Track how your property investments are performing within your portfolio

How to record the purchase of an investment property in Sharesight

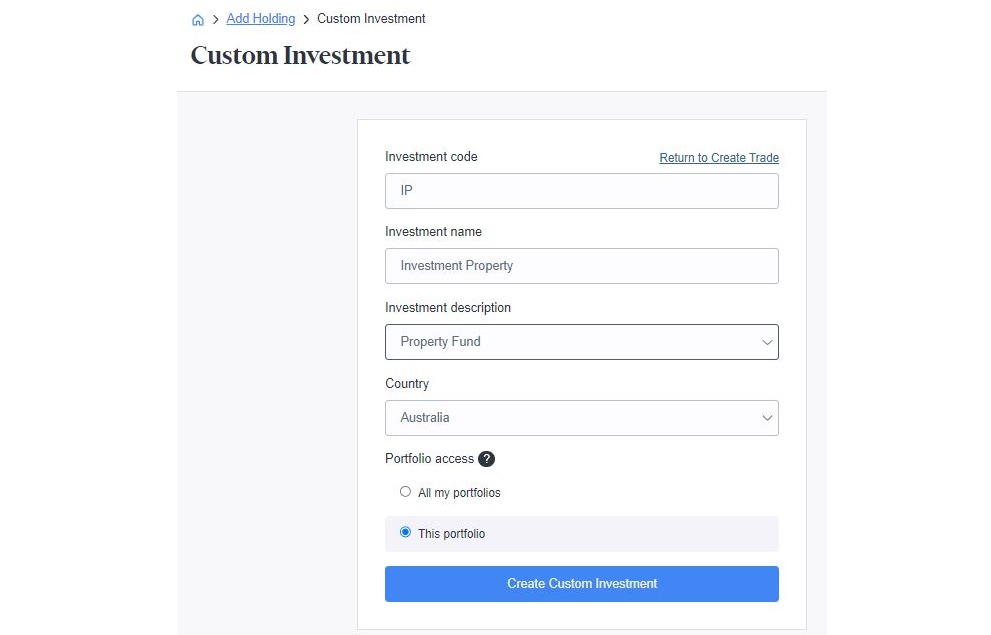

To get started you need to enter the purchase or the "buy" transaction for the property, for this I used the custom investment feature in Sharesight.

Adding a custom investment in Sharesight

Adding a custom investment in Sharesight

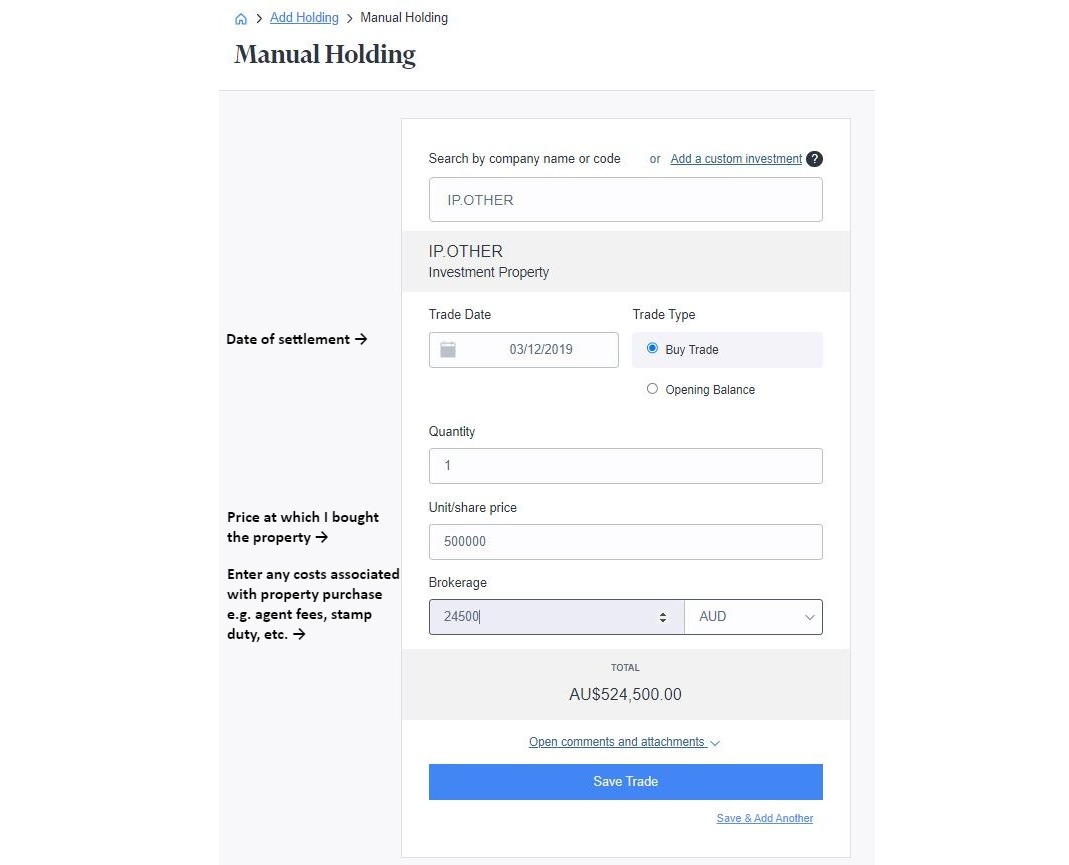

Once you add the custom investment, you can enter details of your property purchase

Once you add the custom investment, you can enter details of your property purchase

Note: In this example, I don’t take any debt used to purchase the property into consideration. Sharesight can’t handle negative balances and interest expenses that may be incurred in buying the property.

I use Sharesight as a tool for record keeping as well as tracking performance of my investments. So I upload copies of any document relevant to this transaction, such as stamp duty receipts, solicitor fees, buyers agent invoice, and property valuations. I also use the comments section to document my investment thesis.

How to track investment property rental income in Sharesight

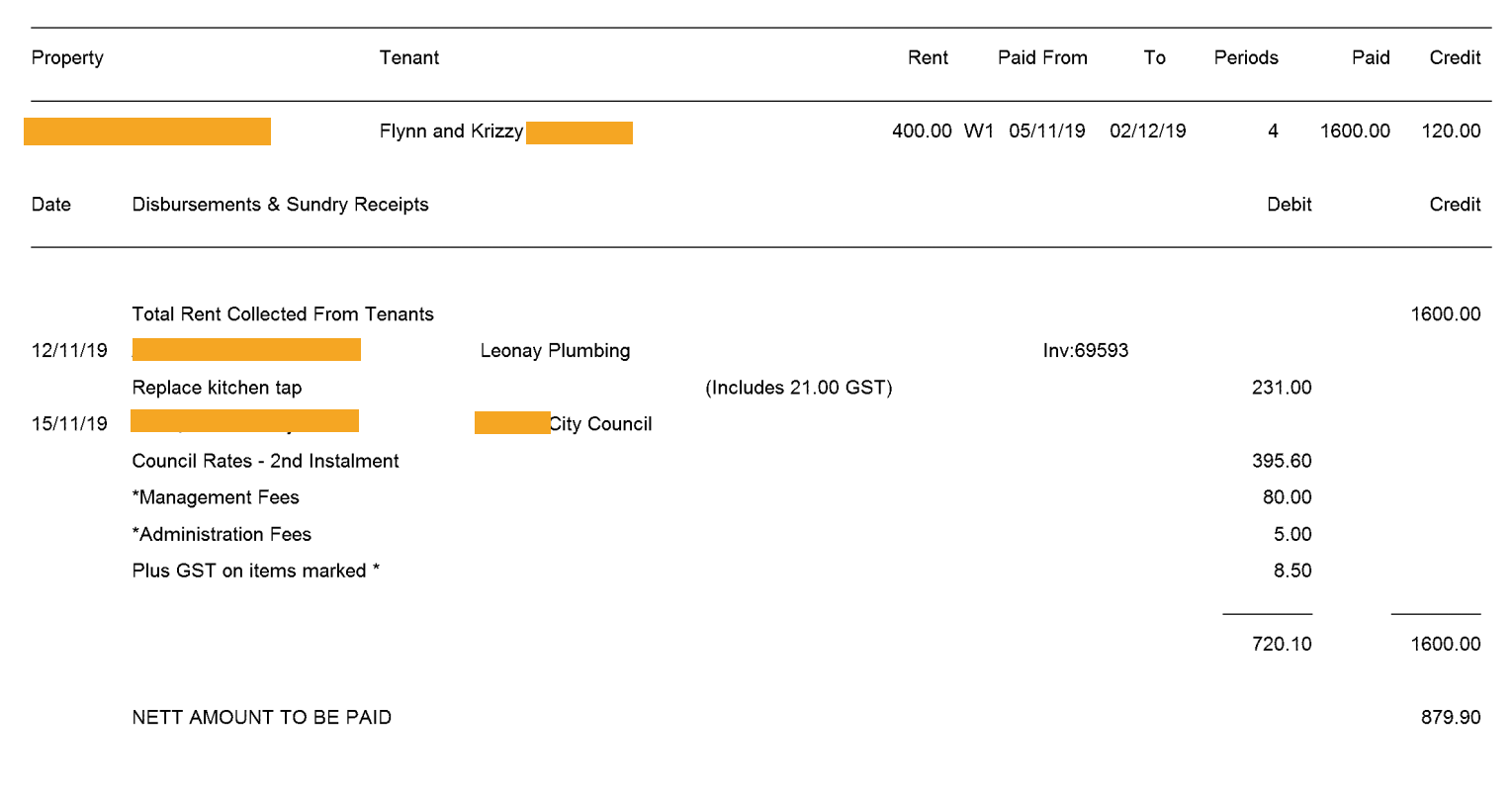

This is an investment property that I also rent out, this rental income can be recorded for the property in Sharesight. Below is a statement screenshot with the rental income and expenses on that particular month.

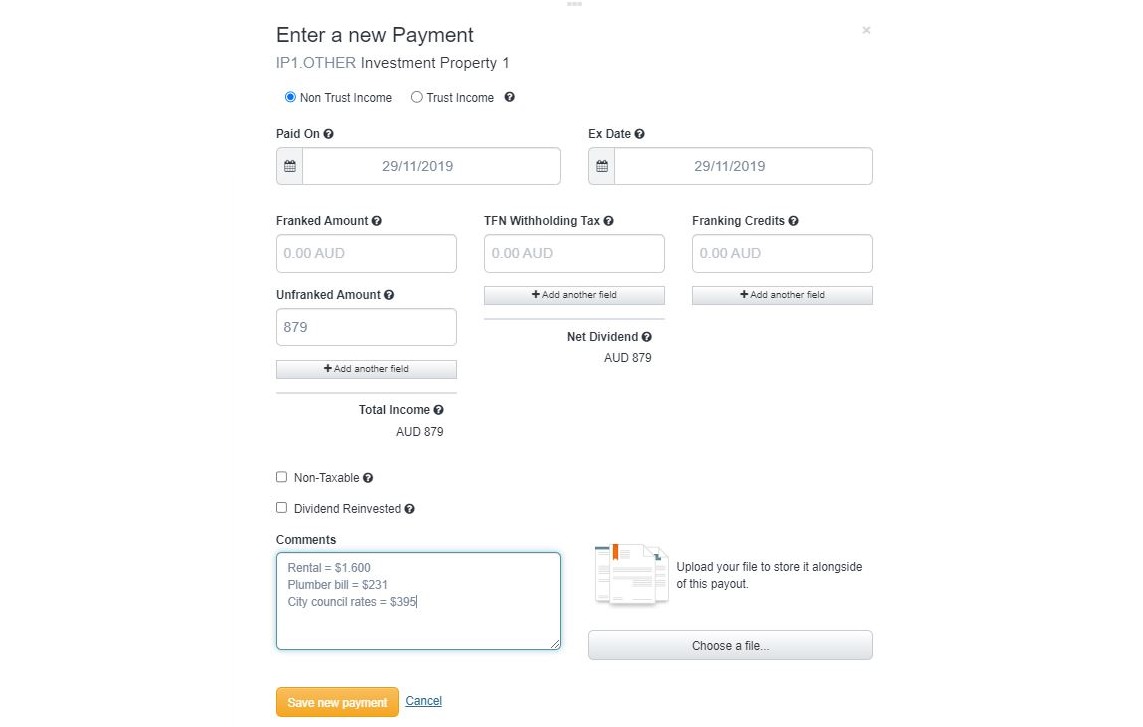

I record this rental income as a 'dividend' payment for the property holding in Sharesight. I also attach the rental income statement from the real estate agency to this dividend entry by uploading the statement against the 'dividend' income payment record.

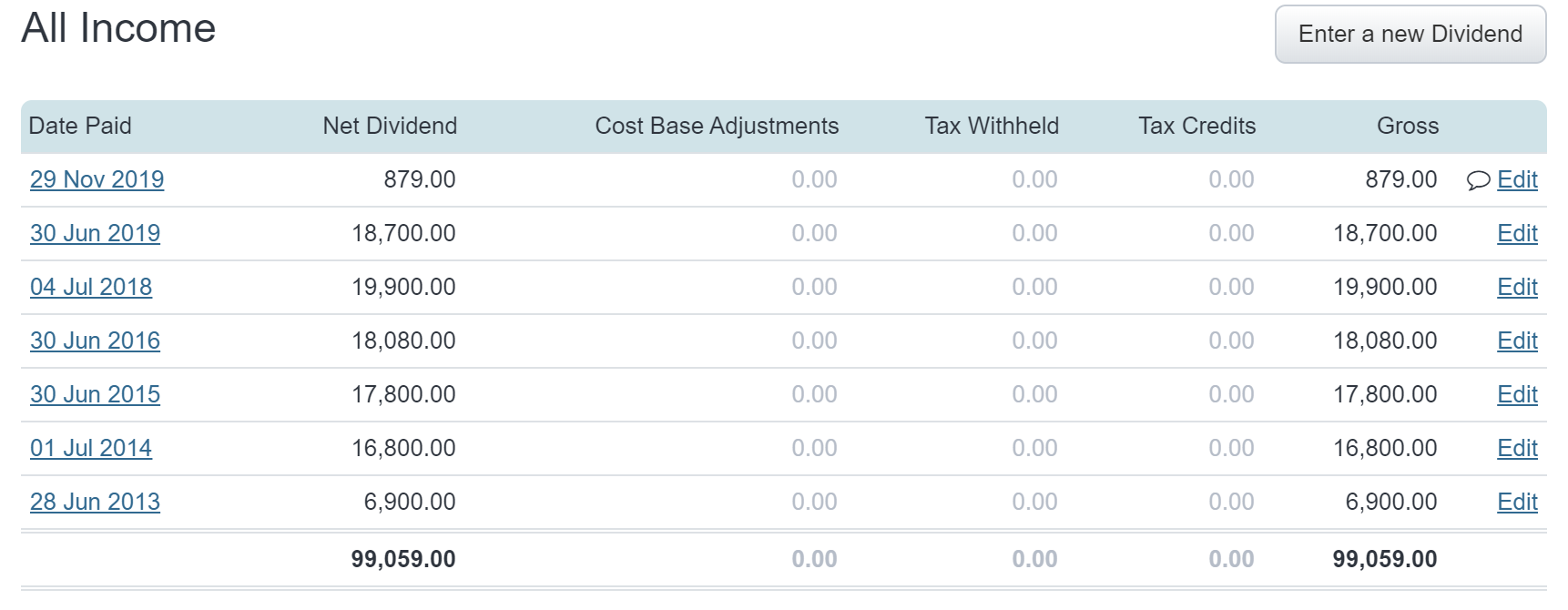

View all your rental income in Sharesight

Once entered, records of this rental income can be easily viewed in Sharesight and is included when running performance and tax reports on your investment portfolio.

How to update your investment property valuation

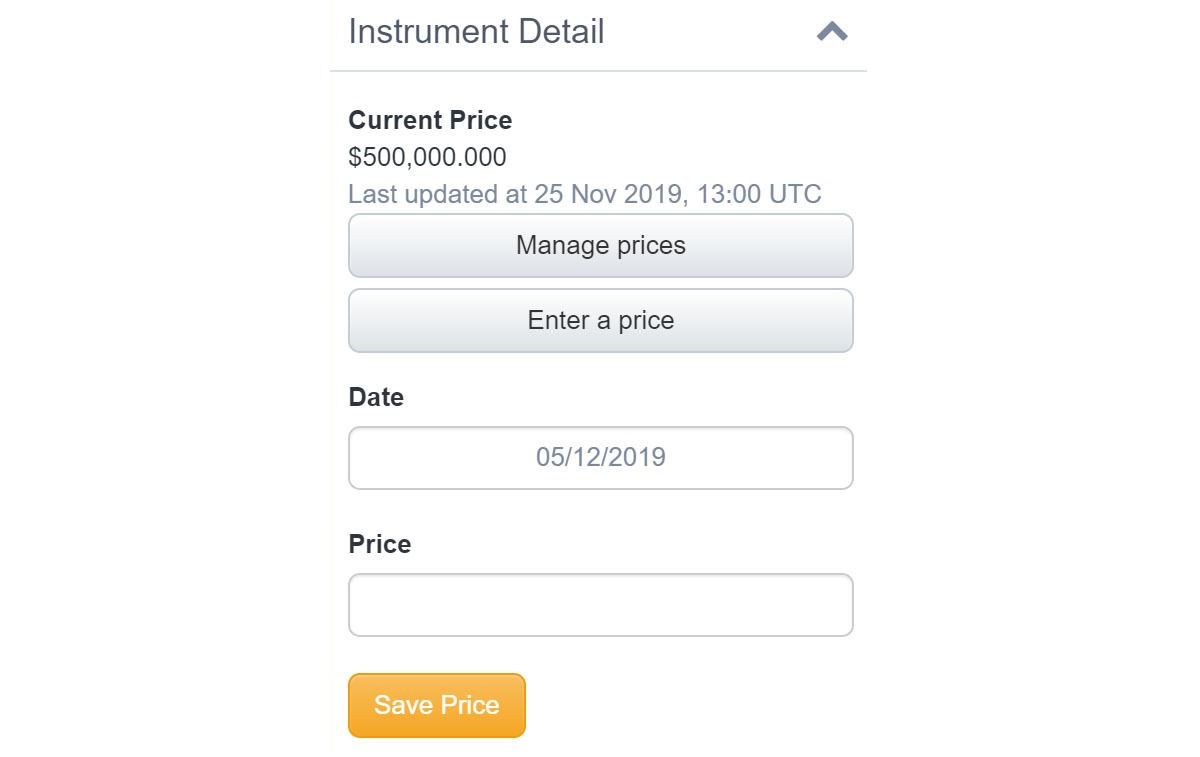

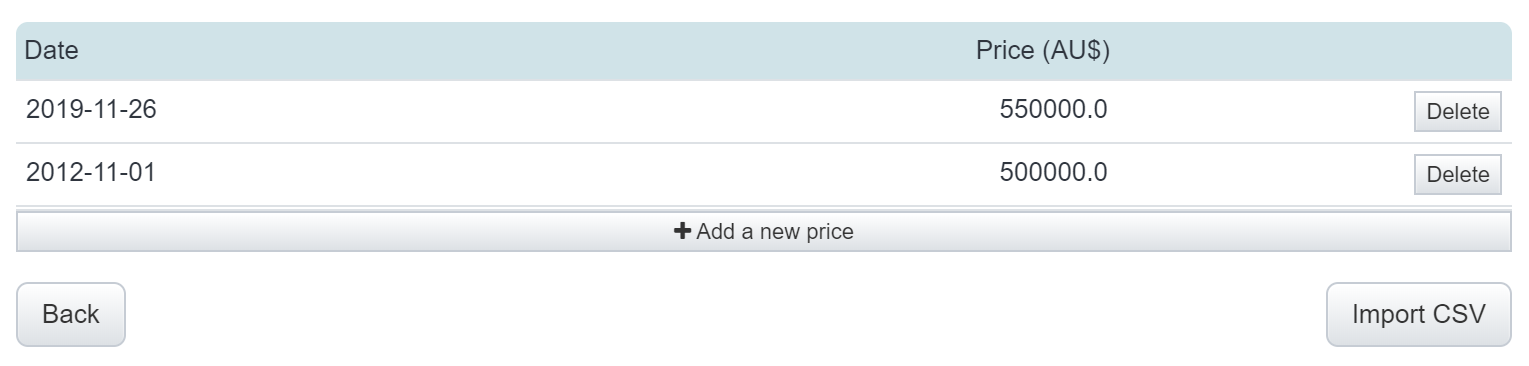

Should you perform an appraisal on your property and its market value changes, you can update the price to reflect your property’s current valuation in Sharesight.

To do this, use the "Manage prices" button on the holding instrument detail section (screenshot above) then update the value to reflect the new valuation for the property - this will allow you to track the value of this property alongside the rest of your investment portfolio over time.

Track how your property investments are performing within your portfolio

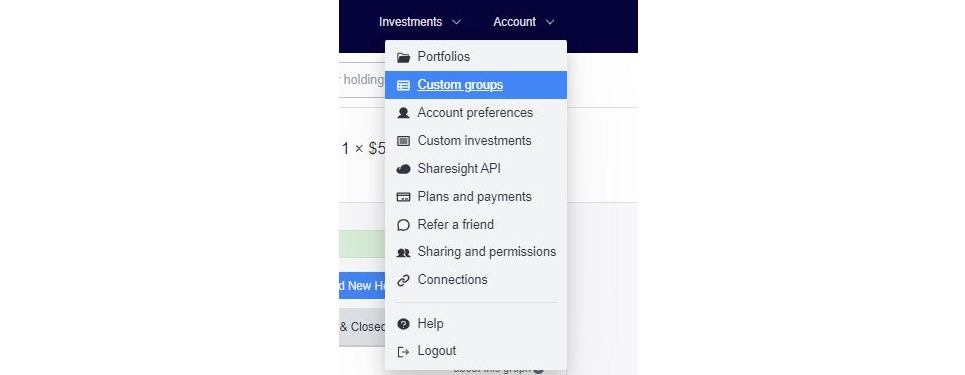

I like setting up my portfolio to visualise my performance by asset class using my own custom group definitions. To access and define your own custom groups, see the screenshot below on where it is located in Sharesight.

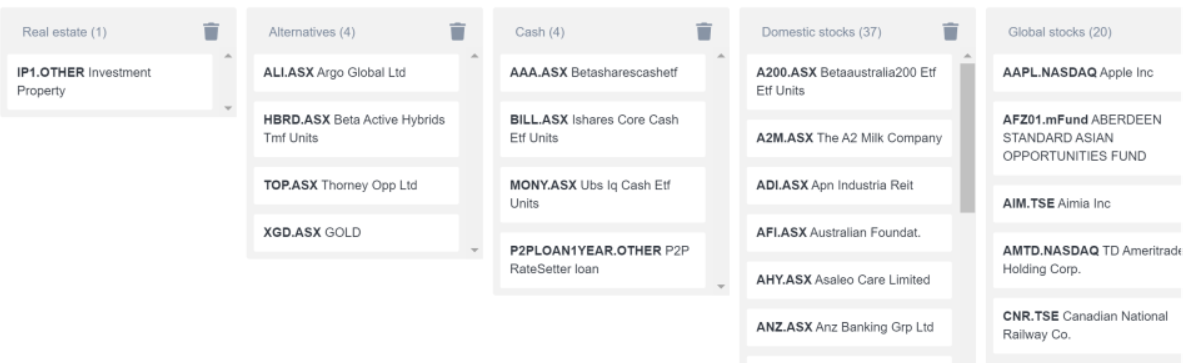

Once in your custom groups settings, you can define and categorise your investments by your own asset type groupings. For example, the groups In my own portfolio are shown below.

Once my custom groups are set, I can use these groupings to view performance broken down along these custom dimensions in Sharesight reports like the performance report, diversity report and contribution analysis to monitor and track the performance of my investments.

Need more information?

For more information on how to track an investment property in Sharesight, see our video:

Embedded content: https://www.youtube.com/watch?v=DsWqfplDAhI

Track all your investments in one place

Not only can you track your investment property with Sharesight, but with Sharesight you can:

- Track all your investments in one place, including property, stocks, ETFs, bonds, and managed funds to name just a few

- Get the true picture of your investment performance, including the impact of fees, dividend and rental income, and capital gains with Sharesight’s annualised performance calculation methodology

- Easily share access of your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments as you do

Sign up for a free Sharesight account and start tracking the impact of your property investments on your investment portfolio today!

![]()

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.