How to evaluate and record stock buybacks

Companies will sometimes offer to purchase stocks back from investors in what is known as a ‘stock buyback’. As an investor, it’s important to understand why stock buybacks occur, how to evaluate them, and whether you should participate in them -- even at a discount.

Why do companies conduct stock buybacks

Stock buybacks are one way of delivering value to shareholders that is common in many markets, and are often used as an alternative to paying dividends in countries where dividend income is taxed less favourably than capital gains, such as the USA.

Stock buybacks benefit shareholders indirectly by reducing the total number of shares on issue. This makes the remaining shares more valuable, as each share owns a greater percentage of the company’s earnings. Of course, if a company spends cash buying back overvalued shares that subsequently fall in price then the buyback can be bad for shareholder value -- but that is another issue. Warren Buffet has discussed this in many of his Berkshire annual letters.

In Australia, where franking credits make dividends quite attractive from a tax perspective, stock buybacks are typically driven by the desire to use these franking credits most tax effectively and generally take a specific "off-market" buyback form where the company will invite shareholders to bid for shares usually at a discount to the prevailing market price.

Why participate in a stock buyback at a discount?

Typically, the price paid in an on-market buyback will be the prevailing market price. In Australia, however, it’s common for investors to be paid at a discount to the prevailing price -- often as much as 14% below the current market price. In return, these investors receive a payment that is mostly made up of a franked dividend, which carries tax advantages.

The tradeoff here is that you are selling at a discount but you are receiving the majority of the payment as a franked dividend which carries with it a tax credit for the tax already paid by the company. This means that if you have a zero or low marginal tax rate, you can come out ahead of just selling the shares at the market price through an exchange. Australian SMSF members in pension mode are often the ones most advantaged by this structure, whereas shareholders on higher marginal tax rates are unlikely to benefit by participating at a discount. NABtrade recently put together some examples for the Woolworths discounted share buyback which demonstrate how this can work.

How do you record stock buybacks in Sharesight?

Stock buybacks can appear quite complicated, but when you boil them down as simply as possible, stock buybacks usually have three components:

-

A buyback price: Which may be less than the market price for the stock if there is franking attached to the buyback.

-

A franked dividend (only in Australia): The bulk of the payment will be in the form of a franked dividend. This should be recorded as a franked dividend in Sharesight. The franking credit should also be recorded in that income payment.

-

A capital component: This should be recorded as a sale transaction in Sharesight equal to the capital component. The company will normally provide all this information to you on a per share basis.

Once both the sale and dividend components are entered into Sharesight, you will see corresponding sale transaction and income payment records for the stock buyback. You can see these for the Woolworths 2019 stock buyback on the 27th and 30th May in our example below:

Now this is where it can get a bit tricky if you’re an Australian investor. The dividend and the capital component will equal the buyback price, but there is a catch. The ATO and the company will work out a deemed CGT component which is an extra amount (not included in the buyback price) that must be added to your sale price for the stock sold. This component sometimes has slightly different names but the company will normally provide the number.

At present this bit is not automated in Sharesight. You can't just add the deemed CGT component to your sale price as it will exceed the cash you received and impact your performance calculations. However, you can handle this manually in Sharesight by recording a note on the sale transaction, then when you calculate your capital gains tax with Sharesight, you can add this amount to the capital component above.

That's it. There are some permutations of the above but this is the basic formula. As always you should seek tax advice if you are not clear on how to apply this to your situation.

Sign up for Sharesight and track your stock portfolio

Unlock the value of stock buybacks by tracking your investment portfolio with Sharesight. Built for the needs of investors worldwide:

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Sharesight automatically tracks your daily price & currency fluctuations, as well as handles corporate actions such as dividends and share splits

-

Run powerful tax reports built for investors, including Capital Gains Tax, Unrealised Capital Gains, and Taxable Income

Sign up for a FREE Sharesight account and get started tracking your investments today.

The above article is for informational purposes only and does not constitute a product recommendation, or taxation or financial advice and should not be relied upon as such. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

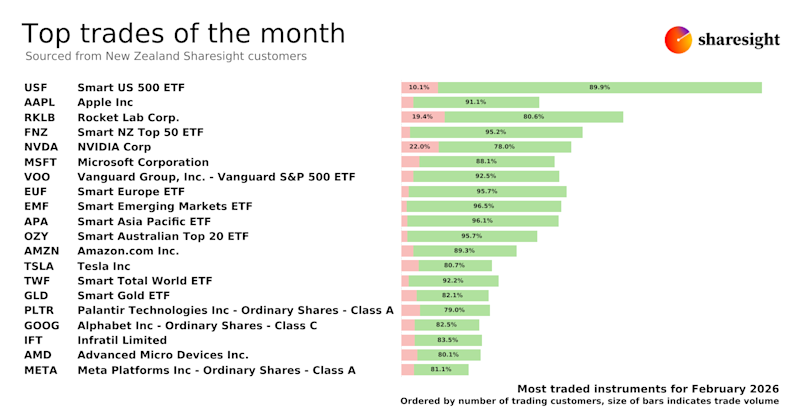

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

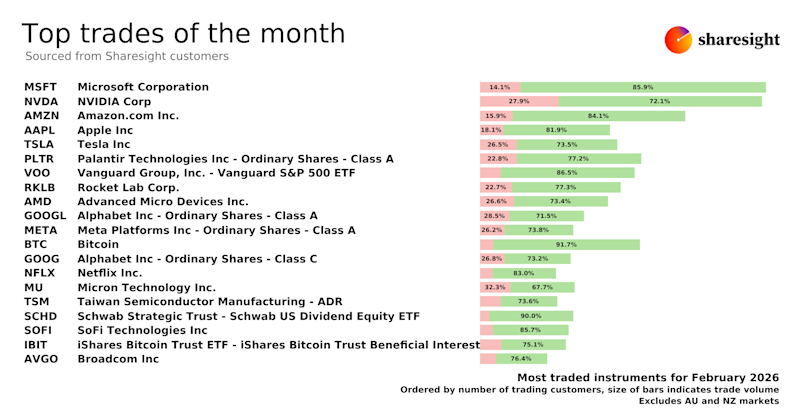

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

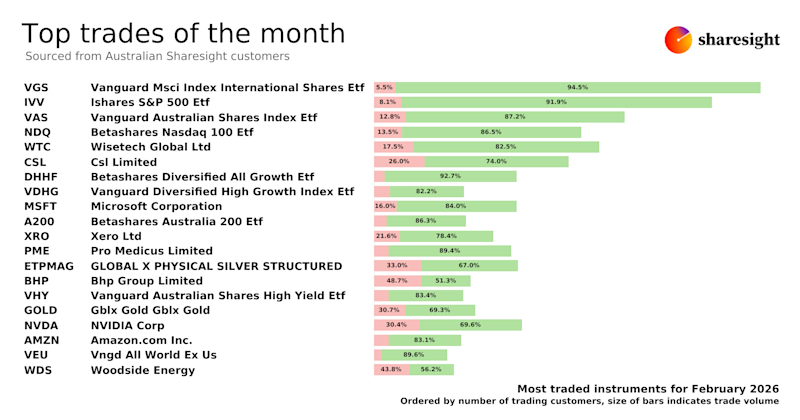

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.