How much money can Sharesight save you?

Clichés are clichés because they’re true. “Gotta spend money to make money” is one of them. The bottom line is that purchasing Sharesight saves investors money... and time, which is money. Another cliché!

Here’s a real life example of why this is true.

Consider Harry. Harry doesn’t use Sharesight. He’s a self-directed investor who earns an annual salary of $100,000. At any given time, he holds roughly 25 stocks and trades about 35 times per year. During the year he receives around 40 dividends and the odd corporate action impacts a couple of his holdings.

Like 70% of people who eventually turn to Sharesight, Harry tries to track his portfolio in a spreadsheet. Even though he’s probably misleading himself in terms of his true performance, he spends an hour each month keeping this albatross up to date. (In reality 12 hours probably significantly understates the time he actually spends on the portfolio spreadsheet each year, but we'll start there.)

So that’s 12 of Harry’s hours, which on his salary works out to be $577.

Now comes tax time. Like most people, Harry’s a proponent of the “shoebox” recordkeeping system. This means that when he receives a trade confirmation, registry letter, or account statement he throws it into a shoebox and slides it under the bed. He feels organised because everything he needs is in one place, but the reality is that come tax time, this will come to be a jumbled stack of paper.

Let’s assume Harry decides to hire an accountant for $120 per hour. It’s Harry’s responsibility to collect and deliver all of his paperwork to the accounting firm, only so they can recreate his investment history - something that Harry has already sunk $577 worth of his time trying to do.

The efficiency and specialisation of an accounting firm will vary, but let's assume that Harry’s accountant spends 8 hours (a business day, give or take) preparing his file. This means Harry owes his accountant $960.

In this scenario, Harry spent $1,537 on investment admin for 12 months.

| DIY Spreadsheet Hours | ||

| Sharesight Investor Plan | ||

| Accountant | ||

| TOTAL |

Now consider Olivia. She earns the same salary as Harry and is same type of investor. But rather than tracking her investments in a spreadsheet, Olivia subscribes to the Sharesight Investor Plan for $275.

Some investors use Sharesight for performance reporting, some for tax specifically. Regardless, to use Sharesight is to have your trades, dividends, and corporate actions tracked automatically, which means that your cost bases are accurate. Built into its DNA, Sharesight is a recordkeeping powerhouse.

Olivia, therefore, has no need to maintain a spreadsheet. Even if she has investments with multiple brokers, or with an advisor, all she needs to do is login (or check her mobile) to instantly see her performance. She’s free to dig down to the cost base level, check dividends, and run reports.

At this point, Olivia has saved $302 compared to Harry.

Like Harry, Olivia hires an accountant for $120 per hour to prepare her taxes. However, her interaction with her accountant is completely different than Harry’s.

Instead of handing her accountant a shoebox, or spending time scanning and uploading her documents to the accounting firm’s website, Olivia logs into Sharesight and with a few clicks, her accountant is sent an email invitation to her portfolio. She’s chosen to give her accountant “Read & Write” access, which means they can make adjustments to things like corporate actions, if necessary.

The beauty of this solution is that the need to recreate the portfolio history is completely eliminated. Plus, the accountant can use Sharesight on their own time, independently of Olivia.

Even though the work has essentially been done for the accountant by Sharesight, let’s assume they still spend 3 hours on her file. This brings the billable amount to $360.

In this scenario, Olivia spent $635 on investment admin for 12 months. So compared to Harry’s spreadsheet approach, Sharesight actually decreased her admin-related costs by 59%.

There are three additional factors that should save Olivia money:

- First, her Sharesight subscription is most likely tax deductible.

- Second, because Sharesight did the admin work for her and the accountant, this should free up time to conduct forward-looking, tax planning discussions together — not just at tax-time, but throughout the year.

- Finally, because she always knows the performance of each of her holdings, Sharesight has probably helped Olivia make better investment decisions. So her subscription fee may have already more than paid for itself!

FURTHER READING

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

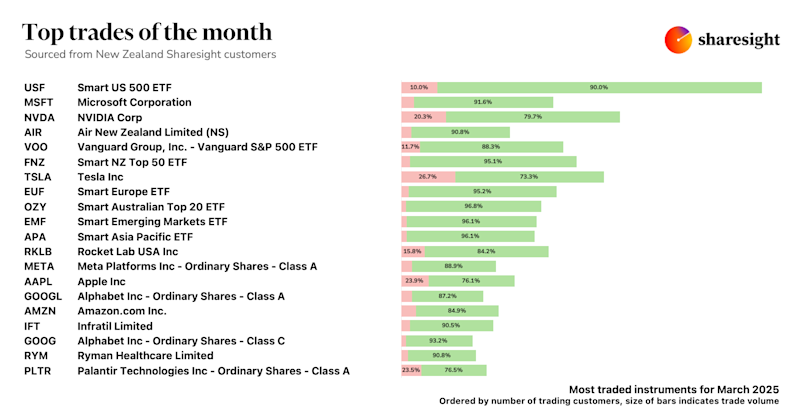

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

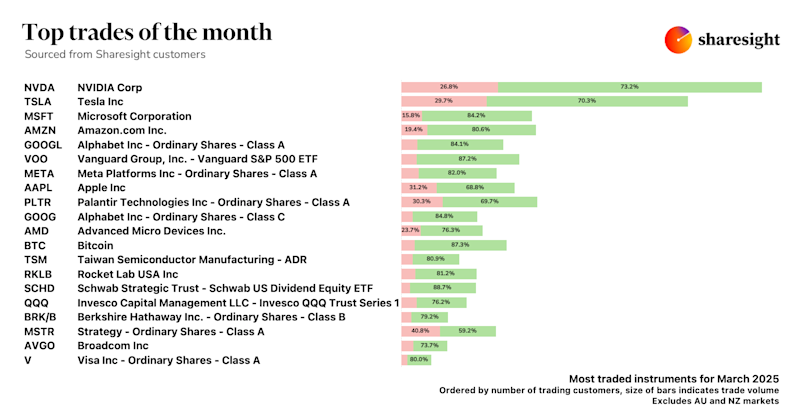

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.