How I make the most of my Sharesight portfolios

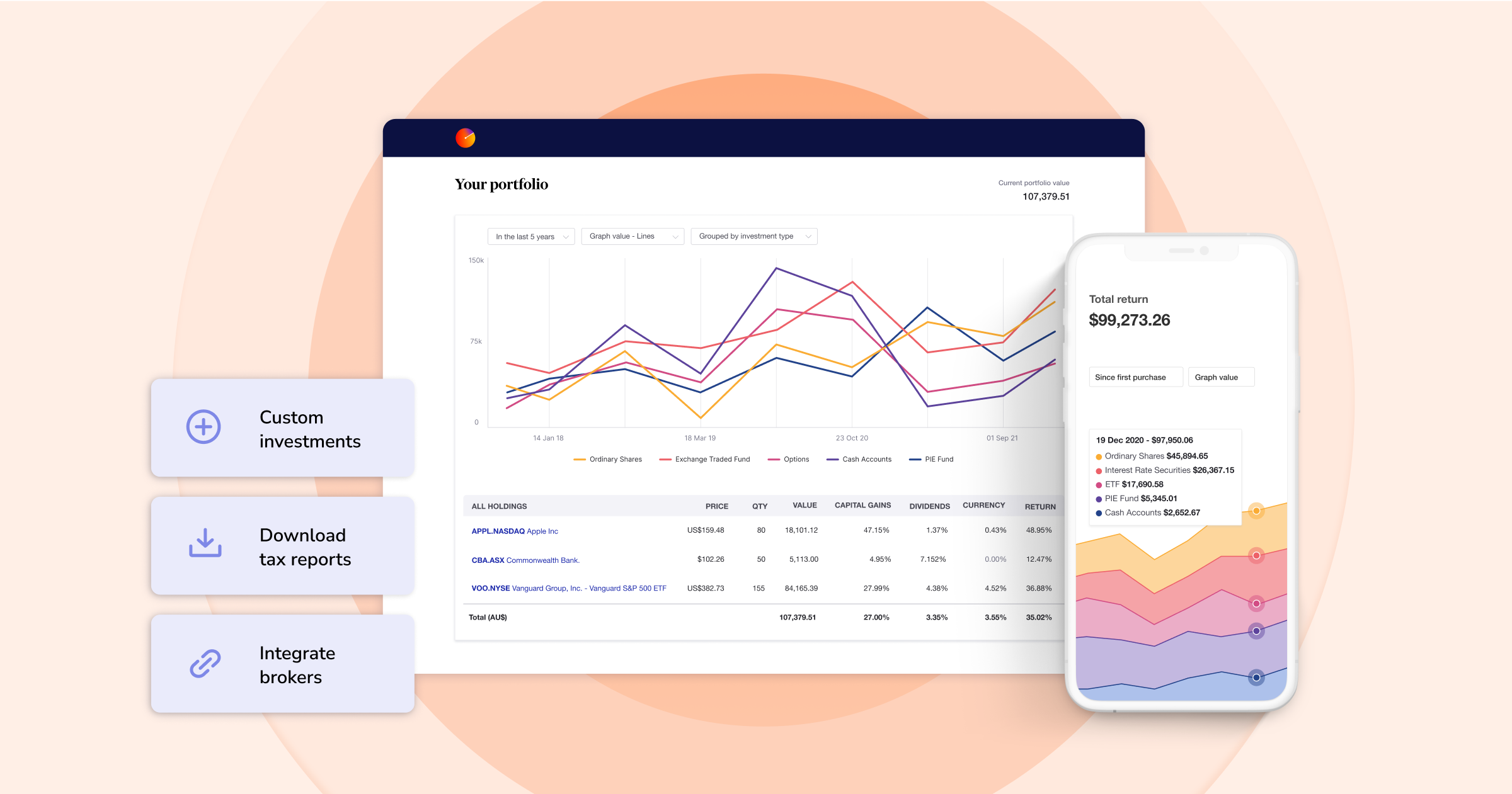

If you’ve been using Sharesight for a while, you’re probably aware that you can use Sharesight for Free to track up to 10 holdings in one portfolio, and when you upgrade to an Investor, Expert or Sharesight's professional plan plan you unlock additional portfolios based on the plan you select.

But if you’re like me, you may only need a handful of portfolios to track the shares you actually own. If that’s the case, you may be left with a couple unused portfolios. As the saying goes, a Sharesight portfolio is a terrible thing to waste. Since you’ve got access to those extra portfolios as part of your premium plan, you may as well use them to become a better investor. In this article, I’ll share how I use my portfolios to track my:

1. I use one Sharesight portfolio to track my trading account

This is made up of shares I’ve bought locally (on the ASX) since I started investing on my own a few years ago. At time of writing, it includes 13 holdings (mostly ETFs and a few individual shares). I track this portfolio very closely, both on my laptop and on the Sharesight mobile app.

2. I use a Sharesight portfolio to track my RRSP

I’m from Canada and I participated in an RRSP (registered retirement savings plan) before moving to Australia. The portfolio is made up of a couple mutual funds traded on the TSE so it’s in Canadian dollars. This is a portfolio that I no longer contribute to directly, but I do reinvest the dividends. Although it’s not a portfolio I track very closely, I’ve loaded it into Sharesight so I can check in on it from time to time (and also because the reports offered by my broker are really terrible).

3. I use a Sharesight portfolio to track my Superannuation

Working in Australia provides me with a Superannuation portfolio, which my employer (Sharesight) contributes to as part of my remuneration. As the fund is unlisted and not unitised, I use Sharesight’s Custom Investment feature and update the total every now and then based on my current balance. This is less about tracking the portfolio’s performance, and more about tracking my overall balance alongside my other investments.

4. I use a Sharesight portfolio as an investment watchlist

One of the best uses I’ve found for my extra portfolios is setting up an investment watchlist. It makes it really easy to keep track of various stocks and compare them against each other.

While I could have set up a watchlist in Google Finance or Yahoo Finance, I decided not to bother since they don’t factor in the impact of dividends or currency fluctuations fees into the returns. Sharesight on the other hand, makes this super easy to track these at a glance:

My watchlist has been especially useful when I’ve been researching different stocks to buy -- especially ETFs that have similar regions or themes. For example, when I was looking to invest in ETFs that track emerging markets, I added the ones I was interested in so I could compare them side-by-side:

By doing this, I was able to check the performance of these ETFs over different periods to "backtest" their returns over time. This is much easier than scrolling through the various ETF providers’ websites. Also, being able to compare the capital gain and dividend yield components of the various ETFs in this way is very handy and not something I was getting anywhere else.

5. I use Sharesight to track my model portfolio

Another use I’ve found for my extra Sharesight portfolios is creating my own model portfolio. Essentially, I created a model portfolio containing all the stocks I was looking to eventually own, and used Custom Groups to organise them according to my preferred asset allocation methodology. I used the Diversity Report to ensure the proportions were as close as possible to what I was trying to achieve:

This was especially handy when I was first getting started with investing, and didn’t yet own all the stocks I wanted, in the proportions I wanted for my target asset allocation. It allowed me to do a bit of backtesting to see how the portfolio performed over various periods of time.

When I started investing a few years ago, I was planning to only invest in ETFs. Since then, I’ve decided to invest in a few individual companies as well. I’ve found that having a model portfolio has been a very useful way for me to compare my actual performance to my model portfolio, and ensure I’m staying on track with my investing goals.

More ways to use your Sharesight portfolios

I've explored how I personally use my Sharesight portfolios, but there are plenty more ways to take advantage of extra portfolios.

Track your family's investments

One of the great things about having extra portfolios is that you can track your family's investments. This is especially useful if you have a tax residency that requires you to file joint taxes with a spouse, or if you manage investments for other family members. In this case, you may wish to run a Consolidated View to see the total return on your investments as a family.

Track an investment club

If you belong to a share investing club, tracking your club's portfolio on Sharesight is a great way to create transparency among members. By using Sharesight's portfolio sharing feature, you can ensure members have access to the club's portfolio data at any given time, making club meetings less about establishing what's in the portfolio and more about the investing decisions the club wants to make. Sharesight's advanced reporting tools such as Performance, Diversity, Contribution Analysis and Multi-Period can also be very useful when making decisions for the club's portfolio.

Track an employee share scheme

If you have investments in an employee share scheme (also known as an employee share plan), you can easily track the performance of these shares in Sharesight. In this case, it is recommended that you use one portfolio for your vested shares and another portfolio for unvested shares. Then when your shares vest you can simply sell them out of the unvested portfolio and buy them in your vested portfolio. Or if you only have one portfolio to spare, you can use Sharesight's Custom Groups feature to tag unvested and vested shares and keep them in the same portfolio.

Track other tax sheltered accounts

I mentioned that I track my RRSP, but you can also use Sharesight to track other tax sheltered accounts such as a Registered Retirement Income Fund (RRIF) or Tax-Free Savings Account (TFSA) for Canadian investors, or a Self-Managed Super Fund (SMSF) for Australian investors. Simply click 'Tax Settings' in your Sharesight portfolio and select the relevant account type. The ensures that the correct tax treatment will be applied to your portfolio.

Track all of your investments in one place with Sharesight

Thousands of investors like you are already using Sharesight to manage their investment portfolios. What are you waiting for? Sign up and:

-

Track all of your investments in one place, including stocks, mutual/managed funds, property and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed Funds

-

Run powerful reports built for investors, such as Performance, Portfolio Diversity, Contribution Analysis, Multi-Currency Valuation, Multi-Period and Future Income (upcoming dividends)

-

See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Top 50 finance and investing podcasts in 2025

The Sharesight team has put together a list of the top 50 investing, personal finance and business news podcasts worldwide.

8 ways to use Sharesight's custom groups feature

This blog explains our custom groups feature, including strategies that can help you gain deeper portfolio insights and make more informed investing decisions.

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).