How Affluence Funds Management uses Sharesight

At Affluence Funds Management, we aim to achieve superior long-term investment performance. If you invest in an Affluence managed fund, you get access to more than 20 of the best fund managers, or ASX Listed Investment Companies (LICs) in Australia, as chosen by us. We focus not only on delivering the best returns we can but also on making those returns as consistent as possible. We take both these goals into account when constructing our fund investment portfolios.

We use Sharesight to assist us in tracking both the performance and tax positions for our managed funds and LICs. We chose Sharesight for several reasons, including its cost-effectiveness, the ability to automate trades, its quality tax reporting, and the regular data feeds which assist us to accurately value our holdings.

The Sharesight commitment to continual development and improvement of their platform is also a key consideration for us, as is our shared goal of helping self-directed investors and their advisors get a better investment outcome.

Automated processing

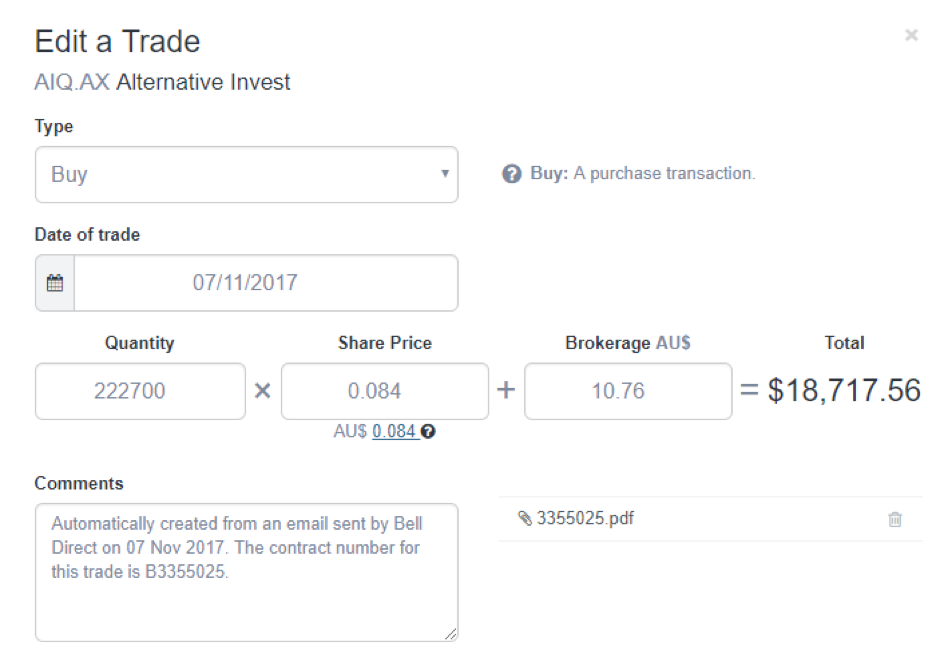

Sharesight saves us a significant amount of processing time. We use Desktop Broker for most of our trading in LICs. Those buy and sell contracts are emailed to Sharesight and automatically processed and uploaded against the transaction.

The corporate actions feature also means that most LIC dividends and managed fund distributions are created automatically. This allows us to check the transaction against the payment advices quickly and efficiently.

Finally, the fund data feeds mean that for many of our unlisted funds we can see the most up-to-date unit prices. This is dependent on the underlying data from Morningstar, but it certainly provides a good cross-check against our other sources of information.

Tracking performance

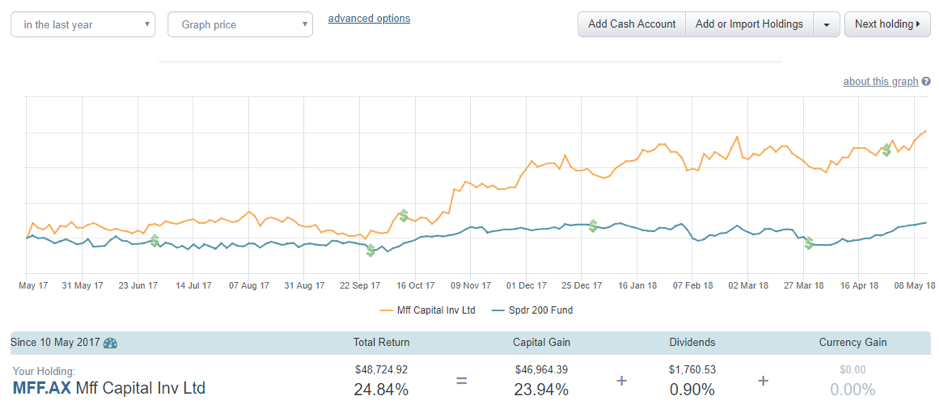

We use the performance reports regularly, particularly for our listed LICs. Using this data, we can easily check performance within a month or even intra-day.

We reconcile this data monthly against our other records to provide a cross-check of our capital gain/loss and income calculations.

Tax reporting

Sharesight has comprehensive tax reporting that allows us to always have up-to-date information on our LIC and managed fund holdings.

Before we sell a stock or fund, we can quickly ascertain the capital gain or loss position and confirm the likely tax impact of selling. This is particularly useful where we might be close to the 12-month qualifying period for a discounted capital gain on the sale, or where we have recently received a dividend and don’t want to breach the 45-day rule, thereby losing entitlement to franking credits.

We also use Sharesight’s tax reporting functions to assist in estimating the tax components of our monthly investor distributions. At the end of the tax year, our Sharesight data is easily exported and used as part of our annual calculation process with our tax advisors.

Maximising efficiency

For many investors, finding quality managed funds and LICs is a very difficult exercise. There are so many options out there, and it’s hard to know which ones might be able to deliver above-average performance. It’s tempting to go for the recent outperformers, but quite often that proves to be a bad choice.

Our process involves reviewing the thousands of opportunities and distilling them down to 25-30 of the best for each of our managed fund portfolios. That makes our model fairly unique. Also, we do not charge investors in our funds any fixed fee, only a performance fee. We also cap the cost of running our funds to limit the impact on investors. All of this means that we must be able to operate efficiently. We use a range of tools and service providers to help us in this regard, and Sharesight is a key part of our investment infrastructure.

Sharesight has allowed us to manage tax records for our funds and assist with performance reporting in a way which is both extremely efficient and cost-effective. Their objective of empowering investors to manage their investment portfolios also resonates with us. It aligns well with our philosophy of providing self-directed investors and their advisors with easy access to many of Australia’s best fund managers.

To find out more about Affluence, sign up to our newsletter, or register to view our Fund portfolios for free, visit affluencefunds.com.au.

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.