Have the doomsayers got it wrong?

Wouldn’t it be great if we could buy Rod Oram’s argument that the doomsayers have got it wrong about the Government’s bank deposit guarantee scheme?

Oram has the powerful forces of wishful thinking on his side but it would be nice if these forces could be armed with rational argument. Oram says our alarm at the bank guarantee scheme is ‘one of the weirder NZ responses to the global credit crisis.’ He contrasts this with other countries that are ‘rejoicing at the stability similar schemes are bringing to their banking systems’. Maybe I’m on a different planet but I don’t see any sign of rejoicing and no sign of stability either. And even if I’m wrong about this any rejoicing would more likely be because these unnamed other countries’ banks have been falling over like nine pins. This is not the case with our banks which Oram admits are ‘conservative, well-capitalised and good judges of risk’.

Oram suggests the Government bank guarantees are a ‘massive regulatory shift’ that starts to bring NZ back into the ‘global mainstream.’ He implies that this is a good thing. All I can say is that the ‘global mainstream’ is a turbulent, muddy, cesspool that everyone is frantically trying to get out of. Why it is weird for us to be reluctant to dive in to it is beyond me.

I share Oram’s concern about the NZ banks’ offshore borrowing but surely this adds weight to the uncomfortable thought that the doomsayers have got it right: not wrong? To think that a Government bank guarantee will forestall or alleviate any problems that this offshore fund-raising might cause is wishful thinking.

I agree that a challenge (although not necessarily ‘the central challenge’ as Oram suggests) is to ring fence the guarantees so they benefit only the NZ banks and not their Australian parents and shareholders. This is more than a challenge – it’s an impossibility. Any benefit to a wholly owned subsidiary will surely also be a benefit to the parent company.

There are also other challenges that cannot be ignored. When it comes to fund-raising, any action that favours one segment of the market (banks) will have adverse consequences for the rest (managed funds, share market and any others that cannot avail themselves of the guarantee). This is patently unfair and could have serious adverse consequences for organisations whose only crime is they are not one of the banks that Oram says have ‘made a mockery of monetary policy’.

The consequences of such a massive regulatory shift that embroils the Government so extensively in the financial markets are impossible to predict. However history suggests that anomalies, distortions, loopholes, exploitation and ever increasing complexity and cost will rule.

Do you think the doomsayers have got it wrong? I would like nothing more than for someone to convince me they have.

This information is not a recommendation nor a statement of opinion. You should consult an independent financial adviser before making any decisions with respect to your shares in relation to the information that is presented in this article.

FURTHER READING

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.

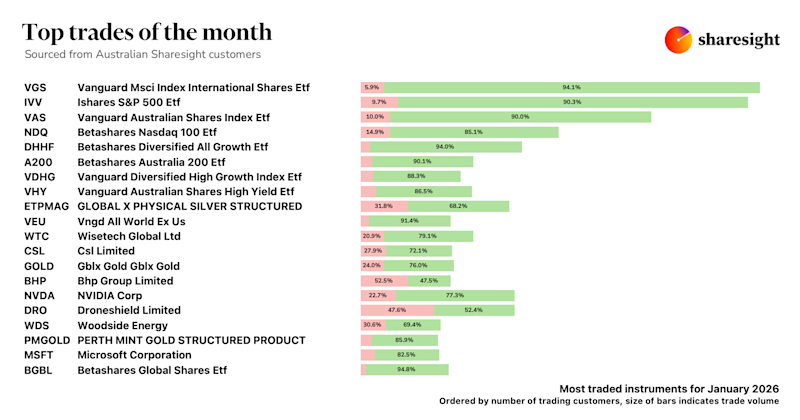

Top trades by Australian Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for Australian investors, where we look at the top 20 trades made by Australian Sharesight users.