How financial advisors meet AFSL requirements with Sharesight

We talk to financial advisors Ben Wieland and Ben Widdup from EGU about how Sharesight helps improve the quality of conversations with their clients. We also discuss how the firm uses the consolidated view feature to meet their AFSL requirements, why the diversity report is so useful and what their clients like most about Sharesight.

1. Tell us a bit about EGU and what you do there.

We are a self-licensed financial planning firm that was born out of an existing accounting firm and family business which started a wealth management division. We create portfolios for clients based around listed products with a strong influence on overseas investments.

As for our client base, a lot of our clients came from our existing accounting firm, which is much older than the wealth management division. Because of that we manage a lot of SMSFs. In terms of life stage, about 50% of our clients are young to middle age and the other 50% would be either just pre-retirement or in retirement.

2. How do you use Sharesight in your business?

We go into Sharesight every day and review every client’s portfolio. And for high-level management purposes, we have created a consolidated group which is under the firm’s name and have added every client’s portfolio to that. That way, we can see at any point in time all the funds under advisement for our firm.

Clients

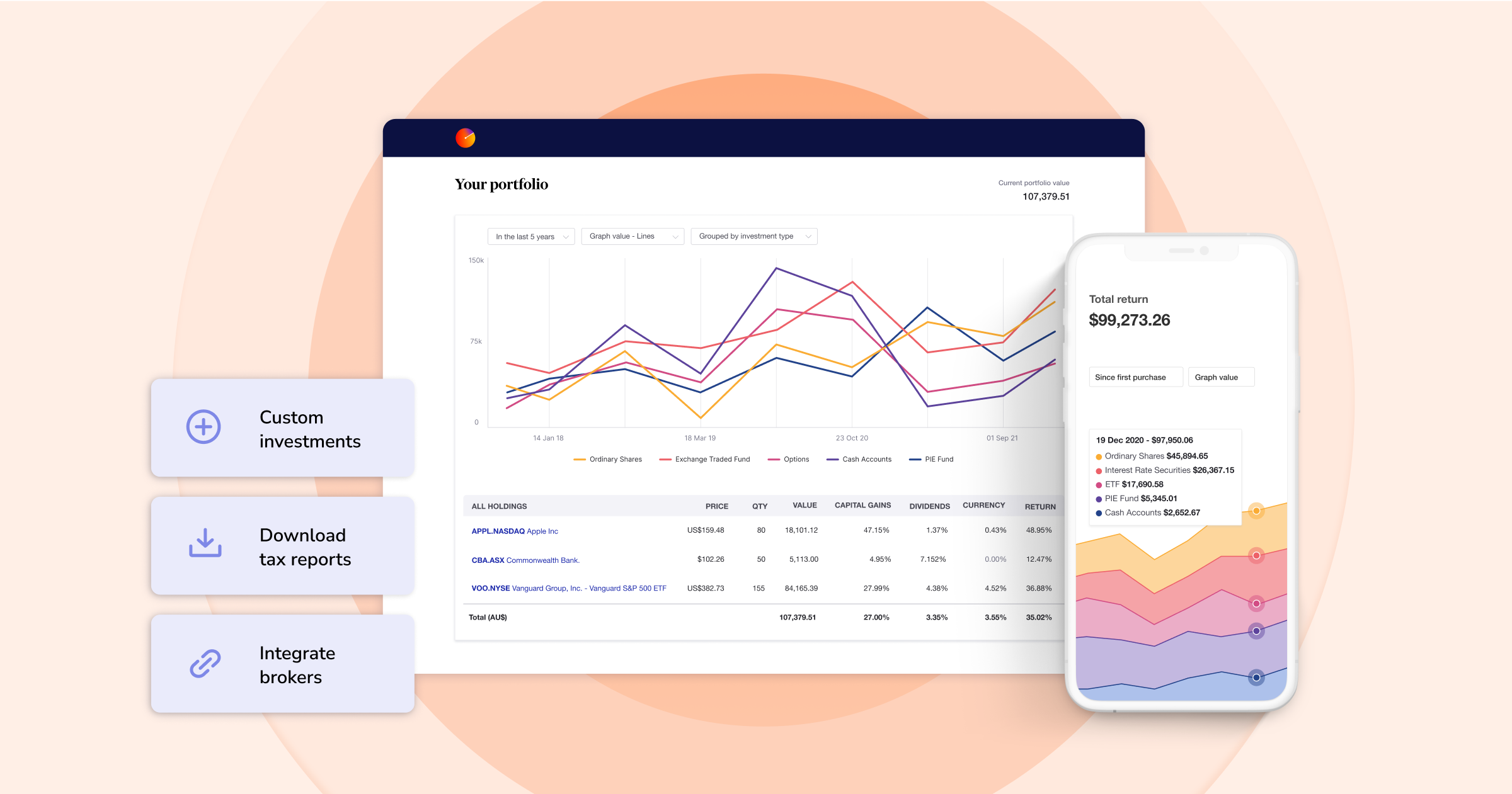

Every client has access to their portfolio and all of our clients go to Sharesight for reporting – no one goes to Saxo Markets (which is the main broker we use). One of the big things to remember is that brokers aren’t reporting houses – they’re an intermediary to get you the asset. Sharesight’s reporting is the best in the business.

We generate Sharesight reports for clients. Every physical meeting we go to, we print out the diversity report, the performance report (in terms of percentage and cash) and the contribution analysis report (to see how much each asset class is contributing). We hand this to the clients, but it’s more of a "nice to have in hand" bit of paper, rather than any new information for the clients, as they will have already looked at their portfolio on Sharesight.

In terms of feedback, our clients love Sharesight. They really enjoy the ease of access, the look of it and having the information at hand. The quality of our conversations with clients has really improved. It’s less of "This is what’s happened" and more “What are we doing? What’s happening in the future? Are we changing this, are we tweaking that? Is there any need to rebalance?” It’s just a much better quality of conversation.

Integrations

We use Macquarie CMA for every client that has a portfolio. Not for platform clients but any non-platform client (which is the vast majority) where we’re using Saxo and Sharesight has a Macquarie CMA account, whether that’s inside or outside of super. We segregate those investment funds from their day-to-day cash account and run them as a portfolio, so the integration works really well.

AFSL requirements

We have to renew our professional indemnity insurance policy every year and they ask us what our funds under advisement are and what is the break-up of the funds between ETFs, managed funds, cash, etc. The consolidated view feature gives us that information. So when the insurance firm asks, "How much have you got in ETFs?" we can say we’ve got 62% (for example).

3. Which feature do you find the most useful?

Probably the diversity report, because it allows us to have conversations about where portfolios are going. This is really useful because our investment philosophy is that a portfolio’s overall construction is more important than any one investment held inside the portfolio. So some of the questions we ask are do they have enough exposure to certain asset classes? Or do they have too much exposure? Are we starting to see inflation creep in and if so, how do we hedge that? That’s what the diversity report really gives you.

Try Sharesight today

If you’re an accountant or financial advisor looking for an investment tracking platform that both you and your clients will love, there has never been a better time to trial Sharesight, and enjoy:

-

The ability to aggregate – Track any combination of brokers or managed funds, and over 60 global exchanges

-

Automated portfolio admin – Automatically track new trades and dividend income (including DRPs)

-

Powerful performance reporting – Access Sharesight’s performance reports at your fingertips instead of waiting for a third party

-

Advanced tax reporting – taxable income, capital gains tax and unrealised CGT

-

Direct portfolio sharing with clients – Securely share portfolio access with your clients, only giving them the level of access they need.

Put Sharesight to the test with a free 30-day no-risk trial – there are no billing details or credit card required and you can upgrade, downgrade or cancel at any time.

Sign up today and a Sharesight Account Manager will be in touch to help you get started.

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.