Event recap: Confess your financial failures

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

At the end of July, we hosted a talk called Confess your financial failures in our Sydney office, where we invited investors to join us for a candid discussion about some of our failures as investors, highlighting where we went wrong and what we could have done better. We would like to thank everyone who attended, especially those who were brave enough to share their own investing fails. And of course we would like to thank our panellists Vince Scully, Phil Muscatello and Fiona Balzer for sharing some failures of their own, along with a lot of wisdom from their experience as investors and professionals.

Left to right: Vince Scully, CEO of LifeSherpa; Prashant Mohan, Chief Marketing Officer of Sharesight; Fiona Balzer, Head of Policy and Advocacy at the Australian Shareholders Association; and Phil Muscatello, host of the Shares for Beginners podcast.

You can watch the full panel here, or see below for a summary of some of the key talking points:

Embedded content: https://youtu.be/HK9fgF675UQ?si=f5Ga1jaQvnl0mIkl

Emotional investing: How do we deal with fear and greed?

Fiona: With most investing, the thing is to know yourself. Some people will have FOMO and they will buy everything as it’s heading up and about to go down. Other people will have a fear of making a mistake, so they buy and as soon as the share price starts to go up, they sell out quickly, even though it’s a multi-year investment that they should let run.

For me, I tend to get too busy at work. So I need to set myself some rules. If you know what type of investor you are, you can cater to what your emotional needs are in the market.

Phil: At the most recent ASA conference, there was an ETF provider that showed over 100 years of data. It was broken down into several aspects, but the main aspect of it that stayed with me was that in 100 years of data, only 7% of companies outperformed the market. We’re all trying to find those companies and you can’t do it in an emotional way.

How should an investor go about research?

Fiona: I do find that you need to be a critical reader of information and checking your information across other sources. As an institutional investor, we never follow the brokers’ recommendations because they don’t know what you’re investing in and why you’re investing. They can say it’s a ‘buy’ but what if you’ve already got shedloads of a particular company? For you it might be a ‘sell’ at this price. So we just use their research to give us ideas and test their forecast.

Vince: The most useful thing you can take from a piece of research is to look at their forecast of growth and profits, and most importantly, cash from operations. Look at what they’re all saying and try and see who’s the outlier. They will tend to form a fairly close band but the ones to read are the ones that are not in that close band — and try to understand why.

How do we deal with timing the market?

Vince: Timing is one of the toughest decisions to make in investing, and you’ve got to make it twice. The problem is that the good days tend to be clumped with the bad days. So if you look at the 20 worst days in the history of the stock market, they tend to be very close to the 20 best days. And that’s because when things get volatile, you get these big swings.

The trick to buying when stocks are down is to avoid “catching a falling knife”. AMP is a really good example of that. The day after the float it was $26 for a day, and it’s pretty much only gone one way since. It’s a good example of how bad management can defeat great companies.

What causes investors to become overconfident?

Phil: Delusion. You see it all the time. People see a story, they fall in love with the story and then they get burnt, because the story isn’t enough. It’s not enough about what the company’s going to do, how well it’s run, or whether there are macro forces acting upon it.

How do you stop yourself from chasing trends?

Vince: If you’re a trader, you might not. For example, if you have a one day, one week or one month view, the trend is your friend. But if you’re taking a 10 year view, punting on (for example) who’s the AI winner, if indeed AI is a winner, what do you know that the market doesn’t? The market may not be perfectly efficient, and it may be irrational at times, but it behaves like it’s rational most of the time.

When looking at investments with a long-term view, the question you have to ask yourself is when is a fad or fashion a genuine step change? The internet is a good example of a step change. The challenge is then finding the companies that will still be around in 10 years’ time.

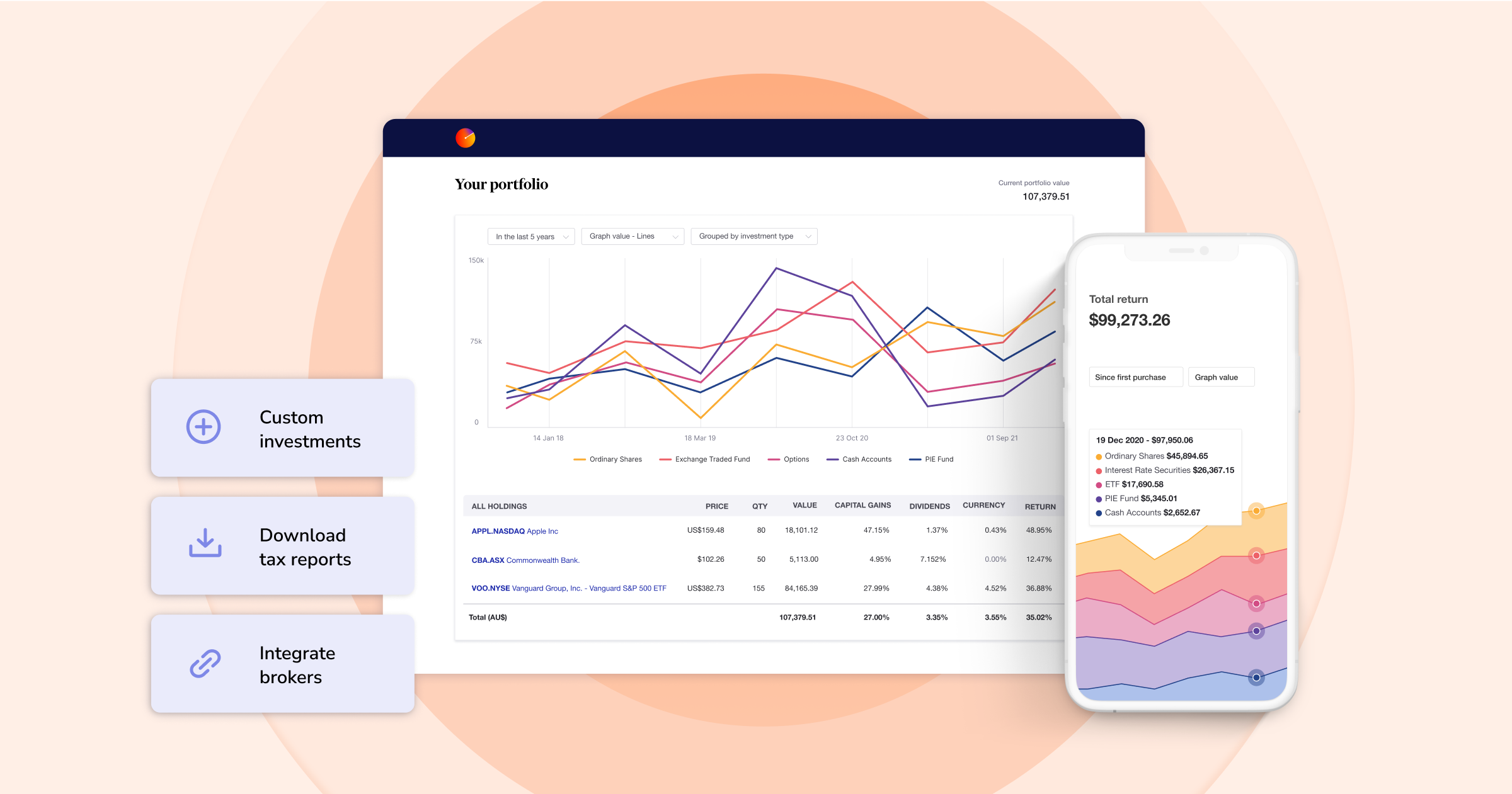

Become a better investor with Sharesight

If you’re not already using Sharesight, what are you waiting for? Join hundreds of thousands of investors worldwide using Sharesight to see the true performance of their portfolio, save time on tax reporting and get the insights they need to make smarter investment decisions.

Sign up for a free Sharesight account and start tracking your performance and tax today.

FURTHER READING

Sharesight vs. alternatives: Why investors choose our portfolio tracker

Compare Sharesight to alternative portfolio trackers and see why 500,000+ investors trust Sharesight for smarter portfolio management and tax reporting.

No rush to buy – Big Tech and banks hold the key

No rush to buy — big tech and banks hold the key. The VIX is rising quietly, signalling a shift in sentiment. Will this be a slow bounce or a longer downtrend?

Investopedia names Sharesight best portfolio tracker for DIY investors

We're proud to share that Investopedia has named Sharesight the Best Portfolio Tracker for DIY Investors in its 2025 review.