Event recap: ASA Investor Conference 2023

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

Earlier this month, we had the pleasure of attending this year’s Australian Shareholder Association (ASA) Investor Conference, which was largely themed around building long-term wealth and how investors can bolster their portfolio amid challenging economic conditions.

Some of the highlights for us were the opportunity for our Chief Marketing Officer, Prashant Mohan, to give a demo of Sharesight, as well as our CEO Doug Morris’s talk about risk and return, including a sneak peek of the new risk report we are currently working on at Sharesight. It was also fantastic to meet so many enthusiastic investors at our display booth, with lots of investors wondering how they can get started tracking their investments using Sharesight.

A big thanks to the ASA for putting on a great event as always, and for those who could not attend, here is a summary of some of the best talks we attended at the 2023 Investor Conference, including a talk given by Sharesight’s CEO.

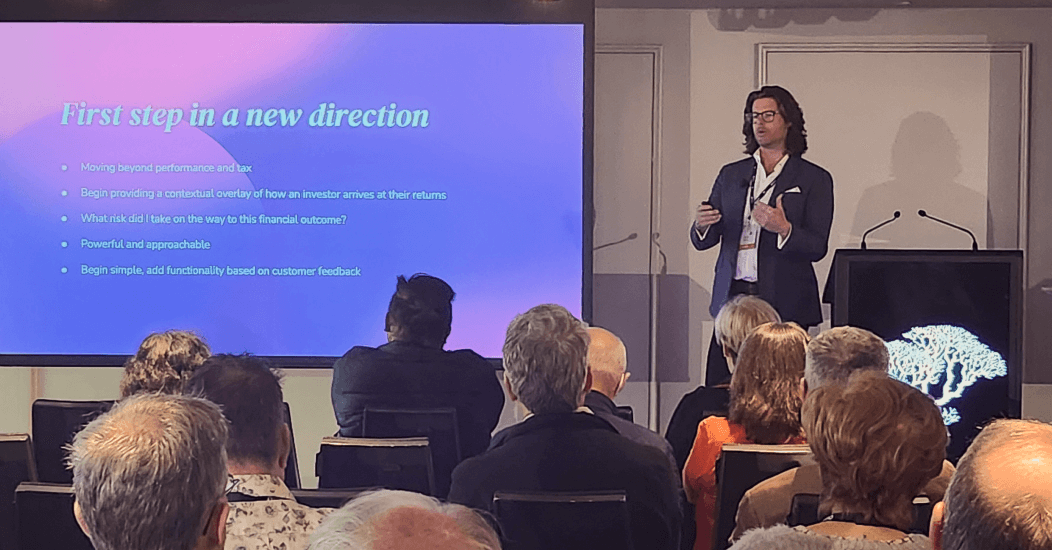

Sharesight CEO Doug Morris gives a sneak peek into our upcoming risk reporting tool in his talk, Understanding Risk and Return: More Important than Ever for Today’s Investor.

Sharesight CEO Doug Morris gives a sneak peek into our upcoming risk reporting tool in his talk, Understanding Risk and Return: More Important than Ever for Today’s Investor.

Understanding Risk and Return: More Important than Ever for Today’s Investor

Doug Morris, Sharesight

-

Until December 2021, the main risk was not being in the market. Now it’s about comparing yourself to the cash rate.

-

We know that over time, being invested in equities will pay off, with Australian equities typically returning 9.5% per year.

-

Currently, defensive assets are once again producing returns.

-

Returns tend to come down to your asset allocation. The 60/40 portfolio (60% stocks, 40% bonds) for example, is still doing well.

-

Risk is often associated with volatility and the associated drawdowns, but it can also be about opportunity cost: for example the time and energy it takes to achieve the same return you could have gotten with a balanced and diversified ETF. This speaks to the importance of benchmarking your portfolio.

Upcoming risk report

-

We are working on a risk reporting tool that will give investors a clear view of their risk at a portfolio level.

-

One of the main methods of measurement we will use is maximum price drawdown. This refers to the maximum loss of an asset, from peak to trough. This will give investors the ability to determine, had they sold an asset at a particular time, how much loss they would have taken on.

-

This will be shown alongside a chart that visually plots your investments (or asset classes) along risk and performance axes, as well as a series of data underneath to give you a precise numerical breakdown of the portfolio’s risk.

Investment and Market Insights

Grady Wulff, Bell Direct

-

We’ve seen a series of market corrections in the last 2-3 months.

-

Compared to the market, healthcare stocks have overperformed over the past 10 years, while at the same time, energy stocks have underperformed.

-

One thing we have seen recently is a shift from investment in high fashion luxury to value brands.

-

Generally however, investors have fled from retail stocks as interest rates rise.

Stocks to note:

Accent Group (ASX: AX1)

-

Sells footwear/athletic wear.

-

Share price is up 35% over the past year, 116% over the past five years.

-

Should benefit from relatively subdued competition during most of Q3.

Telix Pharmaceuticals (ASX: TLX)

-

Specialises in molecularly targeted radiation products for cancer treatment.

-

Share price is up 55% over the past year and 1,317% over the past five years.

-

Revenue has grown significantly, driven by the commercial launch of Illucix.

Boss Energy (ASX: BOE)

-

A uranium company that owns the Honeymoon Uranium Mine in South Australia.

-

Share price is down 11% over the past year but up 4,500% over the past five years.

-

On track for first production of uranium in December 2023.

-

Uranium price has recovered from recent lows as countries shift to nuclear power during the energy crisis.

Top-down vs. Bottom-up: Strategies to Find Value

Matthew Haupt (Wilson Asset Management) and James Holt (Perpetual)

Perpetual

-

Current market: Resources are on the rise again as inflation is good for commodities.

-

The last resources boom was pre-2007, driven by Chinese demand.

-

There will be another boom (likely due to Indian growth).

-

We are facing a long-term inflation battle, possibly reminiscent of the 1970s.

Stocks to note:

Iluka Resources (ASX: ILU)

-

Specialises in mineral sands. Demerged from Deterra Royalties but still has a major stake.

-

Strong cash flow generation.

-

Developing a refinery – could add $5 or $6 more to the share price, currently at $11. Scheduled to commence from 2025.

La Francaise Des Jeux (EPA: FDJ)

-

French lottery business.

-

Very good Point of Sale network performance and continued online dynamism. Online stakes are over 12% of total.

-

75% of growth driven by an increase in the number of players, which has doubled in three years.

Wilson Asset Management

-

Equity markets are performing in line with previous bear markets.

-

Financial conditions for risk assets have tightened (due to bank failures), driven by global rate hikes.

-

If the labour market starts slowing (to which we should look to the US first), this will negatively impact equities.

Stocks to note:

Dexus (ASX: DXS)

-

Macro view: Global economic slowdown, bond yields past peak.

-

Fundamentals: High quality portfolio, strong balance sheet.

-

Positioning: Sentiment at all time lows.

-

Their building portfolio is undervalued.

-

Potential upside over the next two years – the macro will eventually turn and they’re in a strong position with a large margin of safety.

Rio (ASX: RIO)

-

Macro view: Conditions were good for the first few months this year.

-

Fundamentals: Returning to operational stability, inflationary pressures easing.

-

Positioning: Australian minerals are a developed market proxy for China.

-

Still positive on China for the medium-term.

-

Wilson is holding onto this stock, looking to increase position over the next month or so.

Track your investment performance with Sharesight

If you’re not already using Sharesight, what are you waiting for? Join hundreds of thousands of investors using Sharesight to see the true performance of their investments. Sign up and:

-

Track all your investments in one place, including stocks in over 40 major global markets, mutual/managed funds, property, and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation and future income (upcoming dividends)

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account to start tracking your performance (and tax) today!

FURTHER READING

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.