ETFs vs managed funds - what are the differences?

Disclaimer: The below article is for informational purposes only and does not constitute a product recommendation, or taxation or financial advice and should not be relied upon as such. Please check with your adviser or accountant to obtain the correct advice for your situation.

Are you considering investing in an ETF or managed fund? When they’re both available, it can be confusing to determine which one is best for your circumstances. I faced this problem, and decided to do some research on the topic, and document what I found to be the key differences.

What are the similarities between ETFs and managed funds?

First, let’s look at what’s common between them.

-

Ownership: Both ETFs and managed funds are owned under a trust as a legal structure. The assets in the pool are unitised and the units are owned by unitholders.

-

Diversification: They both invest in a variety of underlying shares -- which is the fundamental premise of a pooled structure.

-

Open-ended: Both are structured as open-ended funds, which means as demand for these units increases, more units can be purchased. As the number of units increases, the assets under management (FUM) also correspondingly increase.

-

Theme: The reason an ETF or a managed fund exists is to achieve a certain stated objective for the investor. The purpose or why they exist could be common. For example, both the ETF VGS and the managed fund VAN0011AU have the same goal. Both are Vanguard products tracking international shares -- one is a managed fund (VAN0011AU) and the other is an ETF (VGS).

Differences between ETFs and managed funds

Management fees

In general, managed funds tend to have higher fees than ETFs because they are typically (but not always) actively managed, whereas ETFs are typically (again, but not always) passive funds that track a market index.

For example, when comparing the 2 Vanguard funds -- ASX: VGS and VAN00011AU -- as determined from their PDS documents, for a $10,000 investment, the ETF has a management fee of 0.2% pa whereas the unlisted managed fund has a fee of 0.90% pa.

Brokerage costs

ETFs are instruments traded on a stock exchange and therefore incur a brokerage fee to be paid to the online broker on which the buy or sell trade is made. These fees will eat to returns on the holding.

Managed funds, on the other hand, when passively managed, do not have application or establishment fees, and typically no brokerage. However in some cases there can be opening and closing fees,and when bought through a wrap or platform, there are additional fees involved.

Therefore if you intend on making regular contributions into the fund, then a managed fund will have cost advantages when compared to an ETF, which will have a brokerage cost involved for every transaction.

Minimum investment amount

Most managed funds have a minimum investment of $5,000. ETFs are bought and sold just like shares, and so do not have a minimum investment threshold. However it’s important for the investor to ensure that the cost of brokerage on smaller amounts is not eating away a meaningful percent of the potential return.

Real time reflection of price

For an ETF, the price is a reflection of the performance of the underlying shares in the fund. This is computed in real time and is reflected on the stock market.

For a managed fund, the NAV is calculated at the end of the day and is reflected in the unitised price.

Frequency of dividends/distributions

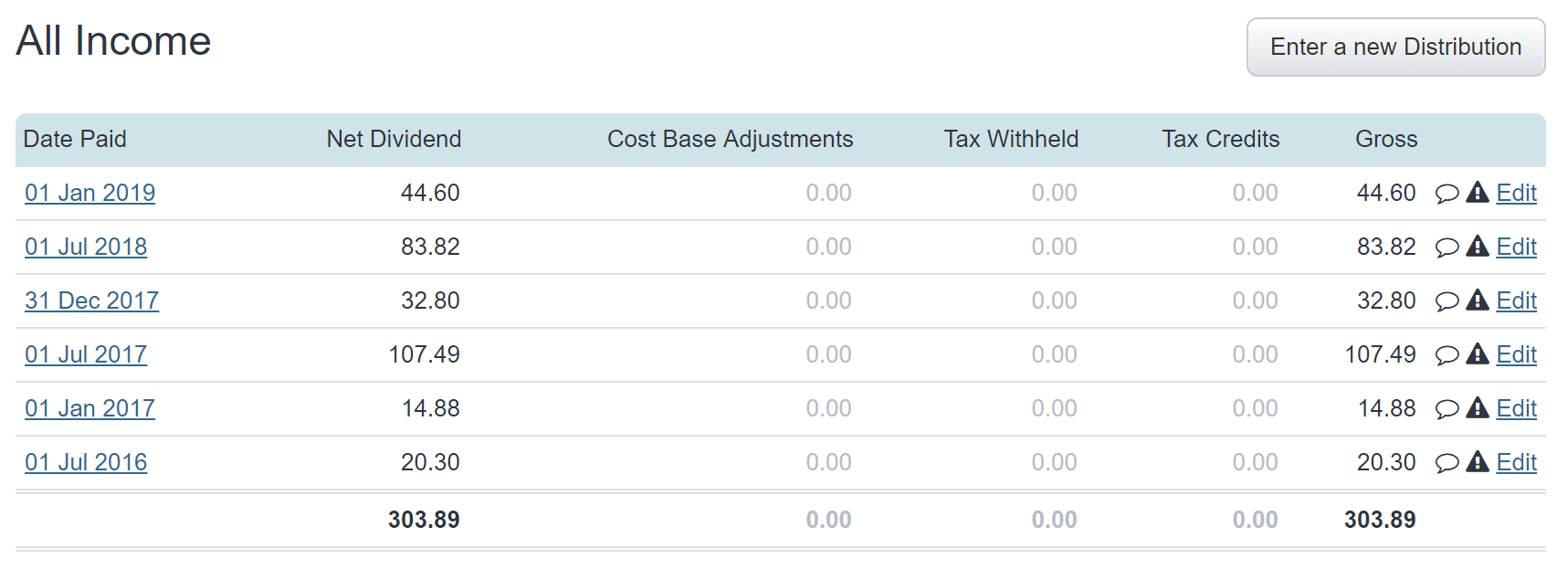

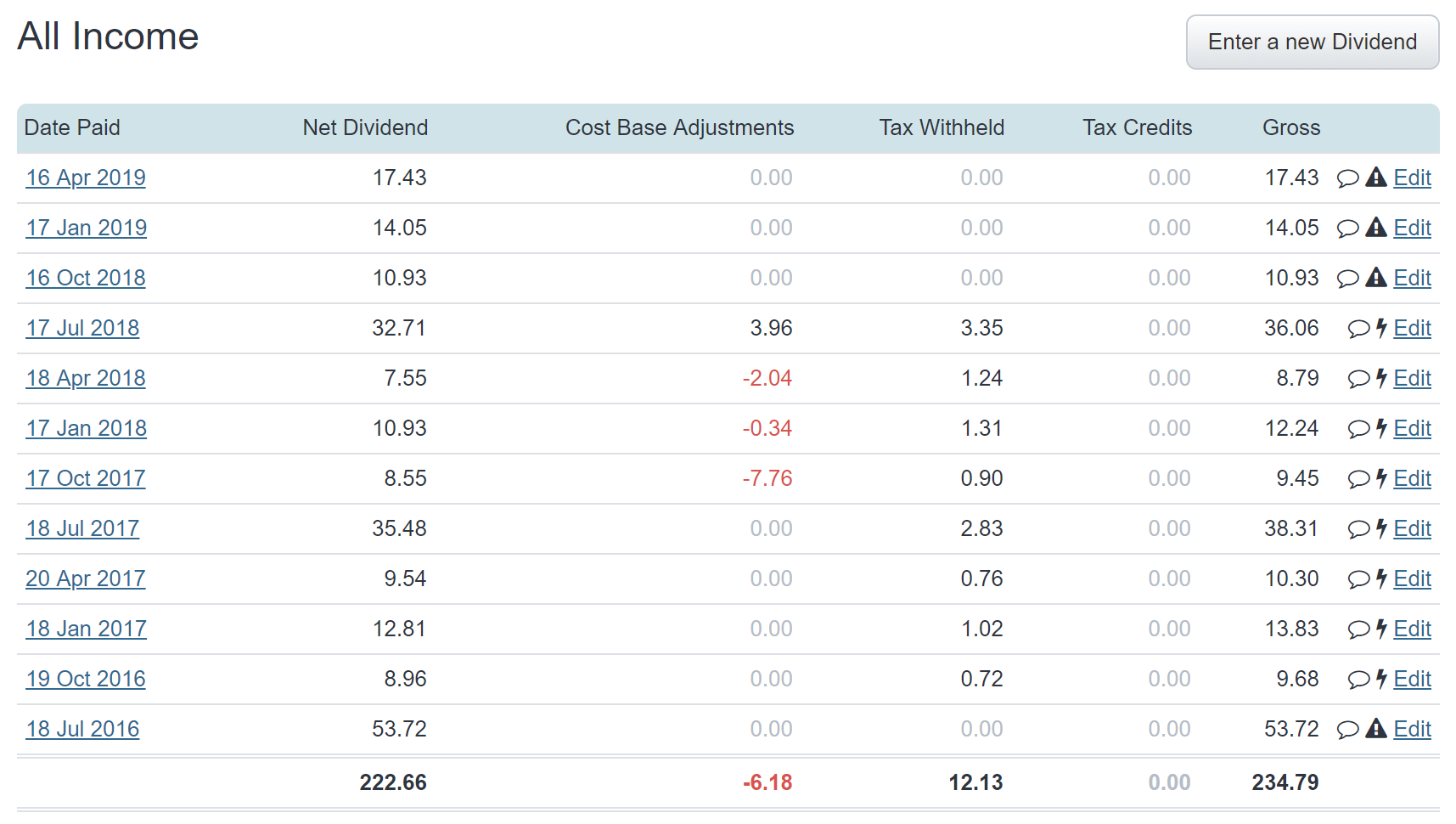

If you are an income investor, you need to check the frequency of dividend distributions. For example, when comparing the same two funds above, the managed fund pays dividends only twice a year, whereas the ETF distributes dividends every quarter.

Here’s a comparison of the distributions paid by each fund over the last three years, as tracked in Sharesight:

Track your ETF and Managed Funds with Sharesight

ETFs and unlisted managed funds provide a challenge to the issuer and the taxpayer alike. If the fund manager is using an attribution managed investment trust (AMIT) structure this provides additional complexity.

In both cases, the tax admin is complicated and fund managers provide a one-time tax statement at the end of the tax year. These final statements contain all of the component and subcomponent information for tax purposes. This information can retroactively modify your cost base and taxable dividend income, making your tax lodgement difficult without a portfolio tracking and tax solution like Sharesight.

Sharesight makes tax time easy

Join thousands of Australian investors already using Sharesight to manage their investment portfolios. To get started for FREE, simply sign-up and import your shares and managed funds. Then watch as corporate actions such as dividends, ETF distributions and stock splits are automatically recorded towards your tax return. We’re confident that you’ll agree Sharesight is the best share portfolio tracker available today.

FURTHER READING

Morningstar analyses Australian investors' top trades of 2025

Morningstar breaks down Australian investors’ top trades of 2025 and explores sector trends and global opportunities for 2026.

Turn market volatility into opportunity with Sharesight

Stay confident in volatile markets and turn uncertainty into opportunity using Sharesight’s suite of future-focused tools.

Sharesight product updates – January 2026

Our latest updates include Abu Dhabi exchange support, enhanced dividend insights, overview page refinements, mobile app improvements and more.