Efficiency: how to boost portfolio share performance

Self-directed share investors are understandably primarily focused on maximising returns from their portfolios. However, what many do-it-yourself investors often don’t consider are the numerous costs associated with managing their portfolios, and the impact that these can have on their overall returns.

Because the fact is, that while investors can’t directly control the returns they are going to receive from the market, they can control how much they are going to spend on managing their share market investing. In other words, it clearly makes sense for investors to focus on factors they can control, with the aim of minimising cost and freeing up funds available for reinvestment.

There are three main areas where controllable costs are incurred. The first is seeking advice on which shares to buy and sell. Then there is the cost (brokerage) of actually doing the buying and selling. And finally there is the cost of portfolio administration. This includes the tedious – but essential – reporting associated with effectively managing a share portfolio.

To reduce these costs, an increasing number of DIY investors are turning to online services. They use online advisory services for investment advice, trade online to reduce brokerage costs, and make use of smart technology platforms that automate much of the administration and generate all the data needed for taxation and accounting purposes. Utilising online services in this way provides all the functionality of a proprietary ‘wrap’ platform for a far lower price. The right kind of online investment portfolio management system can also help provide a full understanding of the true returns of a portfolio, in turn enabling investors to make more informed and cost-effective decisions. Features to look out for in an online platform include:

-

Comprehensive record-keeping. Look for an online portfolio management system that provides all the information you require, leaving you free to utilise the services of any broker or investment advisor you like. This is in contrast with most wrap platforms, which bundle fees for advice and administration with brokerage, giving investors limited ability to see whether they are getting value from each component. The right online portfolio management system allows investors to disaggregate these services and select those which offer the best value for money.

-

Investment performance monitoring. Investors should look for an online portfolio management system that provides a transparent view about how each individual investment is performing. This compares with a traditional wrap platform, from which it is often difficult to determine which individual stocks are better performing.

-

Automated administration. Many D-I-Y investors become distracted by the administrative tasks associated with managing their portfolio. Many direct share owners cannot afford, or choose not to, use an accountant or financial planner to carry out this administration. This can include calculating dividends and franking credits, and capital gains. Look for an online system that can automate the recording of transactions and other relevant share investment activity, producing all the information required to complete a tax return in a few clicks.

-

Compliance. If you’re an investor managing your own super fund, aim for an online share management system that can automate the flow of data to your accountant. This will not only save considerable time, but also reduce bookkeeping and accounting fees.

Of course, the total cost efficiencies generated by using an online share portfolio management system will depend on the nature and size of the portfolio, and how actively it is traded. However, choosing an option that provides control, transparency, automated reporting and has the facility to link to other relevant software is certainly a great place to start.

This information is not a recommendation nor a statement of opinion. You should consult an independent financial adviser before making any decisions with respect to your shares in relation to the information that is presented in this article.

FURTHER READING

My investment portfolio used to be gold bangles

For International Women’s Day, Morningstar's Shani Jayamanne explores the ways that women have taken back financial control.

Simplify property tax & investment tracking with TaxTank + Sharesight

Simplify property tax management with the Sharesight + TaxTank integration—track CGT, investment income, and tax data in one seamless, automated platform.

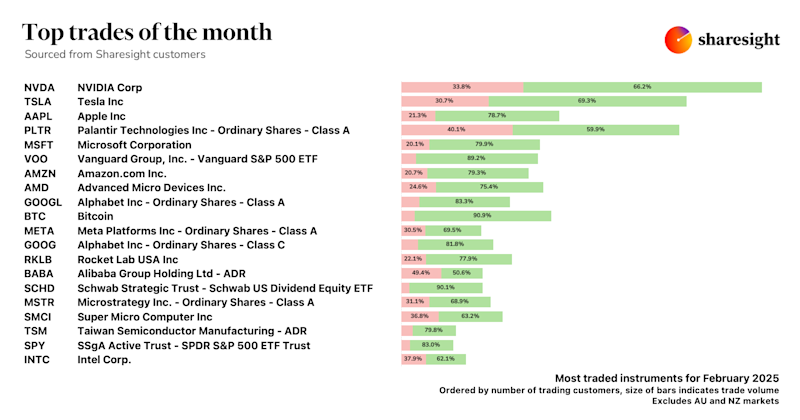

Top trades by global Sharesight users — February 2025

Welcome to the February 2025 edition of Sharesight’s trading snapshot for global investors, where we reveal the top 20 trades by Sharesight users worldwide.