Dividends vs. share buybacks: Which is better for investors?

Investors look to publicly traded companies for both capital appreciation and income. However, for some investors, the key priority is how listed companies return profits to their shareholders and the sustainability of this income. Here we examine how this is done via dividends and share buybacks, looking at which is more beneficial for shareholders and considering the tax implications of both approaches.

Dividends

Companies pay dividends to shareholders as a means of sharing profits and rewarding their investment in the company. These regular dividends may be attractive to investors who prefer to earn a steady stream of income without selling their shares. While some public companies pay dividends from their profits, it is important to note that not all companies offer them and there are no laws requiring them to distribute their earnings to shareholders.

Advantages

It is fair to assume that regular dividend payments, either via cash payments or additional shares, are a sign of financial health and are another way to make money from stocks. Some investors take this further and base their investment strategy on buying established companies with a history of good dividends to add stability to their portfolio. The regular income stream these provide can be especially attractive to income-focused investors such as retirees.

Disadvantages

While regular dividend payments are a sign of a quality company, they may also signify predictable earnings that don’t fluctuate much. The share prices of top-income stocks generally don’t plummet, but they don’t rise much either. This may be an issue for younger investors looking for growth stocks or the next sector with upside potential. Stocks with high growth potential tend to invest all their earnings back into the business and have a greater chance of rising in value.

Share buybacks

A share buyback occurs when a company offers to re-purchase some of its shares from existing shareholders. It generally does this because management considers them to be undervalued. On-market buybacks are when a company buys its own shares on an exchange in the ordinary course of trading. Off-market buybacks refer to buybacks that do not occur on an exchange, but rather when the company makes its offer directly to shareholders.

Advantages

As with dividend payments, share buybacks show that a company has additional cash on hand and no cash flow problems. However, the main advantage is the potential boost to shareholder returns as a company’s profit is spread across fewer shares after the buyback. Earnings per share (EPS) is an important variable in determining share price and existing shareholders will have a higher percentage ownership after a buyback. As a result, a buyback announcement usually sees the share price rise.

Disadvantages

Buybacks can be ill-timed, as a company is more likely to buy back shares when it has plenty of cash or when things are going well. The stock price may be high at such times with the risk that it drops after a buyback. Buybacks may also fuel market speculation as to why extra cash is not instead being allocated to new investment opportunities, projects or research and development. For some analysts, buybacks suggest a company may be prioritising short-term considerations over a long-term view.

Tax implications

Dividends are the payment of profits by a company to its shareholders, and in most countries are considered to be income for tax purposes. In some jurisdictions, tax offices further distinguish dividends between those where the company has already paid company tax on profits and those where it hasn’t.

While dividends are subject to ordinary income tax, buybacks are generally taxed at the capital gains tax rate. This gives the investor a few more options as shareholders have the chance to defer capital gains if share prices rise and is also dependent on how long the stock has been held. In other words, if you sell the stock back to the company, you'll have to pay the capital gains tax on any profits you make. However, if you've held the stock for more than a year, you'll qualify for the long-term capital gains rate, usually lower than the ordinary income tax rate. As always, it's a good idea to consult with a tax professional or financial adviser to determine the best strategy for your situation.

Company perspective

Companies buying back shares has become an increasingly common strategy in recent times. But for some analysts, there is always the concern that they are only doing so to artificially increase EPS to meet market expectations or exceed internal targets. Buybacks are also often sold to investors as “one-off” events, which makes them quite different from the regular yearly dividends that some companies pay out. Unlike buybacks, which can start or stop at any time, most dividend-paying companies have a firm dividend policy and track record.

Investor considerations

Investors may want to consider adding dividend-producing shares to their portfolios for a variety of reasons. These companies tend to be large and well-established in their sectors, making them attractive to more risk-averse investors looking for regular income. This may suit older investors looking to play it safe and use the income stream from dividends to fund their retirement outright, or supplement the aged pension. However, this makes them less attractive to investors who wish to minimise tax or who are still building a nest egg and trying to reduce taxable income. Such investors may see each dollar paid out as a dividend as a lost opportunity for the company to invest and grow the business.

In a recent poll of our Linkedin followers, the vast majority of investors chose dividends as their preferred method of receiving company profits.

Share buybacks tend to be more attractive to growth-focused investors who prefer share price growth, which is more tax-efficient than paying a dividend. By reducing the number of shares on issue, a share buyback should lead to an increase in the price of remaining shares over the long term. Investors will only realise any capital gain from the share price increase when they sell the shares. This also means that any tax payable on the increase in value is deferred until the shares are sold.

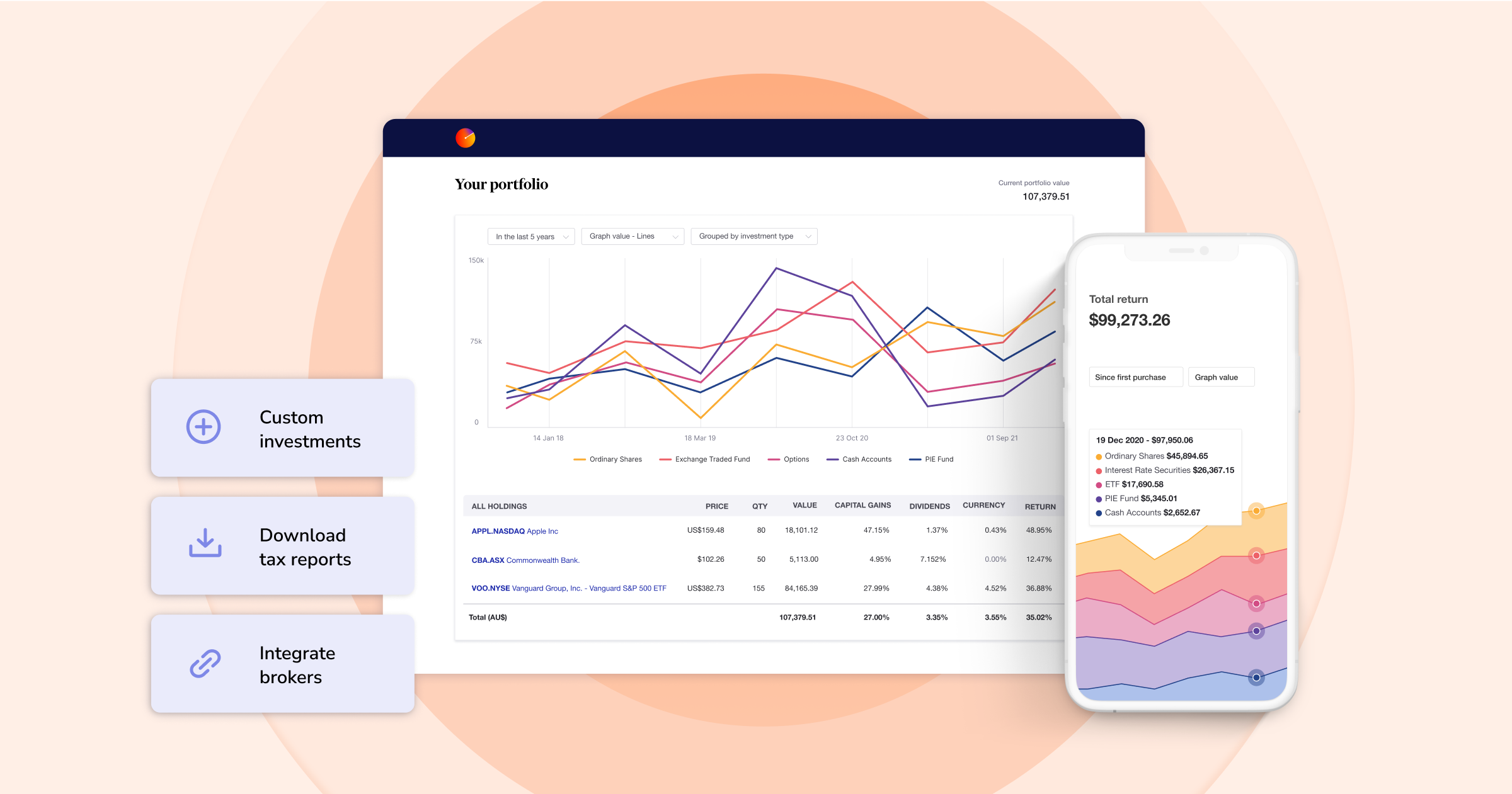

Become a smarter investor with Sharesight’s portfolio tracker

If you’re not already using Sharesight, what are you waiting for? Join hundreds of thousands of investors using Sharesight to track their portfolio and make better investment decisions. Sign up today so you can:

- Track all your investments in one place, including stocks in over 60 major global markets, mutual/managed funds, property, and even cryptocurrency

- Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation, exposure and future income (upcoming dividends)

- Easily share access to your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments as you do

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

8 ways to use Sharesight's custom groups feature

This blog explains our custom groups feature, including strategies that can help you gain deeper portfolio insights and make more informed investing decisions.

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.