Corporate actions and your investment performance

Online brokers earn revenue based on the size and number of trades you make (and cash accounts), which is why they invest in features like real-time dashboards, technical charting, and new investment offerings.

Online brokers don’t provide what Sharesight does. It’s not like they don’t want to. It’s just really hard to do.

Hard things are hard.

I was reminded of just how difficult recently when logging in to my US broker -- a full service broker -- with a great online capability. We’ve already demonstrated how misleading the performance information is on your broker’s website. This was a similarly puzzling situation, but it was a corporate action that tripped me up.

I own shares in Spectra Energy, a pipeline company in the United States. At least I thought I owned shares in Spectra Energy. I received a price alert email from Sharesight telling me the price had gone to $0. Checking the Sharesight Mobile App revealed that yes my Spectra shares were worthless.

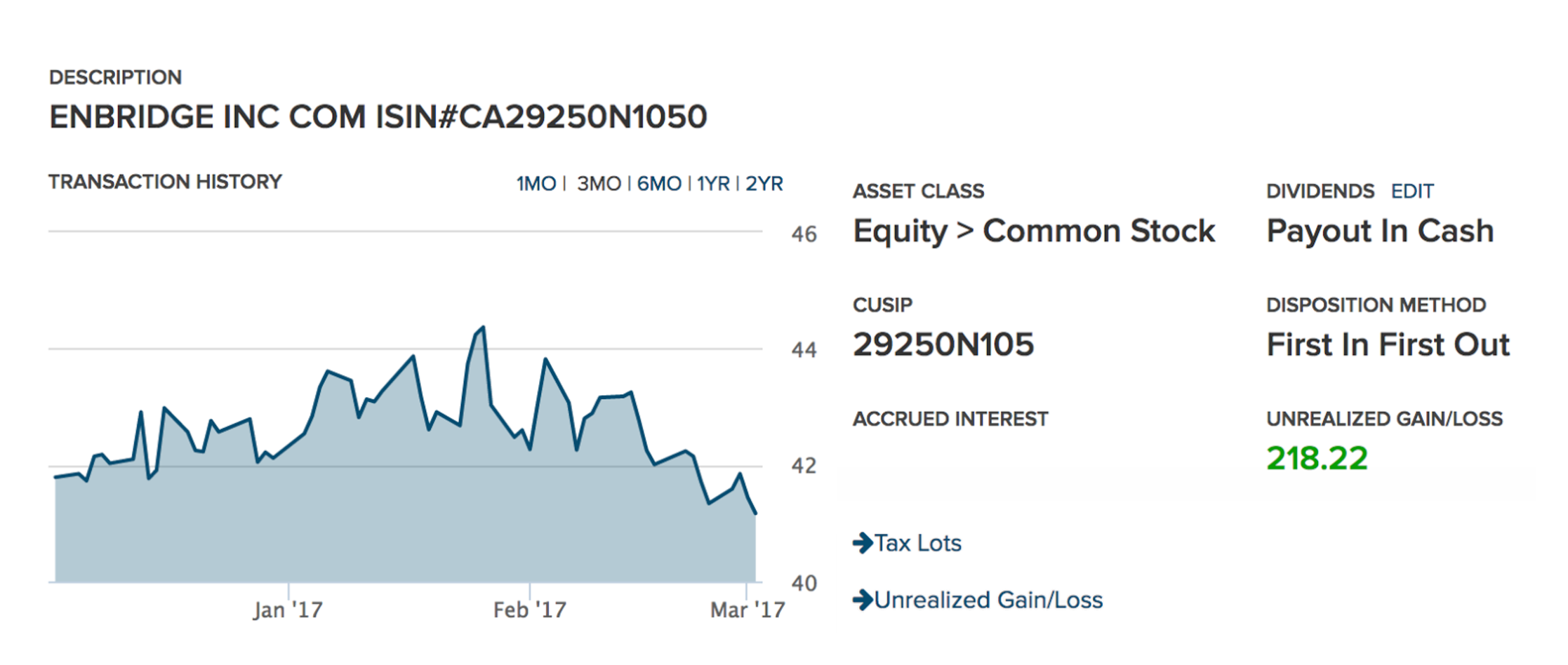

So I logged in to my broker. My current holdings page was missing Spectra altogether. Skimming the screen, a new company caught my eye -- Enbridge, which had already netted me $218 somehow.

As any experienced investor would have guessed, there was a takeover of some kind. But, that’s not where I’m going with this. I received no alert or mention of this from my broker whatsoever. I checked my email, nothing. I checked the communications area on the broker’s site, nothing.

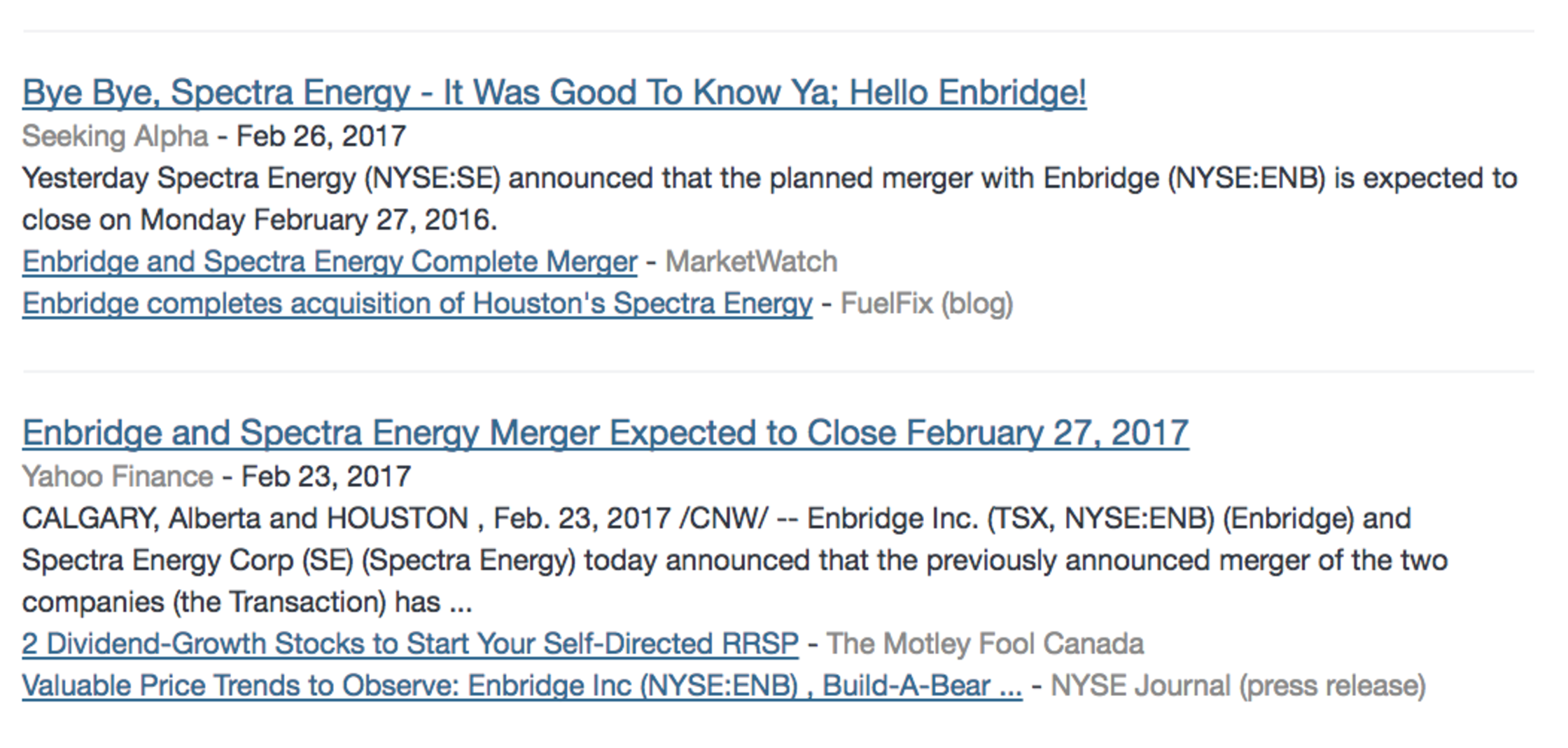

For a less experienced investor this would be confusing, perhaps enough to make you sell off Enbridge altogether. For a buy and hold type (like me) this was an unpleasant surprise. Fortunately, the news feed inside Sharesight contained articles on what happened.

Doing more digging, I checked the broker’s unrealized gains page. Their return calculations are non-annualized, which simply compare the buy price with the last price, irrespective of dividends or new money in and out - not a real performance calculation!

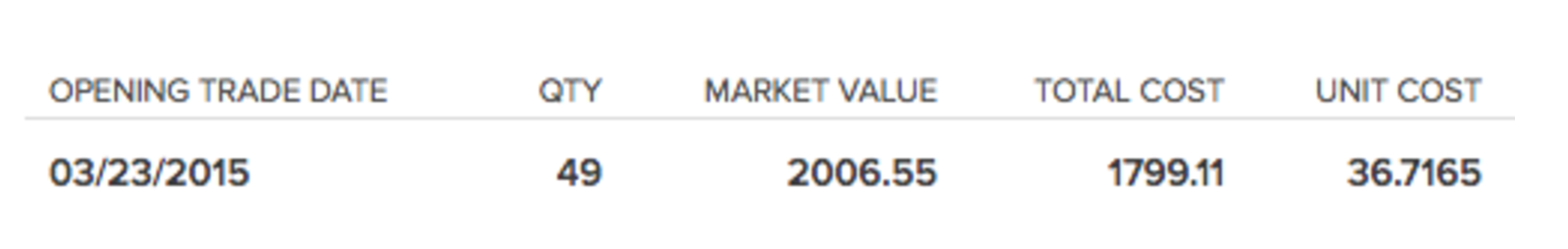

And there was Enbridge again. Checking the tax lot details revealed another surprise -- I’ve owned Enbridge for two years! Although I have no way of knowing for certain, I think the broker allocated my Enbridge shares on the original buy date for Spectra for capital gains tax purposes.

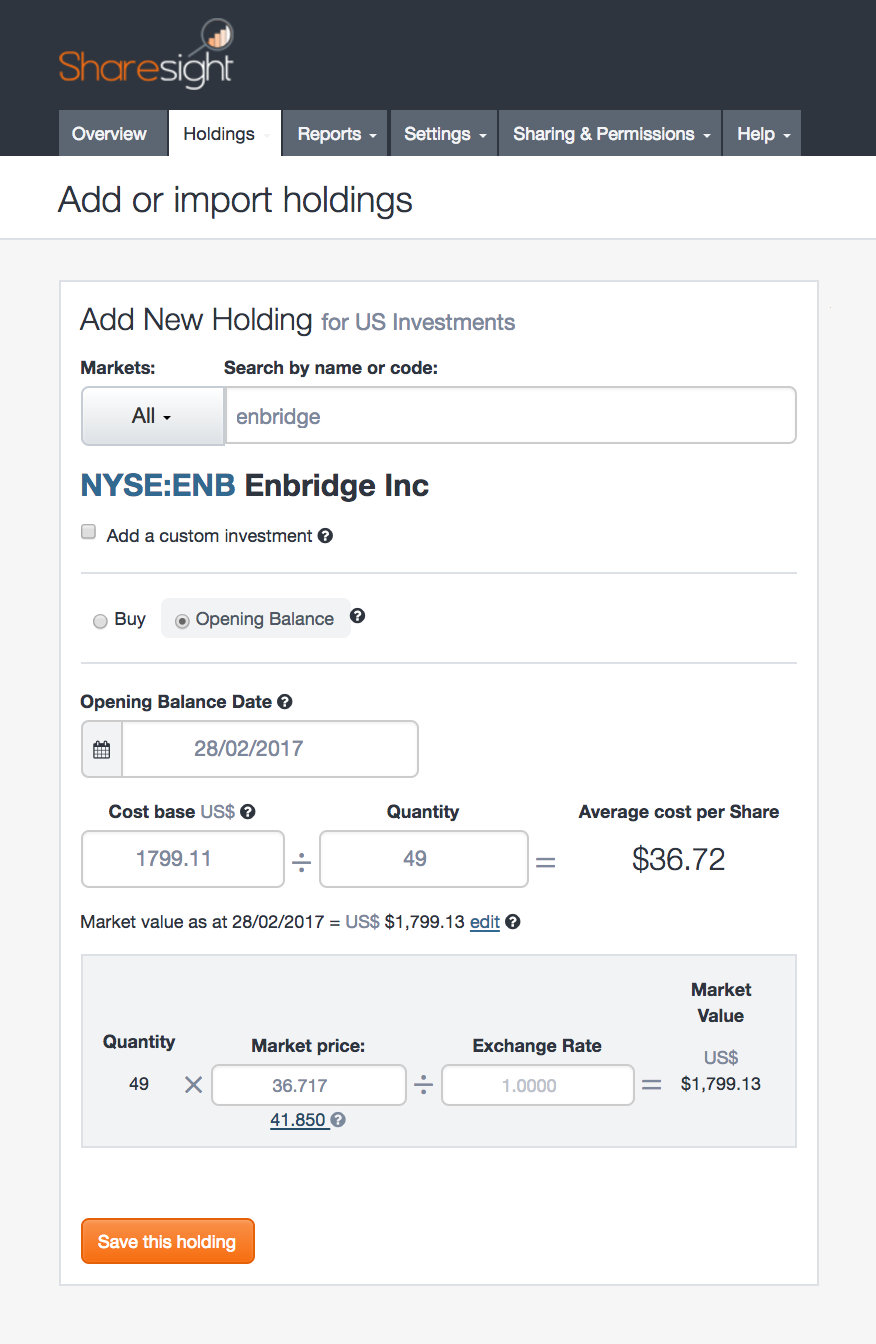

The broker also shows me my adjusted cost for 49 Enbridge shares is $1,799.11. That means my average cost per share should be $36.72 (as they display below). However, Enbridge closed at $48.44 on 23 March 2015. That’s a 33% difference. The broker provides no information to explain this, but I assume it’s due to the ratio used to apportion the shares.

So at this point, I own shares in a surprise company at a cost base I don’t understand. The broker’s site contains no information on my Spectra shares whatsoever. There is no preservation of my investment history for tax or performance purposes.

Fortunately, I’ve been tracking this portfolio in Sharesight. I have full visibility across both companies and total control of the data -- including Spectra’s dividend history, which was never factored into my broker’s data in the first place. If I need help from my accountant, we have a complete track record of data as delivered to Sharesight by the stock exchange.

To handle this in Sharesight, I enter a sell trade against my Spectra shares at the original cost base. Then I add my Enbridge shares using an opening balance. I use the official corporate action date of 28 February 2017 for both. Even though Sharesight wants me to use the closing price for that day ($41.85) to work out the market value, I’m able to override this in order to use the mystery cost base that my broker displays.

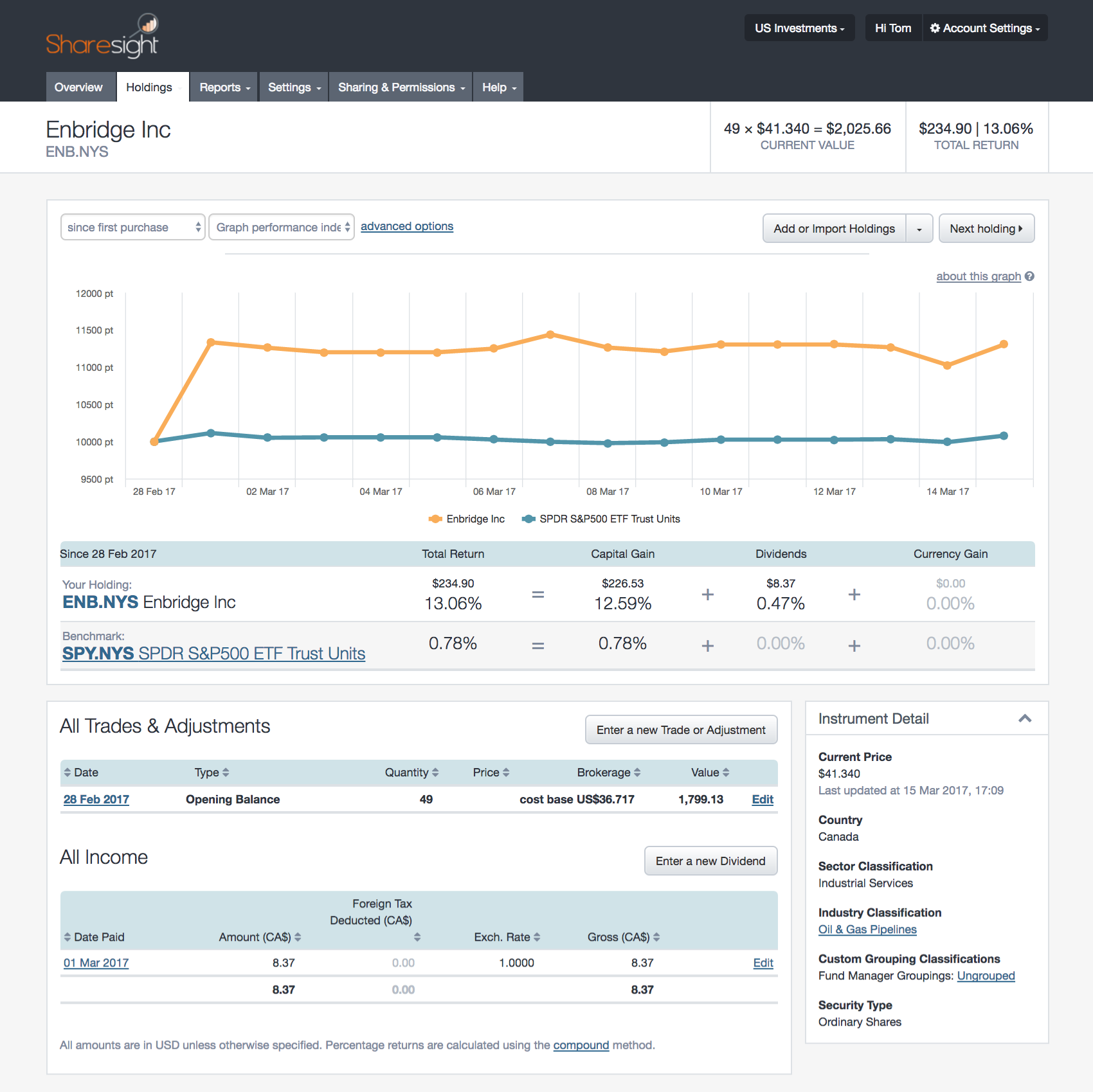

This approach preserves my performance history by linking the two companies. This is important to me as an investor -- I want to know the true performance of a stock that I did in fact own for two years. I’ll consider future performance to be attributed to what Enbridge management does from the takeover date onwards. This approach also maintains my dividend income from Spectra, and doesn’t factor in old Enbridge dividends that I never received.

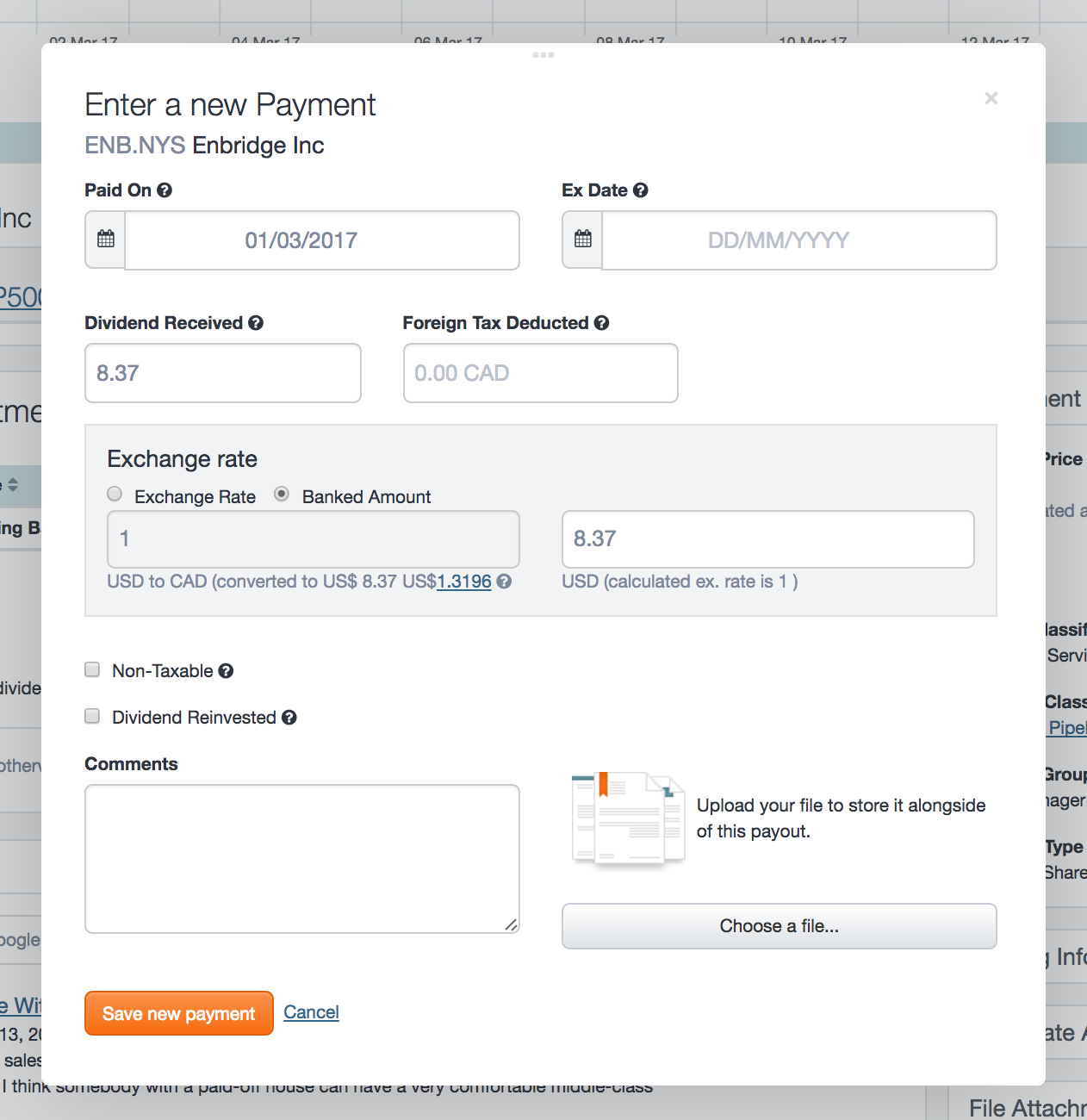

Finally I enter a special dividend to reflect a residual amount of cash received because no partial shares were issued when converting Spectra to Enbridge. To add a final bit of complexity, Enbridge is a Canadian company. Spectra was based in the US. Sharesight gives me the option to record this dividend in CAD, but I choose to record the banked amount in USD to match my bank transaction history.

This is why investors must fill in the gaps. Your broker knows 1, your share registry knows 2, but only Sharesight can tell you they add up to 3.

Major corporate actions are difficult for portfolio managers at all levels to handle, but Sharesight alerted me to the issue and gave me a straightforward, step-by-step pathway to handle the takeover. Moreover, my steps are all safely stored in my portfolio so my accountant can double check them at tax time.

The end result is smooth portfolio performance, alongside accurate tax reporting that reflects what turned out to be a massive $166B merger between two energy companies.

FURTHER READING

- Topic -- Corporate Actions

- Blog -- 3 reasons why you need to be tracking dividends

- Blog -- How to track a dividend reinvestment plan

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.