Cash accounts now sync transactions with your portfolio

Tracking your trading cash account as part of your Sharesight portfolio has been a highly demanded feature by our users. We released our cash account feature in 2018, as well as additional improvements in 2019, and have just released another update that automates the previously manual data entry required to record dividend/distribution payouts in your cash account.

You can now elect to have one of your Sharesight cash accounts be your nominated trading cash account (as long as the cash account currency matches your portfolio currency).

Now, you can elect to have the following transactions from your portfolio automatically synced to your cash account:

-

Buy and sell trades.

-

Payouts (dividends and distributions).

Why track your trading cash account?

A cash account helps you monitor the movement of your money (cash flow) into and out of your portfolio, and allows you to see your investable cash at any given moment. This gives you the complete picture of your investments including the value of cash you have on hand that is not fully invested.

For more information on the role of cash in a portfolio, refer to the blog on the topic written earlier.

How to set up a cash account in Sharesight

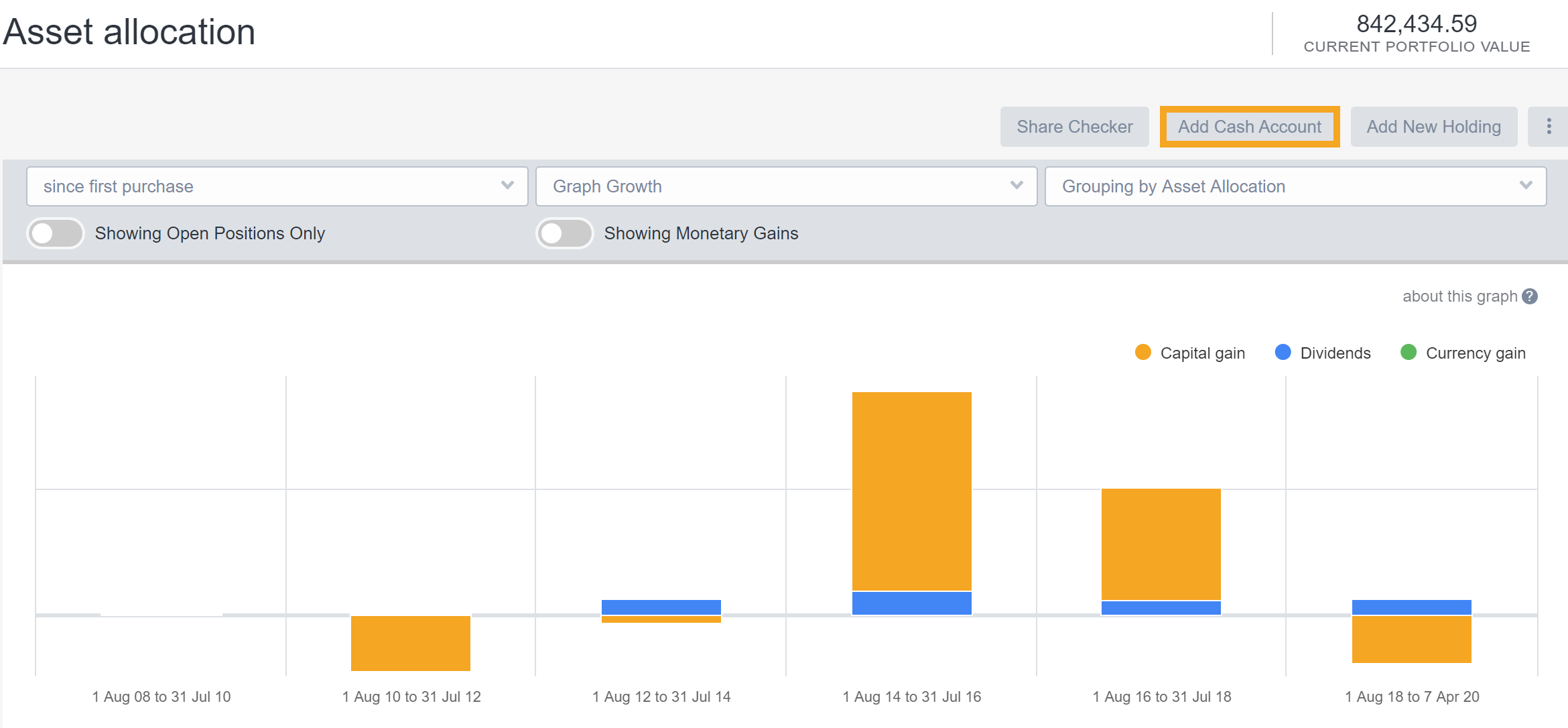

The "Add cash account" button is on the Portfolio Overview page. From there you can specify the name and currency of the cash account which will be tied to the portfolio (including its tax residency).

After you have added transactions to the account, the balance of the cash account will appear at a glance on the Portfolio Overview page.

With Sharesight’s new and improved cash account feature, you can now elect to have one of your manual cash accounts linked to your portfolio as a trading cash account (as long as the cash account currency matches your portfolio currency).

To enable this feature, go to your "Settings" -> “Basic details” in your Sharesight portfolio. You have the ability to set the following parameters.

-

Select the cash account to which you want your buy and sell trades to sync with.

-

Select the cash account to which you want the payouts to sync with. In this example, I have selected the same cash account to sync both. You can choose to sync them to two separate accounts.

Syncing historical transact to your cash account

After you have linked your cash account to a portfolio you can then sync historical transactions from your portfolio automatically by clicking on 'Manage Synced Trades' when viewing your cash account. You can then choose the date to sync trades from automatically.

For example, by selecting a date of 07/04/2010, you can get all transactions after that date to sync with the cash account then clicking "Sync all trades".

You can expect to view the cash records in the nominated cash account as below:

Please note that only the dividend payouts that have been confirmed for each holding will appear in the cash account here.

Cash account notes

The value of your cash account is included when calculating your portfolio’s value, but does not impact the percentage return figure.

You can only use this feature with Sharesight’s built-in cash account feature. Due to the way Xero connected cash accounts and Macquarie cash accounts push data into Sharesight automatically, these accounts sync automatically already.

Clicking on a cash account transaction that has been created from a synced trade will bring up the trade "edit" form. Cash account transactions will update automatically when the trade is edited. As these transactions are linked, it is not possible to edit the cash transaction separately from the underlying trade.

-

The cash account’s currency has to match the currency of your portfolio.

-

Updating a linked payout will result in an update to the cash transaction value.

-

Deleting a linked payout will delete the corresponding linked cash transaction.

-

If the payout cash account is the same as the Trade cash account then the 'Manage Synced Trades' label on the cash account screen will read 'Managed Synced Trades & Payouts'.

-

If the payout cash account is the same as the Trade cash account then the 'Sync all trades' button on the Manage Synced Trades modal will read 'Sync all trades & payouts'.

-

If the payout cash account is not the same as the Trade cash account then the existing 'Manual Synced Trades' will read 'Manage Synced Payouts'.

-

If the payout cash account is not the same as the Trade cash account then the 'Sync all trades' button on the Manage Synced Trades modal will read 'Sync all payouts'.

-

Deleting the payout cash account should delete all the corresponding cash transactions and remove the link to each payout.

-

If a payout has been reinvested then it will not be linked to a cash transaction.

-

Net dividend amount for FX payouts will be calculated using the exchange rates at the time of the payout.

Upgrade today to track your cash

Sharesight’s cash accounts are a premium feature available only on Sharesight's Starter, Standard and Premium plans. Upgrade your Sharesight plan to add a cash account to your portfolio and get the full picture of your investment portfolio today.

Everything you need to know about Sharesight cash accounts

FURTHER READING

Morningstar analyses Australian investors' top trades of 2025

Morningstar breaks down Australian investors’ top trades of 2025 and explores sector trends and global opportunities for 2026.

Turn market volatility into opportunity with Sharesight

Stay confident in volatile markets and turn uncertainty into opportunity using Sharesight’s suite of future-focused tools.

Sharesight product updates – January 2026

Our latest updates include Abu Dhabi exchange support, enhanced dividend insights, overview page refinements, mobile app improvements and more.