Track investments from leading Canadian brokers

If you’re a Canadian investor, you can easily import your trades in stocks, ETFs and mutual funds directly into Sharesight from a range of leading Canadian brokers — unlocking the power of Sharesight’s award-winning performance, dividend tracking and tax reporting in just a few easy steps. Keep reading to learn more about the Canadian brokers that Sharesight supports, plus how you can sync your trades to your Sharesight portfolio.

Canadian brokers supported by Sharesight

Easily add and track the performance of stocks, ETFs and mutual funds in Sharesight from the following Canadian (and global) brokers:

- BMO InvestorLine

- CI Direct Trading

- CIBC Investor’s Edge

- Coinbase

- Desjardins

- HSBC InvestDirect

- Interactive Brokers

- National Bank Direct Brokerage

- Qtrade Investor

- Questrade

- RBC Direct

- Scotiabank

- TD Direct Investing

- Wealthsimple

Why should Canadian investors use Sharesight?

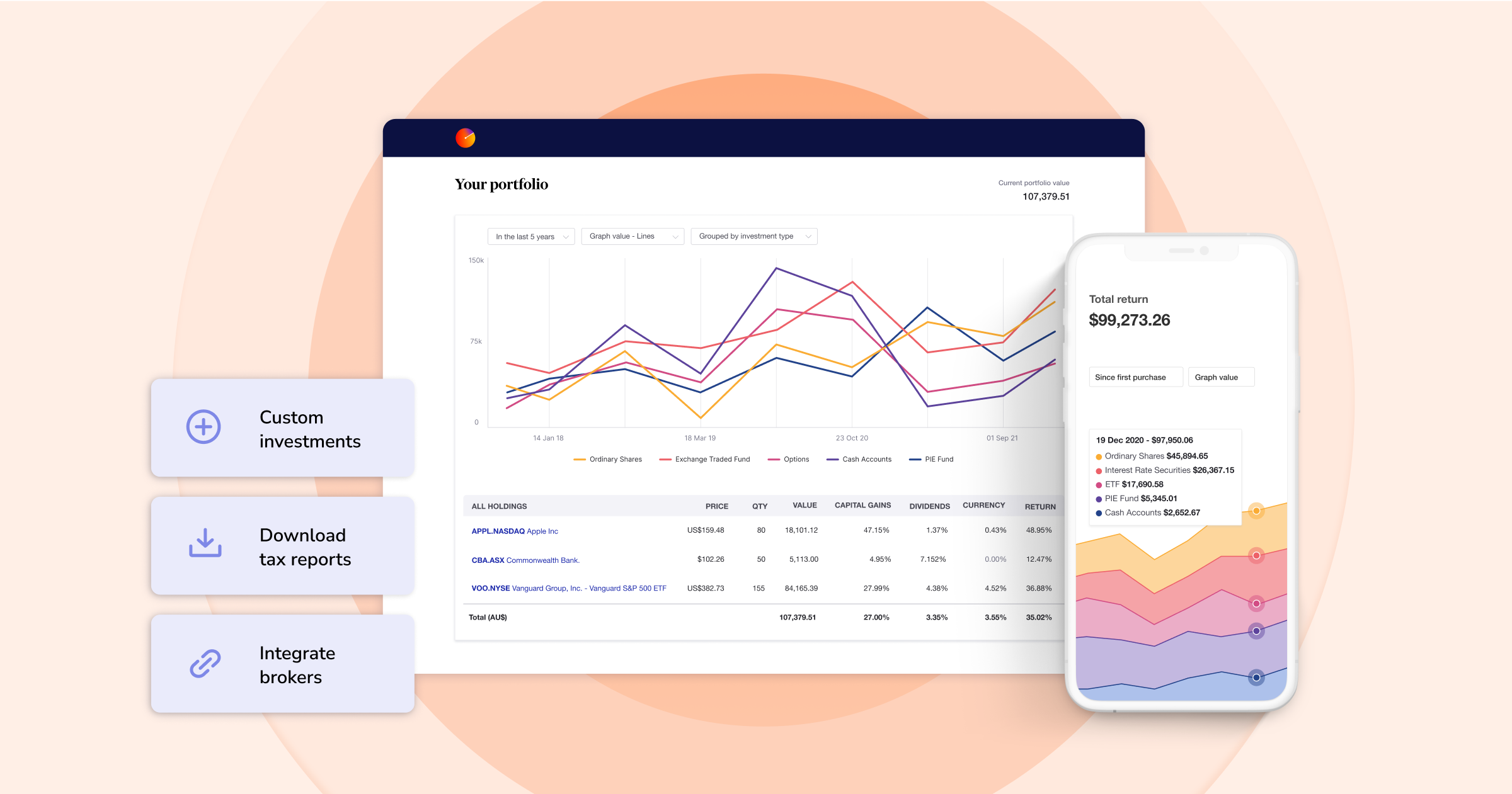

By importing your trades to Sharesight (along with the rest of your investments), you can easily track your investment performance across different brokers, asset classes and over 60 global markets, including the Toronto Stock Exchange, TSX Ventures Exchange, Canadian Securities Exchange and NEO Exchange. Sharesight also offers a range of powerful reports for investors including performance, portfolio diversity, contribution analysis, multi-period, exposure and multi-currency valuation, plus a Canadian capital gains tax report. The ability to track cash accounts, property, cryptocurrency and over 40,000 Canadian mutual funds is just another reason that Canadian investors should consider using Sharesight to track their investment portfolio.

How to sync your trading data to Sharesight

Depending on which broker you use, there are a number of ways you could sync your trading data to a Sharesight portfolio — from establishing a direct connection between Sharesight and your brokerage account, to automatically forwarding your trade confirmation emails to Sharesight or uploading a spreadsheet file filled with your trades.

To find out the best way to sync trades from your broker, simply select your broker from the list above or select the ‘Brokers’ tab at the top of your Sharesight portfolio and search for your broker. Once you select your broker, you will be directed to a page with the specific instructions to sync your trading history and future trades to your portfolio.

Track your Canadian trades with Sharesight

Thousands of investors like you are already using Sharesight to manage their investment portfolios. What are you waiting for? Sign up and:

- Track all of your investments in one place, including Canadian and international stocks, mutual funds, property and even cryptocurrency

- Track your TFSA, RRSP and RRIF investment accounts with tax calculations built to CRA rules

- Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, exposure, multi-currency valuation and capital gains tax

- Easily share access to your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments that you do.

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

8 ways to use Sharesight's custom groups feature

This blog explains our custom groups feature, including strategies that can help you gain deeper portfolio insights and make more informed investing decisions.

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.