Benefits of Sharesight's business plan vs. WRAP platforms

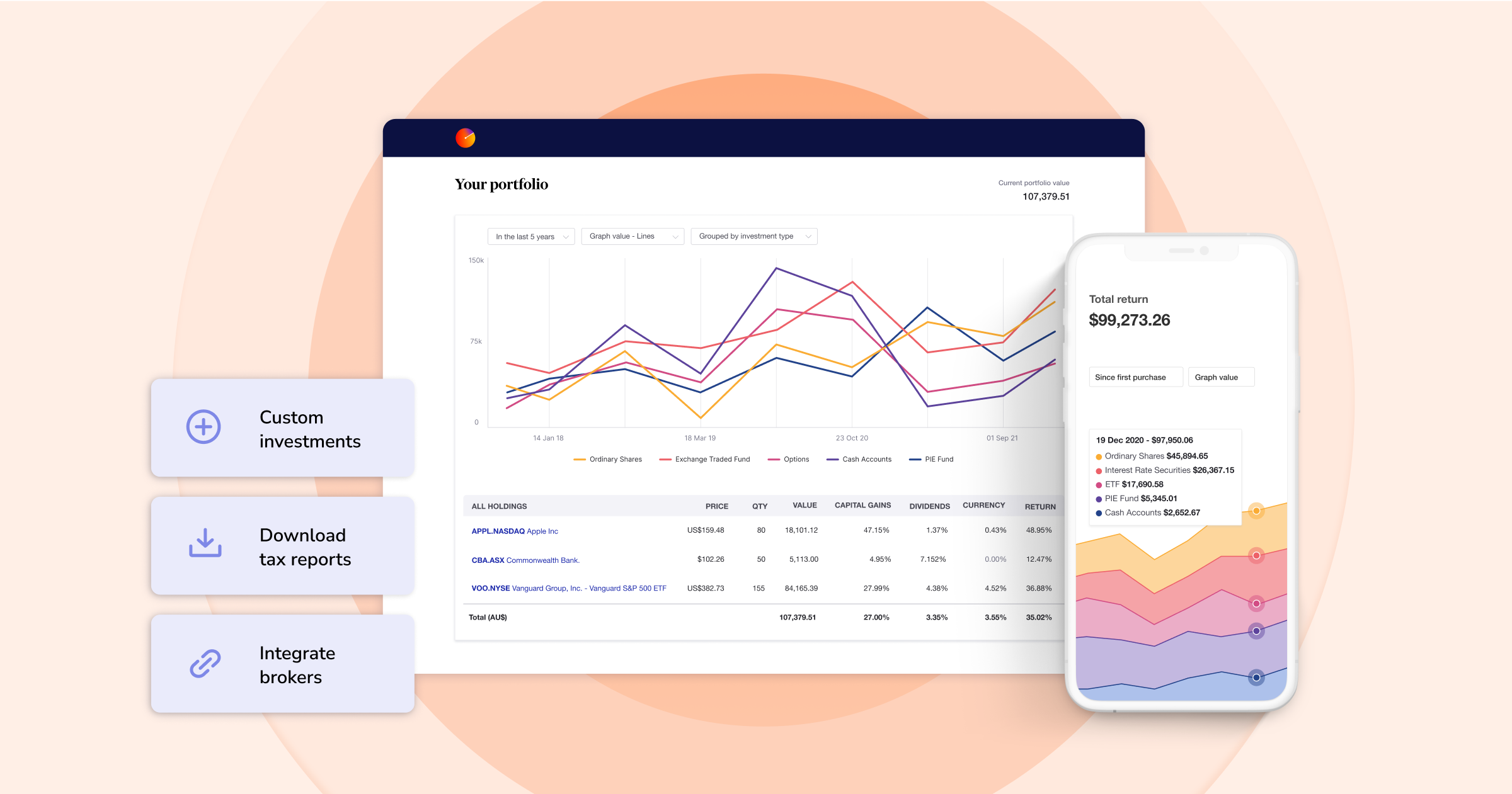

Financial advisors are increasingly turning away from traditional WRAP platforms to better service their clients. Sharesight's business plan provides a low-cost alternative to these platforms and many advantages for both advisors and their clients. With easy data aggregation plus advanced performance and tax reporting, it’s time you took a look at Sharesight's business plan.

Why financial advisors are going off-platform

According to Platforum research, the key reason why financial advisors are looking to transfer away from WRAP platforms is cost; costs you will need to pass through to your client in an increasingly competitive space. Alongside this were decreased service levels and a lack of investment choices.

This is where Sharesight comes in. With lower costs and an investment agnostic platform, Sharesight's business plan makes it easy for your clients to track investments directly in shares, managed funds and ETFs executed through a broker or provider of their choice. This allows you to deepen your client relationship by passing on lower costs and increasing the amount of time dedicated to providing advice.

The high cost of WRAP platforms vs. Sharesight's business plan

To illustrate the cost savings of moving to Sharesight's professional plan, let’s break down the cost of administration and account keeping fees on a $1,500,000 portfolio for three Australian WRAP platforms vs Sharesight's business plan.

| Platform 1 | Platform 2 | Platform 3 | Platform 4 | |

| Costs on a $1,500,000 portfolio | 0 to $250,000 = 0.48% P.A. $250,001 - $500,000 = 0.38% P.A. $500,001 - $1,000,000 = 0.22% P.A. $1,000,001 - $1,500,00 = 0.11% P.A. Account keeping fee $180 P.A. |

0 to $250,000 = 0.35% P.A. $250,001 - $500,000 = 0.25% P.A. $500,001 - $1,000,000 = 0.15% P.A. $1,000,001 - $1,500,000 = 0.05% P.A |

$0 to $250,000 = 0.37% P.A. $250,001 - $500,000 = 0.30% P.A. $500,001 - $1,000,000 = 0.20% P.A. $1,000,001 - $1,500,001 = 0% P.A. |

Sharesight = $162 P.A.* Xero cashbook = $180 P.A. (for transaction reconciliation purposes) |

| Total (est) annual cost* | $3,980 | $2,500 | $2,675 | $342 |

* 1) These fees were sourced from the most recent PDS available for the platforms we reviewed when writing this article. Please refer to the PDS of your platform(s) for information specific to your scenario. 2) The calculation only includes Administration & Account Keeping Fees. The calculation excludes any international security fees, expense recovery, compliance, cash account fees, ICRS/MERS, brokerage, or any additional fees which may be applicable. 3) Please consider any insurance within your WRAP provider before changing. 4) Sharesight's business plan prices in AUD excluding GST (based on the cost to track one client portfolio).

As you can see, these costs add up over time, and the cost savings, when reinvested over the life of your client relationship will have significant impacts on their returns.

Benefits of Sharesight's business plan vs WRAPs

The cost savings of moving off-platform to Sharesight present an ideal opportunity to update your SOA and give your client access to their Sharesight portfolio to deepen client engagement with Sharesight’s extensive reporting capabilities.

Plus, with Sharesight's business plan you get access to a dedicated Account Manager and free support and training, no matter how many client portfolios are tracked.

Here are the key advantages of Sharesight's business plan vs WRAPs

-

One low monthly cost per portfolio, regardless of FUM, plus you can cancel at any time

-

One place to track all your clients’ investments with no APL requirements

-

Track stocks and ETFs on over 60 global exchanges, managed funds/mFunds/mutual funds (and 100+ global currencies and cryptocurrencies)

-

Use the Unlisted Investments feature to track property, term deposits, commodities and fiat currency

-

Adviser Portal (Sharesight's professional plan) access for staff & clients

-

White labelled reporting including performance, contribution analysis, diversity, drawdown risk, future income and more

-

Tax reporting you can run at any time, not only at the end of the financial year

-

No administration fee or risk of administration errors

-

No PDS or FSG (Sharesight's professional plan is not a platform)

-

Dedicated Sharesight Account Manager

-

Real-time integrations with Macquarie CMA & Xero

-

Make changes and access portfolios anywhere and anytime.

Trial Sharesight today and see what your clients are missing

If you’re a financial advisor looking to deepen your client relationships, there has never been a better time to trial Sharesight's business plan. With Sharesight you get:

-

The ability to aggregate -- Track any combination of brokers or managed funds and over 60 global exchanges

-

Automated portfolio admin -- Automatically track new trades and dividend income (including DRPs)

-

Powerful performance reporting -- Access Sharesight’s performance reports at your fingertips instead of waiting for a third party

-

Advanced tax reporting -- Taxable income, capital gains tax and unrealised CGT

-

Direct portfolio sharing with clients.

To get started, sign up today and a Sharesight Account Manager will be in touch to help you get started.

FURTHER READING

- 7 reasons why Sharesight is better than a spreadsheet

- How one couple saves time and money using Sharesight

- 6 reasons why accountants love Sharesight professional plan

You can time the market – and ETFs are the way to do it

Marcus Today founder and director Marcus Padley discusses timing the market, and how investors can do this using exchange-traded funds (ETFs).

Morningstar analyses Australian investors’ top trades: Q1 2025

Morningstar reviews the top 20 trades by Australian Sharesight users in Q1 2025, and reveals where their analysts see potential opportunities.

Sharesight product updates – April 2025

This month's focus was on improving cash account syncing, revamping the future income report and enabling Apple login functionality.