AWI & ASX Fintech Expo - Roundup

Last week we were given a chance to speak and host a stand at the Self-Directed Investor Fintech Expo, hosted by AWI and ASX. It was a terrific event with a great DIY investor turnout. Lots of curiosity following our Sharesight demo and lots of investors stopping by to learn more about Sharesight. Our basic theme was: "ditch the spreadsheet."

There are some exciting - and more importantly - some very real things going on in the Australian and New Zealand financial technology space. Running your investment life online is possible. Today.

To be honest, it can get lonely running an online business. Don't get me wrong, the Sharesight staff manages to have a lot of fun. But, much of our work is heads down, earphones on, hunched over laptops. That's why it's so nice to get together with fellow fintech companies to learn about what works, what doesn't, and to swap war stories.

A few presentations (and quotes) stood out:

Yeah, we're biased. But, regardless of your stand on active versus passive investing, Stockspot represents one of the best elements of fintech: connected applications. Chris Brycki and his investment team use Desktop Broking (Bell) for execution, Macquarie CMAs for cash management, and Sharesight for client reporting. Much of what they've accomplished relies on off-the-shelf APIs and some clever (but lightweight) engineering. What does this mean for you, the investor? Transparently managed, responsible, low-cost portfolios. Chris had a quote that resonated when discussing the glut of index-hugging, high-fee fund managers: "pay for alpha that counts, but rely on low-cost beta"

Investing is overly complex. Keep your research simple. Keep it visual. Those were the themes covered by Al Bentley from Simply Wall Street. We enjoyed their clever presentation and their snowflake charts. Very useful way to represent a company's financial health, discount to fair value, dividend yield, and past and future performance. Al didn't mention it specifically, but he addressed a topic that we're passionate about at Sharesight: KISS ("keep it simple, stupid").

This one caught our eye because of its simplicity. There's a lot of investment opinion out there - some of it high quality, some of it noise. Livewire is like a curated twitter feed comprised of industry experts, top investing personalities, and well-respected research houses. Works great on mobiles too - I've already bookmarked it.

These guys took a different approach. In a day filled with fast-talking product demos (me included), Jason Prowd took a step back and reminded the audience that you can be a successful stock picker but you must remain contrarian. It was a breath of fresh air. Intelligent Investor has been around since 1998, but they're the first research house whose content and delivery looks appropriately contemporary. Over a giant picture of Warren Buffett, Jason reminded us: "no one ever made money by not being contrarian."

These guys took a different approach. In a day filled with fast-talking product demos (me included), Jason Prowd took a step back and reminded the audience that you can be a successful stock picker but you must remain contrarian. It was a breath of fresh air. Intelligent Investor has been around since 1998, but they're the first research house whose content and delivery looks appropriately contemporary. Over a giant picture of Warren Buffett, Jason reminded us: "no one ever made money by not being contrarian."

Interestingly there was a lot of conflict amongst the products at the Expo. Stockspot told the crowd that returns come from asset allocation while Intelligent Investor reminded us that there are indeed high quality companies to be found. Simply Wall Street kept on the theme that the industry is basically designed to screw over the average investor, while Livewire has already tapped into more than 30,000 investors hungry for institutional-calibre research. Macrovue took the middle road and explained how to invest cost-effectively in global themes.

This kind of conflict is good. It means investors have choice. They can mix and match products that suit them best. Nearly every idea represented is a low-cost product that can be bought (and cancelled) online. (We already have a few discussions going about hooking-in to some of these exciting applications. Stay tuned for more details...)

In a follow-up article about the event, managing director of AWI Ventures Toby Heap summed it up nicely by saying, “ innovation is crucial if financial services are to keep pace with technology-driven advances in other industries ”. In the same article, Toby also said that Sharesight exemplifies "the trend towards consumer empowerment". That's definitely at the core of our DNA, so it's great to be recognized as such by our peers.

Sincere thanks to AWI and ASX for organising and hosting such a fantastic event, and to the other startups for participating in the expo. It's an exciting time to be part of the Fintech industry, and working alongside innovative companies like these makes it that much more fun.

Why Strawman’s founder uses Sharesight to track performance and tax

We spoke with Andrew Page, founder of Strawman.com, about how he uses Sharesight to track his portfolio and how it benefits investors.

Top trades by New Zealand Sharesight users — March 2025

Welcome to Sharesight’s March 2025 trading snapshot for New Zealand, highlighting the top trades made by New Zealand Sharesight users.

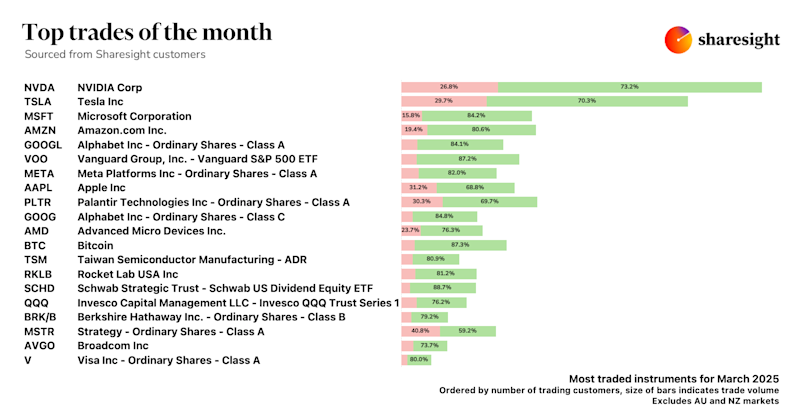

Top trades by global Sharesight users — March 2025

Welcome to the March 2025 edition of Sharesight’s trading snapshot, where we review the top trades made by Sharesight users worldwide.