Automatically import Jarden Direct trades to Sharesight

Investors trading with Jarden Direct can directly connect their brokerage account to Sharesight, allowing them to automatically sync their historic and ongoing trades to their Sharesight portfolio. This makes it easy for investors to track the price and performance of their investments, including the ability to automatically track dividends and DRPs, or take advantage of Sharesight’s advanced tax reporting features. With support for more than 200 leading global brokers, plus automatically updated price and dividend information on over 240,000 stocks, ETFs and mutual/managed funds, Sharesight is the ultimate tool to track all of your investments in one place.

Who is Jarden Direct?

Jarden Direct is a New Zealand-based broker with an online trading platform aimed at DIY investors. The platform allows Australian and New Zealand investors to invest in shares, ETFs, bonds and funds in a range of markets such as the New Zealand (NZX), Australian (ASX), London (LSE) and New York (NYSE) stock exchanges, as well as the Nasdaq. These markets are also supported by Sharesight. Other key features of Jarden Direct’s trading platform include the ability to create watchlists, see the latest investing news and access Shareclarity market research.

Why you should track Jarden Direct trades with Sharesight

By importing your Jarden Direct trades to Sharesight, you can easily track your investment performance across multiple brokers and asset classes, or take advantage of Sharesight’s advanced performance and tax reporting designed for the needs of self-directed investors.

Importantly, Sharesight gives investors the true picture of their investment performance by taking into account the impact of brokerage fees, dividends and capital gains on their returns. Sharesight also offers a range of powerful reports for investors including Performance, Portfolio Diversity, Contribution Analysis, Multi-Period, Multi-Currency Valuation and Future Income (upcoming dividends). The ability to track cash accounts, property and even cryptocurrency is just another reason that investors should consider using Sharesight to track their investment portfolio.

Track your dividend income

Unlike other portfolio trackers, Sharesight automatically tracks dividend and distribution income (including dividend reinvestment plans) and takes this into account when calculating your investment return. In the screenshot below for example, dividends make an important contribution to this stock’s returns, highlighting the value of a portfolio tracking solution that includes more than just capital gains in its performance calculations.

How to import your Jarden Direct trades to Sharesight

Investors trading through Jarden Direct can easily establish a secure connection between their Jarden Direct and Sharesight accounts, which will automatically import historical and ongoing trades into their portfolio. Investors who choose not to link their Jarden Direct and Sharesight accounts can also import their historical trading data by uploading a spreadsheet file of trades, or have their Trade Confirmation Emails automatically forwarded to Sharesight to capture ongoing trades.

Connect your Jarden Direct account to Sharesight

Jarden Direct leverages the Sharesight API to allow investors to automatically import historical and ongoing trades into a Sharesight portfolio.

If you’re new to Sharesight, you can get started by signing up for a free account.

Once signed up, click ‘Import from a Broker’ on the ‘Add Holding’ page and select Jarden Direct, following the instructions to establish a connection between your Jarden Direct and Sharesight accounts.

Note: Jarden Direct’s integration with the Sharesight API means none of your Jarden account details will be visible to Sharesight, and your trading data is downloaded through a secure connection. You can revoke the connection to Sharesight at any time.

Start tracking your Jarden Direct trades with Sharesight

Thousands of investors like you are already using Sharesight to manage their investment portfolios. What are you waiting for? Sign up and:

-

Track all of your investments in one place, including stocks, ETFs, mutual/managed funds, property and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

-

Run powerful reports built for investors, including Performance, Portfolio Diversity, Contribution Analysis, Future Income, Multi-Period and Multi-Currency Valuation

-

Run tax reports including Taxable Income (dividends/distributions), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

-

See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

![]()

FURTHER READING

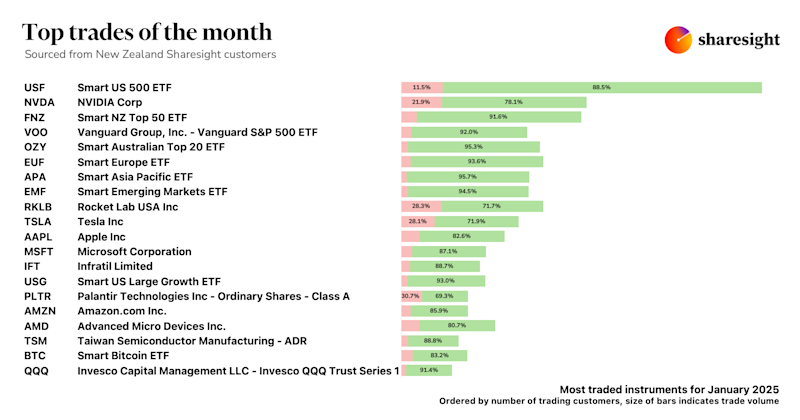

Top trades by New Zealand Sharesight users — January 2025

Welcome to the January 2025 edition of Sharesight’s trading snapshot for New Zealand investors, where we look at the top trades by New Zealand Sharesight users.

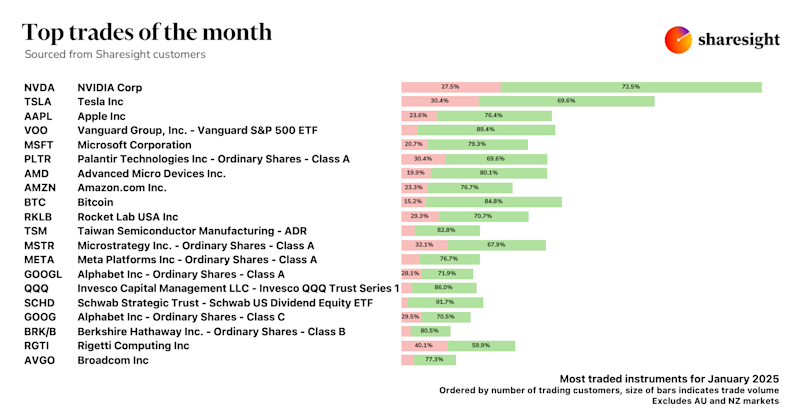

Top trades by global Sharesight users — January 2025

Welcome to the January 2025 edition of Sharesight’s trading snapshot for global investors, where we look at the top trades by Sharesight users around the world.

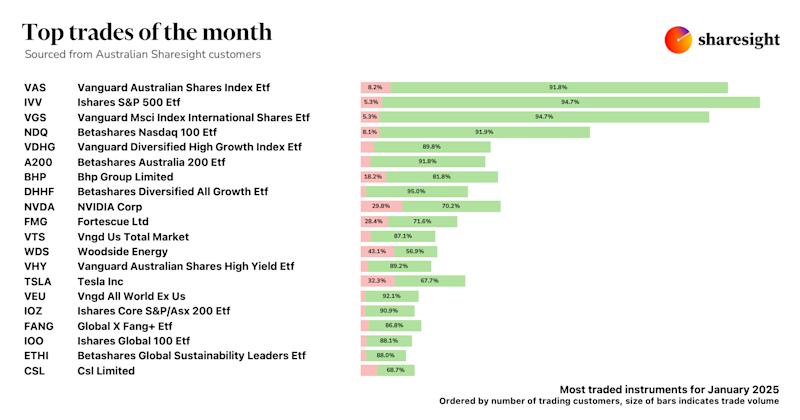

Top trades by Australian Sharesight users — January 2025

Welcome to the January 2025 edition of our trading snapshot for Australian investors, where we look at the top 20 trades made by Australian Sharesight users.